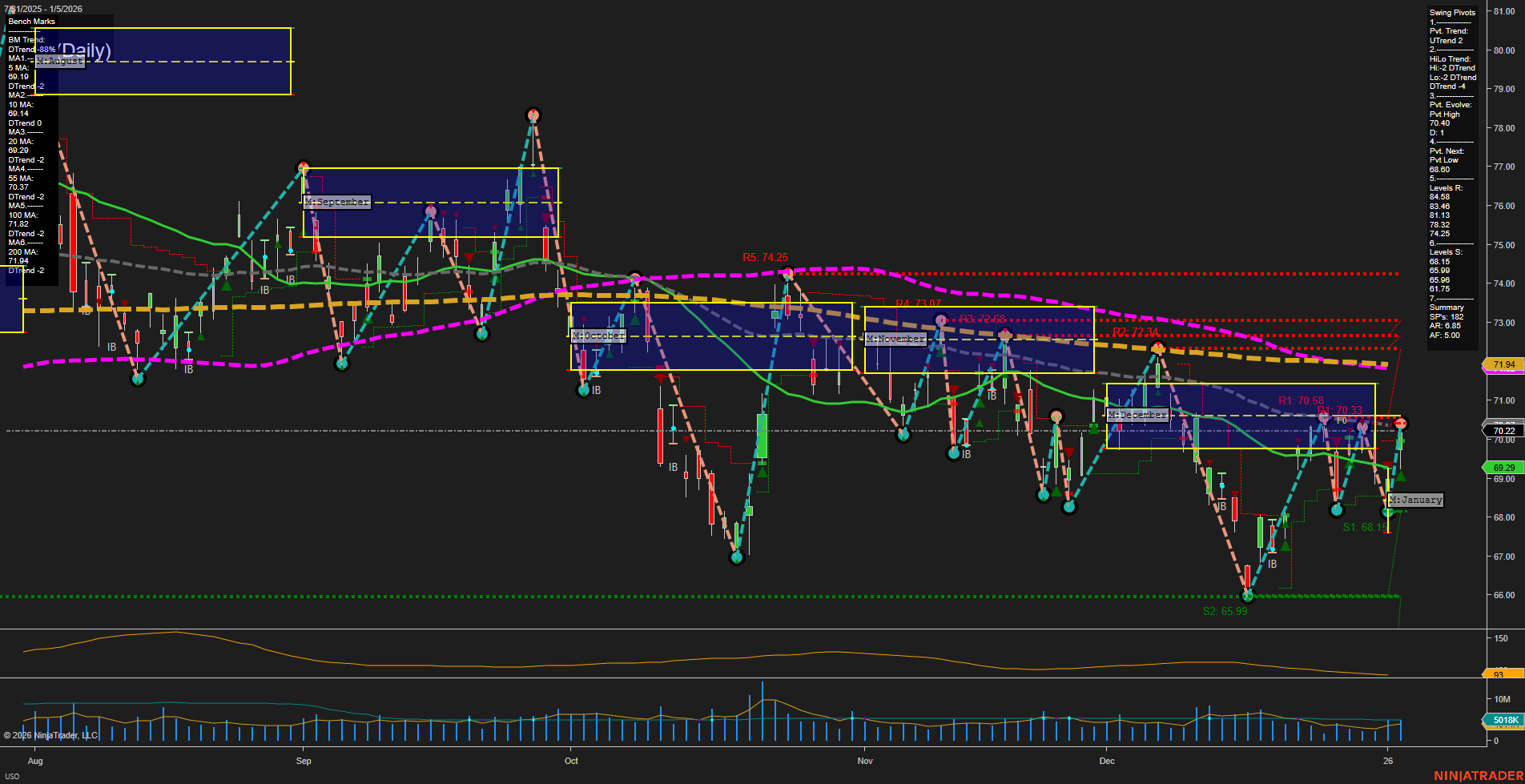

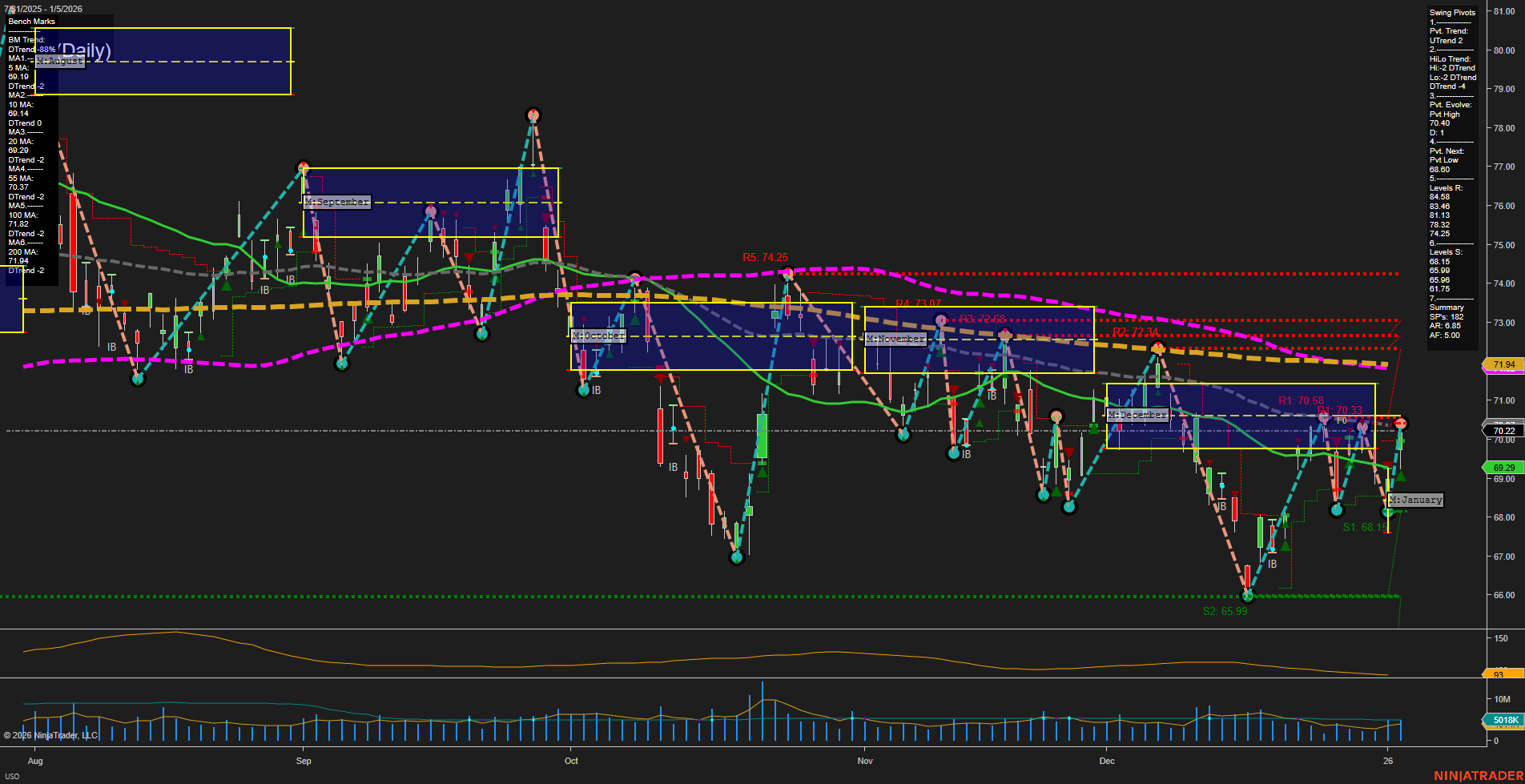

USO United States Oil Fund LP Daily Chart Analysis: 2026-Jan-06 07:21 CT

Price Action

- Last: 70.22,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 70.1,

- 4. Pvt. Next: Pvt low 68.80,

- 5. Levels R: 74.25, 73.29, 72.48, 71.23, 70.58,

- 6. Levels S: 68.11, 66.99, 65.99, 61.75.

Daily Benchmarks

- (Short-Term) 5 Day: 69.14 Up Trend,

- (Short-Term) 10 Day: 68.70 Up Trend,

- (Intermediate-Term) 20 Day: 69.29 Up Trend,

- (Intermediate-Term) 55 Day: 70.01 Down Trend,

- (Long-Term) 100 Day: 71.04 Down Trend,

- (Long-Term) 200 Day: 71.94 Down Trend.

Additional Metrics

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

USO is currently showing a short-term bullish reversal, with price action pushing above the 5, 10, and 20-day moving averages, all of which are trending upward. The most recent swing pivot is a high at 70.1, with the next potential pivot low at 68.80, indicating a possible short-term pullback zone. However, intermediate and long-term trends remain neutral to bearish, as the 55, 100, and 200-day moving averages are still in a downtrend and overhead resistance levels are clustered between 70.58 and 74.25. The ATR suggests moderate volatility, and volume is steady but not spiking, indicating a lack of strong conviction from either buyers or sellers. The chart structure shows a series of lower highs and higher lows, suggesting a broad consolidation phase with choppy price action. The market is currently testing the upper end of its recent range, but has not yet broken out of the longer-term downtrend. Swing traders may note the potential for continued short-term rallies within a larger context of resistance and range-bound trading, with key levels to watch for potential reversals or breakouts.

Chart Analysis ATS AI Generated: 2026-01-06 07:21 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.