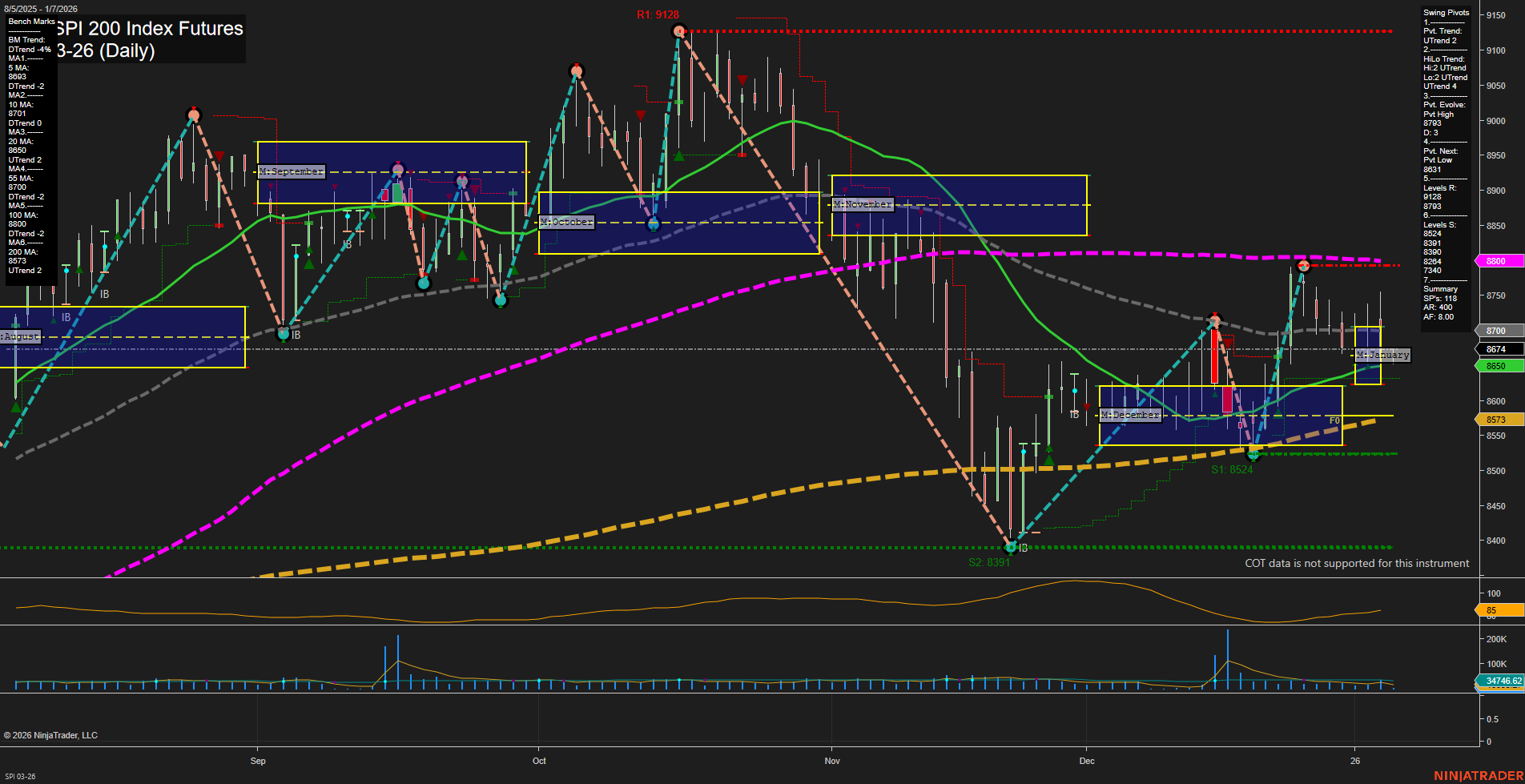

The SPI 200 Index Futures daily chart is currently showing a constructive environment for swing traders, with both short-term and intermediate-term trends in an uptrend, as confirmed by the swing pivot metrics and the majority of short and intermediate moving averages trending higher. Price is consolidating just below recent swing resistance (8793), with the next key support at 8631 and 8524. The 20-day and 200-day moving averages are both supporting the current price, while the 55-day and 100-day remain above as potential resistance, indicating a transition phase. Volatility (ATR) is moderate, and volume is steady, suggesting a balanced market without extreme moves. The overall structure points to a market in recovery mode after a prior sell-off, with higher lows forming and a potential for further upside if resistance levels are cleared. However, the long-term trend remains neutral as the 55-day and 100-day MAs are still in a downtrend, so sustained momentum above these levels would be needed to confirm a longer-term bullish shift. The market is currently in a consolidation phase, with a bullish bias in the short and intermediate term, awaiting a breakout or rejection at key resistance.