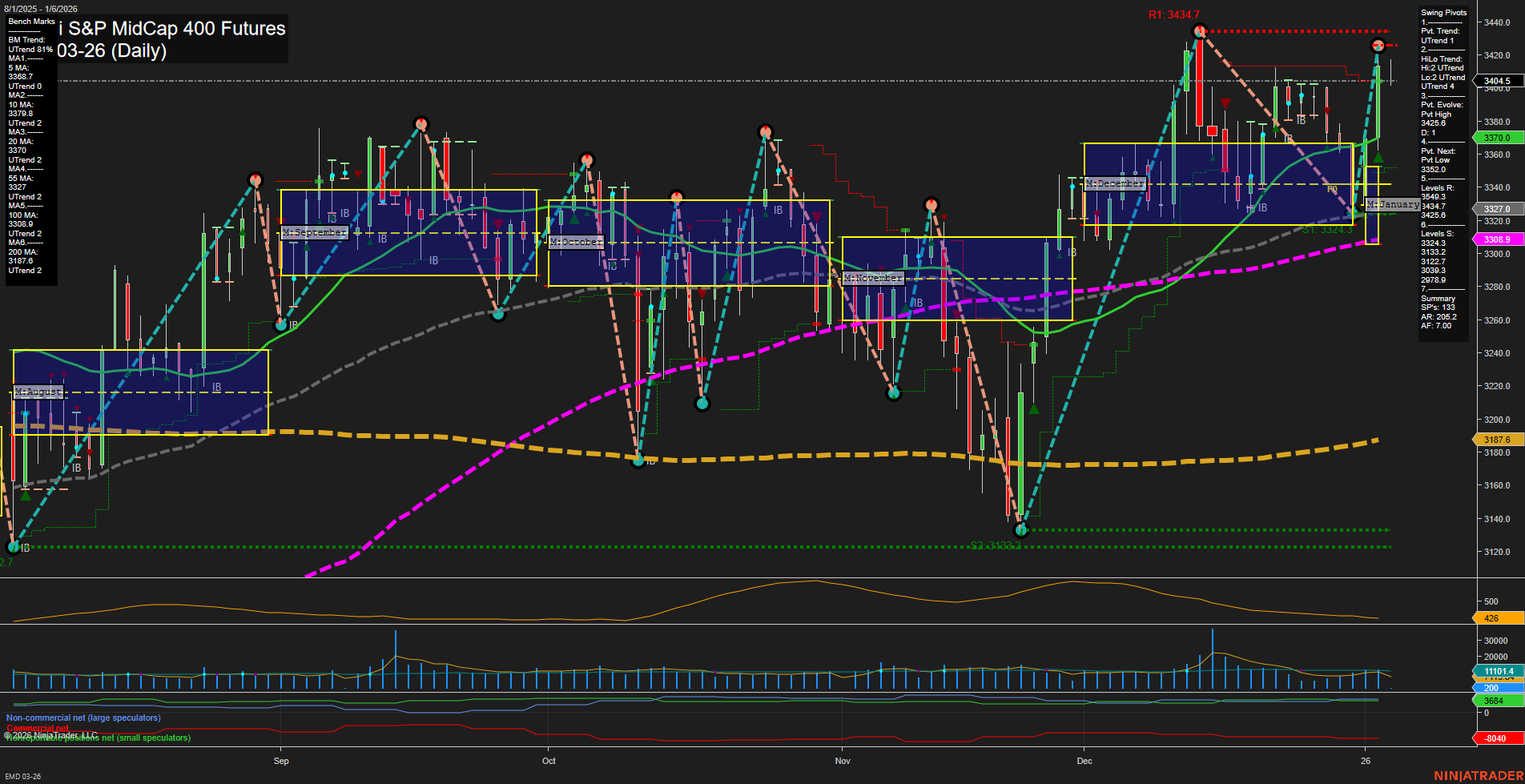

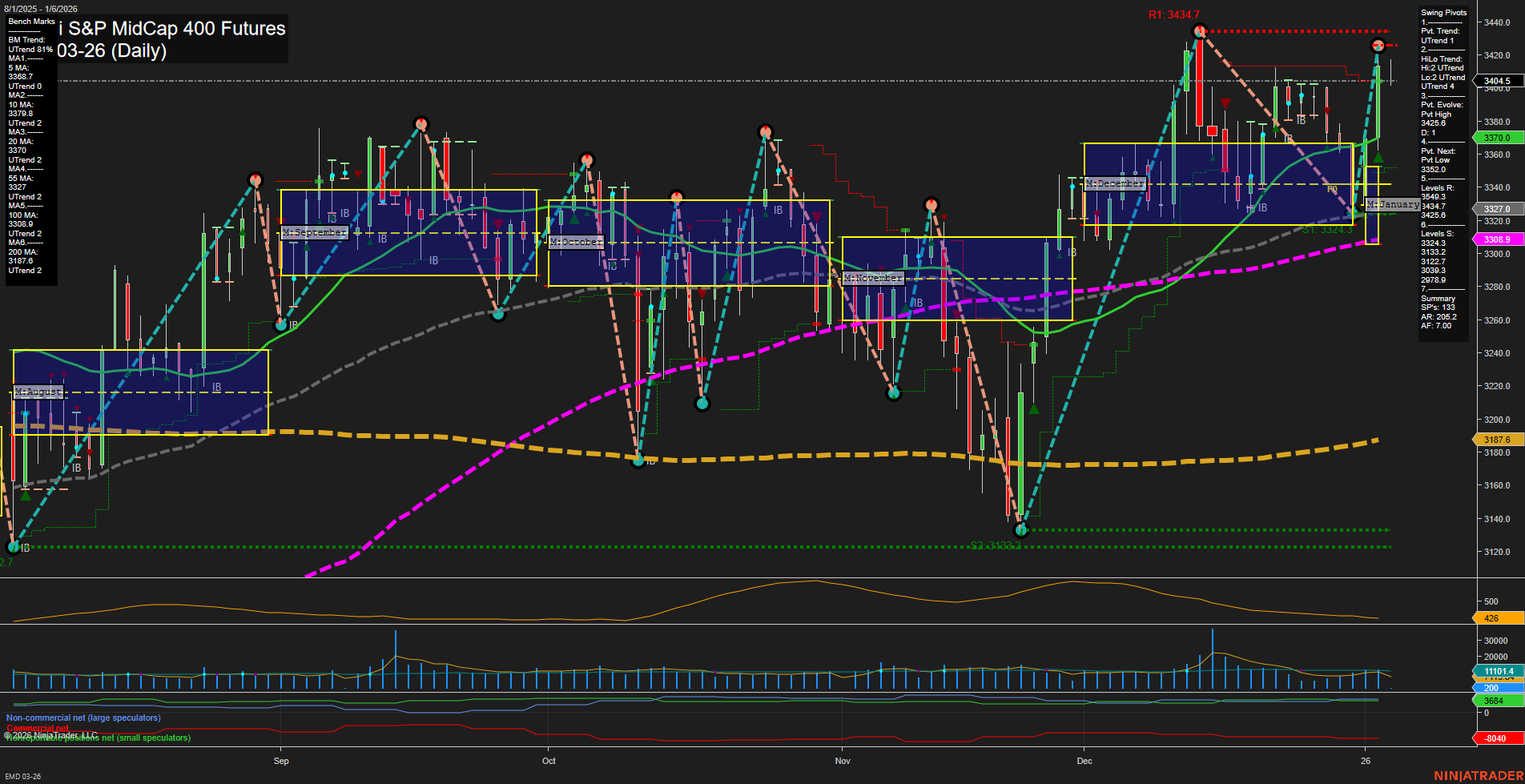

EMD E-mini S&P MidCap 400 Futures Daily Chart Analysis: 2026-Jan-06 07:06 CT

Price Action

- Last: 3404.5,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 44%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: 46%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 1%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 3434.7,

- 4. Pvt. Next: Pvt Low 3320.0,

- 5. Levels R: 3434.7, 3404.5,

- 6. Levels S: 3370.8, 3320.0, 3283.9, 3208.9, 3078.8.

Daily Benchmarks

- (Short-Term) 5 Day: 3388.1 Up Trend,

- (Short-Term) 10 Day: 3370.8 Up Trend,

- (Intermediate-Term) 20 Day: 3327.0 Up Trend,

- (Intermediate-Term) 55 Day: 3300.9 Up Trend,

- (Long-Term) 100 Day: 3187.6 Up Trend,

- (Long-Term) 200 Day: 3187.6 Up Trend.

Additional Metrics

Recent Trade Signals

- 05 Jan 2026: Long EMD 03-26 @ 3366.6 Signals.USAR-MSFG

- 02 Jan 2026: Long EMD 03-26 @ 3352.9 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The EMD futures daily chart is showing a strong bullish structure across all timeframes. Price is currently above all key moving averages, with the 5, 10, 20, 55, 100, and 200-day benchmarks all trending upward, confirming broad-based momentum. The most recent swing pivot is a new high at 3434.7, with the next potential pivot low at 3320.0, indicating the market is in an uptrend but could see a pullback toward support if momentum stalls. Both the weekly and monthly session fib grids show price holding above their respective NTZ (neutral zones), reinforcing the bullish bias. ATR and volume metrics suggest moderate volatility and healthy participation. Recent trade signals have triggered new long entries, aligning with the prevailing uptrend. Overall, the market is in a strong rally phase, with higher highs and higher lows, and no immediate signs of reversal or exhaustion.

Chart Analysis ATS AI Generated: 2026-01-06 07:07 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.