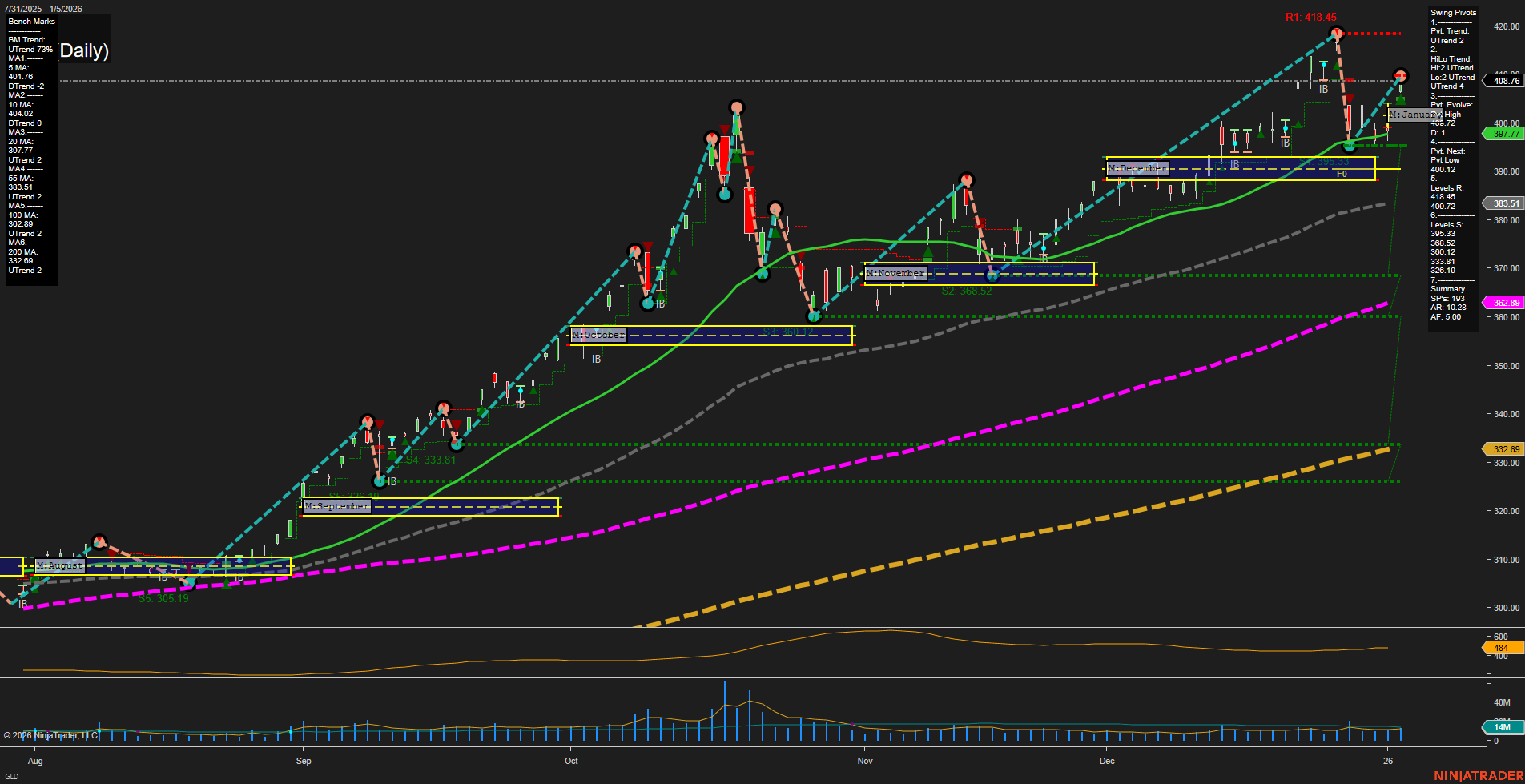

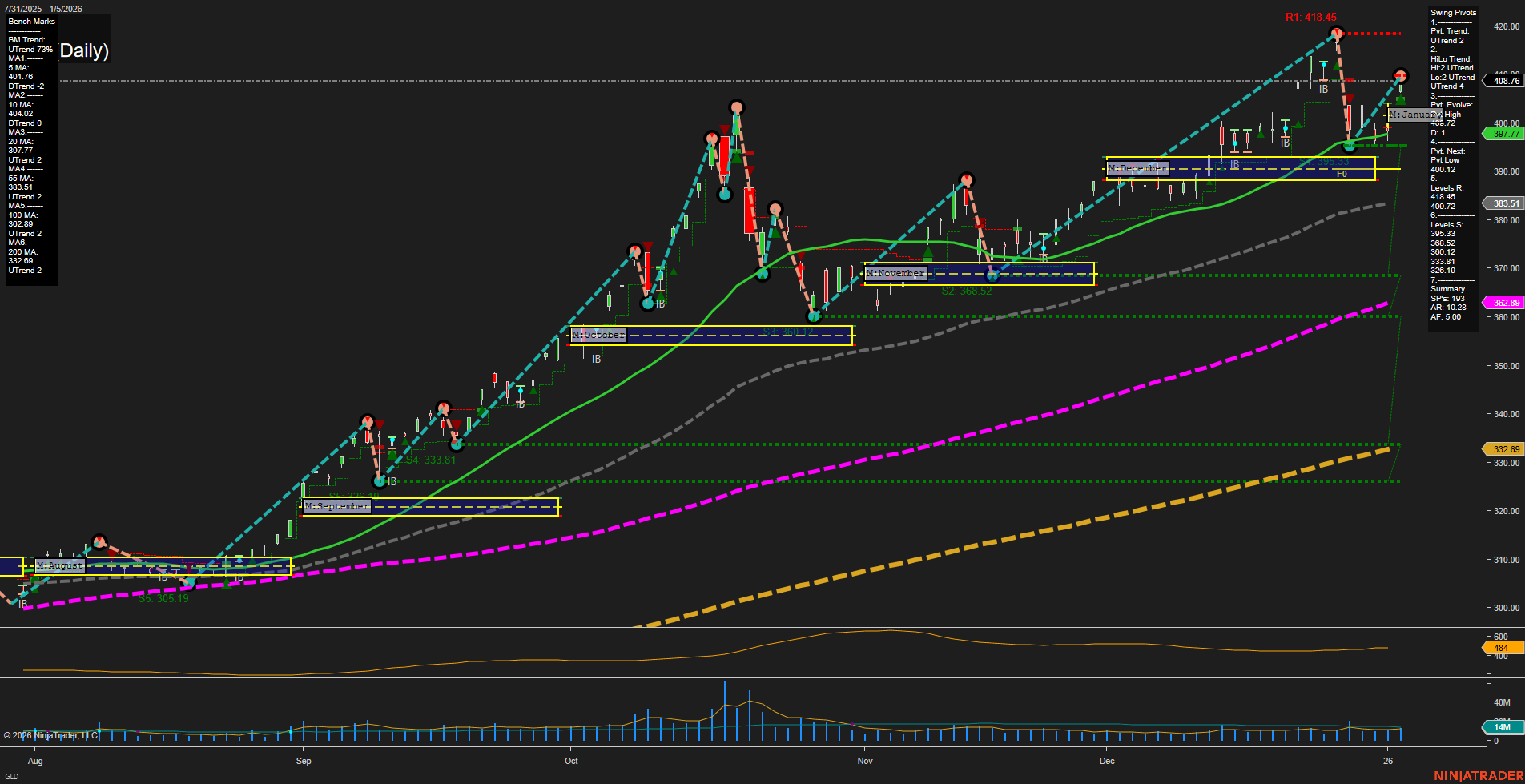

GLD SPDR Gold Shares Daily Chart Analysis: 2026-Jan-06 07:12 CT

Price Action

- Last: 406.76,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 418.45,

- 4. Pvt. Next: Pvt low 397.77,

- 5. Levels R: 418.45, 400.12,

- 6. Levels S: 397.77, 386.52, 362.89, 332.69.

Daily Benchmarks

- (Short-Term) 5 Day: 401.76 Up Trend,

- (Short-Term) 10 Day: 404.02 Up Trend,

- (Intermediate-Term) 20 Day: 409.72 Up Trend,

- (Intermediate-Term) 55 Day: 383.51 Up Trend,

- (Long-Term) 100 Day: 362.89 Up Trend,

- (Long-Term) 200 Day: 332.69 Up Trend.

Additional Metrics

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

GLD continues to demonstrate a strong bullish structure across all timeframes, with price action maintaining higher highs and higher lows. The most recent swing pivot is a high at 418.45, with the next key support at 397.77, indicating a healthy pullback zone within an ongoing uptrend. All benchmark moving averages are in uptrends, confirming broad momentum and trend alignment. The ATR remains moderate, suggesting steady volatility, while volume is consistent with recent averages. The market is consolidating just below recent highs, with no immediate signs of reversal or exhaustion. The overall technical landscape supports a continuation of the prevailing bullish trend, with the market respecting both intermediate and long-term support levels. No significant counter-trend signals are present, and the structure remains constructive for trend-following strategies.

Chart Analysis ATS AI Generated: 2026-01-06 07:12 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.