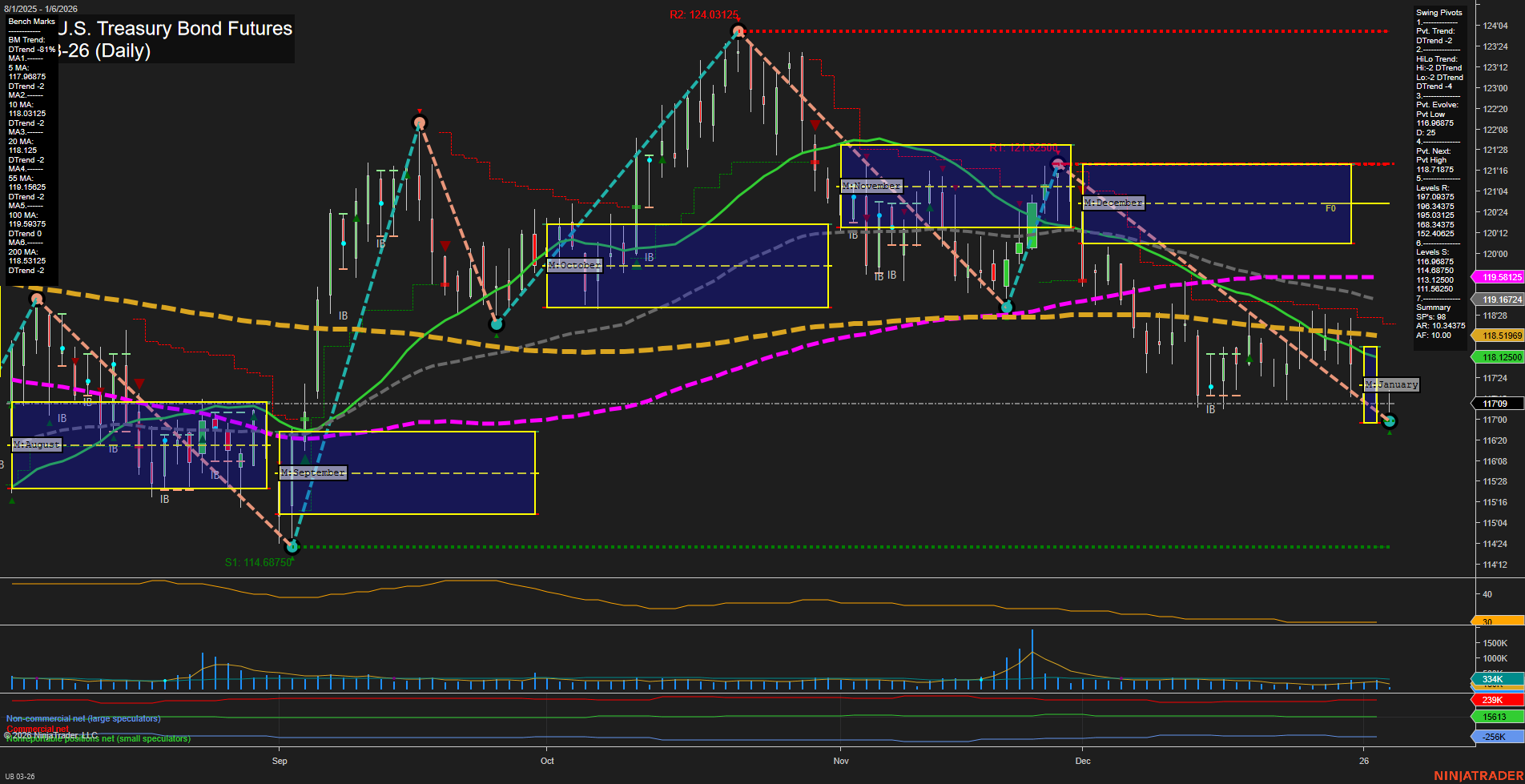

The UB Ultra U.S. Treasury Bond Futures daily chart is exhibiting a clear bearish structure across all timeframes. Price action is subdued with slow momentum and medium-sized bars, reflecting a lack of strong buying interest. The contract is trading below all key session fib grid levels (weekly, monthly, yearly), with each grid showing a persistent downtrend and price below the NTZ/F0% levels, confirming sustained selling pressure. Swing pivot analysis reinforces this bearish outlook, with both short-term and intermediate-term trends in a downtrend (DTrend). The most recent pivot is a swing low at 117.09, with the next potential reversal only above 118.71875, indicating that the market would need to overcome multiple resistance levels to shift sentiment. Support is thin below, with the next major level at 114.6875. All benchmark moving averages (from 5-day to 200-day) are trending down, and price remains below each, further confirming the dominance of sellers. The ATR is moderate, suggesting controlled but persistent volatility, while volume metrics are steady, not indicating any capitulation or reversal activity. Recent trade signals have all triggered short entries, aligning with the prevailing trend. There is no evidence of a reversal or significant bounce, and the market continues to make lower highs and lower lows. The overall environment is one of trend continuation to the downside, with no technical signs of exhaustion or a base forming yet.