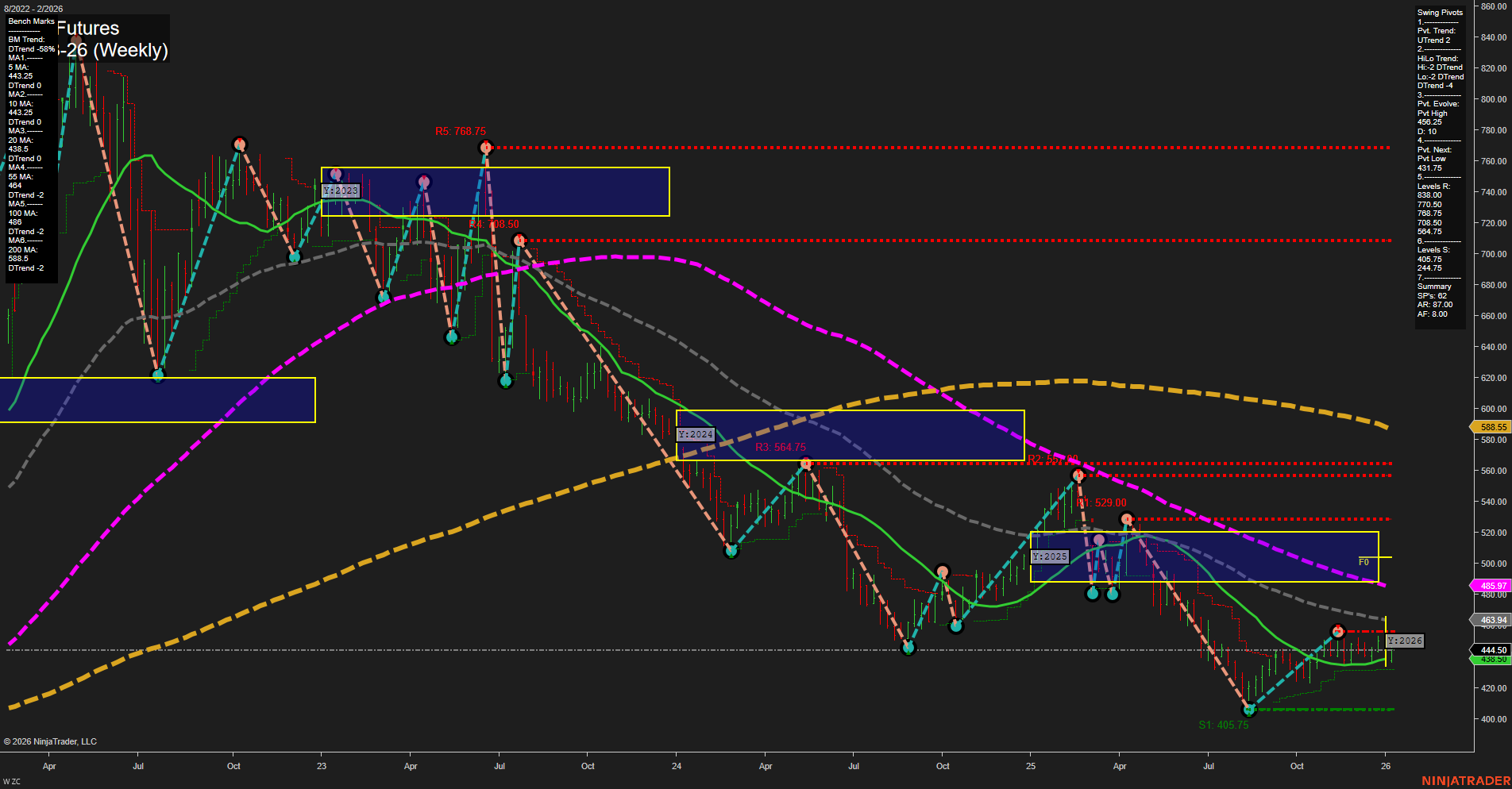

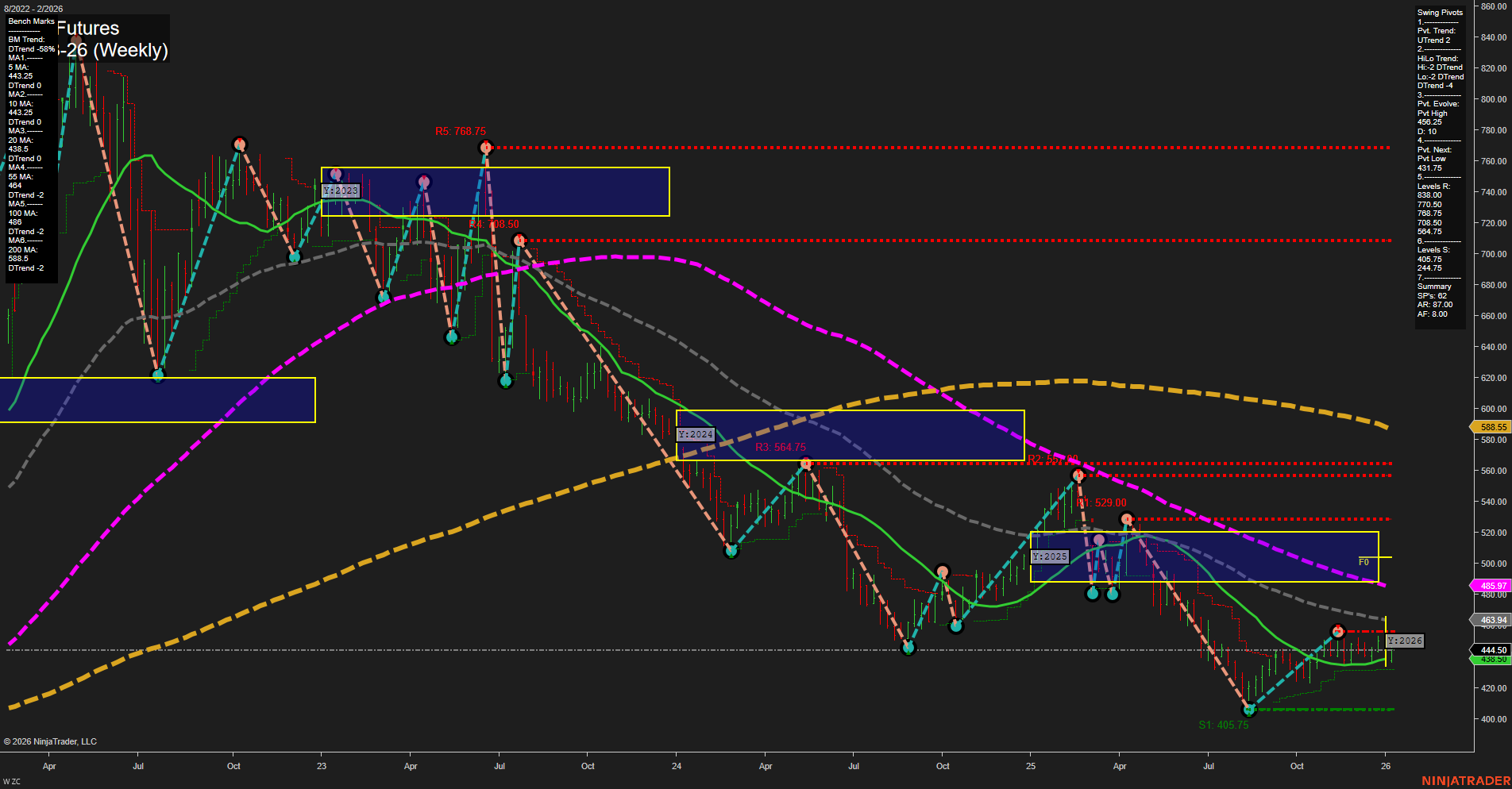

ZC Corn Futures Weekly Chart Analysis: 2026-Jan-06 07:25 CT

Price Action

- Last: 438.50,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 69%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: 18%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: -3%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 456.25,

- 4. Pvt. Next: Pvt low 431.75,

- 5. Levels R: 838.00, 768.75, 708.50, 564.75, 529.00, 456.25,

- 6. Levels S: 405.75, 244.75.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 439.25 Up Trend,

- (Intermediate-Term) 10 Week: 434.90 Up Trend,

- (Long-Term) 20 Week: 444.50 Up Trend,

- (Long-Term) 55 Week: 463.91 Down Trend,

- (Long-Term) 100 Week: 485.97 Down Trend,

- (Long-Term) 200 Week: 588.55 Down Trend.

Recent Trade Signals

- 06 Jan 2026: Long ZC 03-26 @ 445 Signals.USAR-MSFG

- 05 Jan 2026: Long ZC 03-26 @ 443.5 Signals.USAR.TR120

- 30 Dec 2025: Short ZC 03-26 @ 440.75 Signals.USAR.TR720

- 29 Dec 2025: Short ZC 03-26 @ 448.25 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bearish.

Key Insights Summary

Corn futures are showing a notable shift in short- and intermediate-term momentum, with both the WSFG and MSFG trends turning up and price action holding above their respective NTZ/F0% levels. The most recent swing pivot trend is up, supported by consecutive long signals and rising short-term moving averages. However, the longer-term context remains bearish, as the yearly session fib grid trend is still down and price is below the annual NTZ, with major resistance from the 55, 100, and 200 week moving averages overhead. The market is currently in a recovery phase from a significant downtrend, with a series of higher lows forming since the July bottom, but faces strong resistance in the 444–456 zone and above. The technical landscape suggests a developing counter-trend rally within a broader bearish structure, with volatility likely as price tests key resistance levels. The interplay between short-term bullish momentum and long-term overhead resistance will be critical in determining whether this rally can evolve into a sustained trend change or remains a corrective bounce within a larger downtrend.

Chart Analysis ATS AI Generated: 2026-01-06 07:26 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.