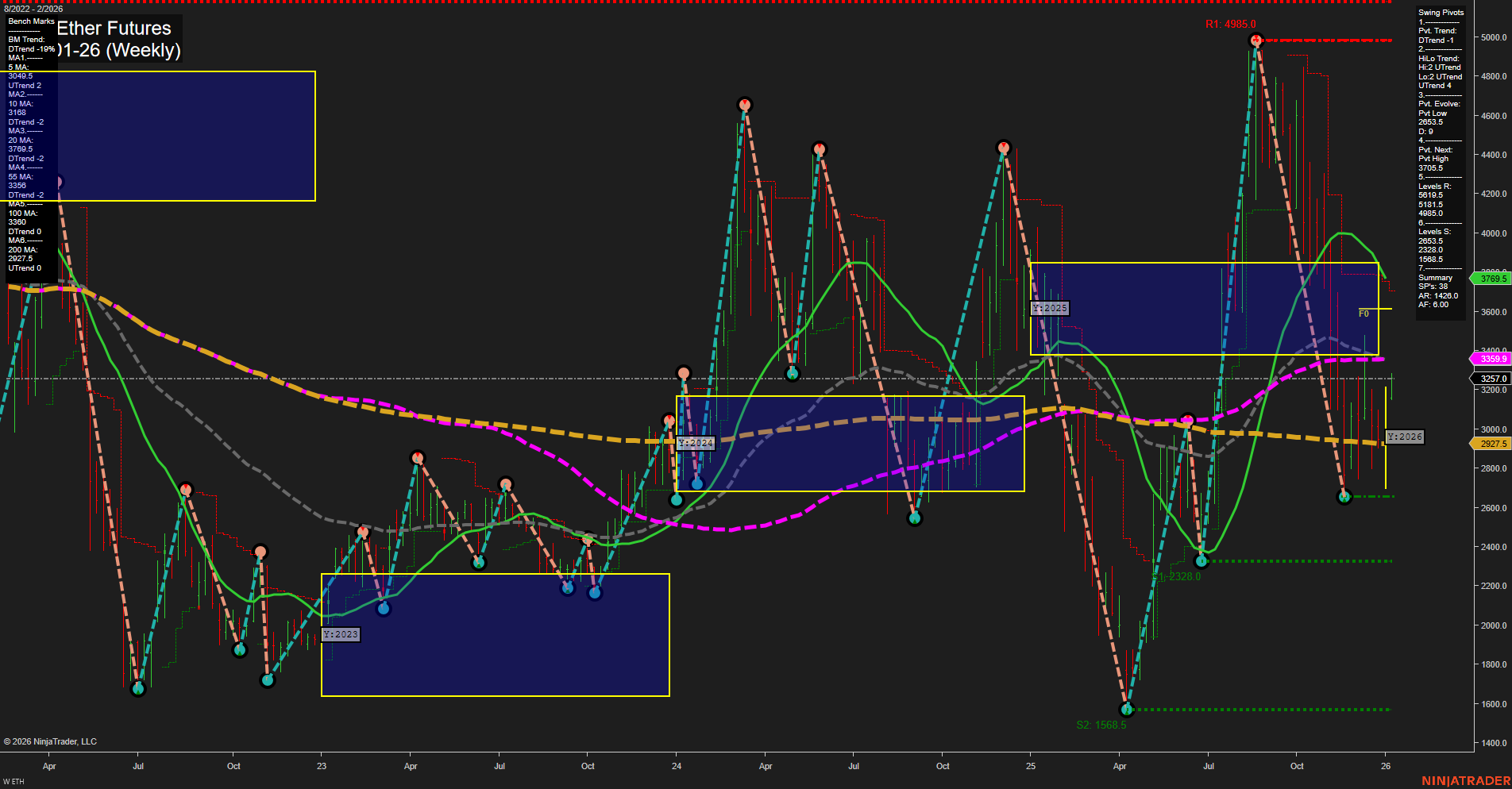

The current weekly chart for ETH CME Ether Futures shows a market in transition. Price action is characterized by large bars and fast momentum, indicating heightened volatility and active participation. The short-term WSFG and intermediate-term MSFG both show price above their respective NTZ/F0% levels with uptrends, suggesting bullish sentiment in the near to intermediate term. However, the short-term swing pivot trend is down, while the intermediate-term HiLo trend remains up, reflecting a possible pullback or consolidation phase within a broader uptrend. Key resistance levels are clustered at 3268.5, 3581.5, 3795.5, and 4985.0, with support at 2328.5 and 1568.5, highlighting a wide trading range. The weekly moving averages show short-term strength (5 and 10 week MAs trending up), but longer-term averages (20, 55, 100, 200 week) are still in downtrends, indicating that the market has not fully transitioned to a sustained long-term uptrend. Recent trade signals have triggered long entries, aligning with the intermediate-term bullish bias. Overall, the market is showing signs of recovery and potential trend continuation, but the presence of large bars and mixed signals across timeframes suggests ongoing volatility and the potential for further consolidation before a decisive breakout or sustained move.