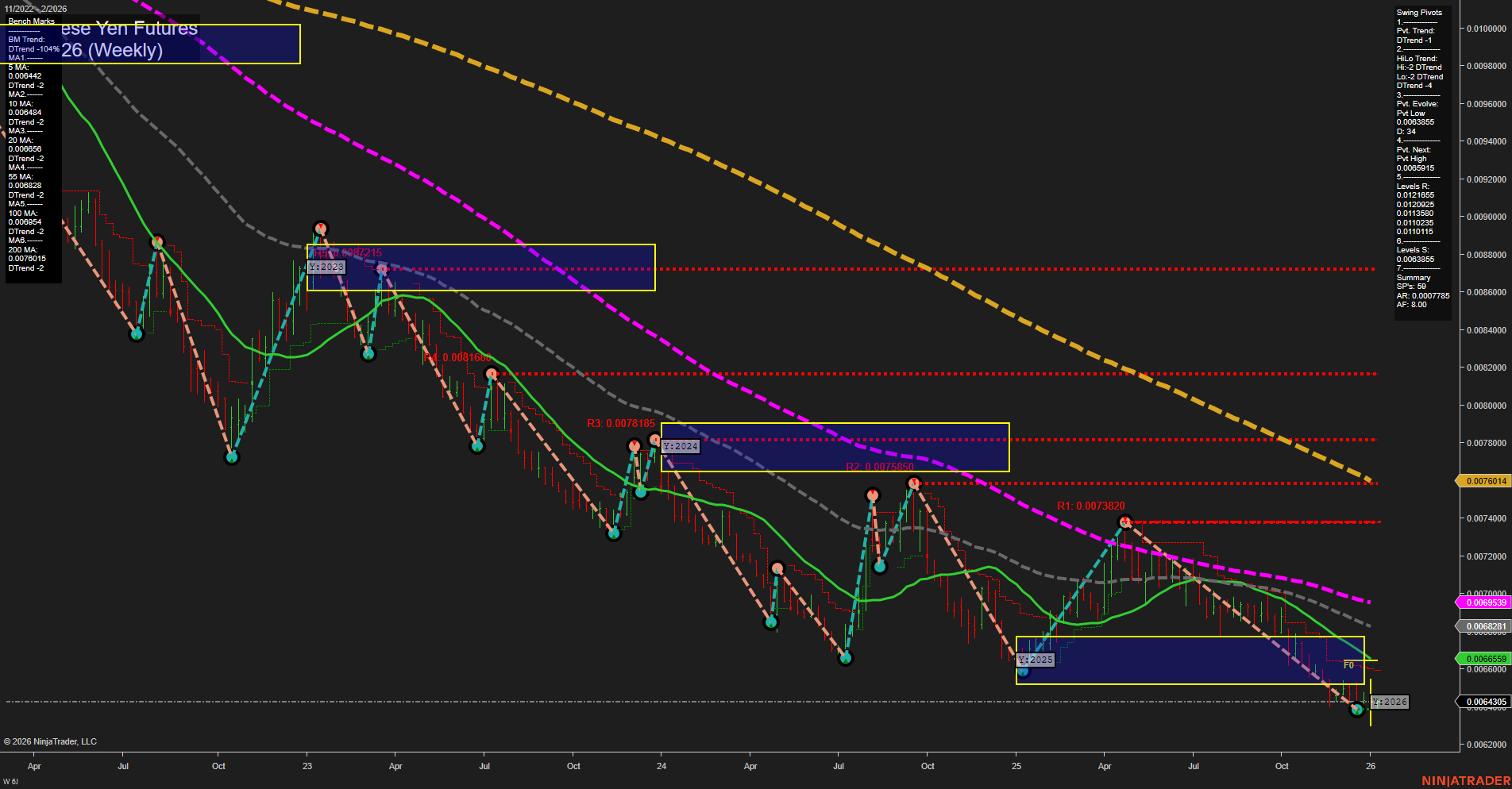

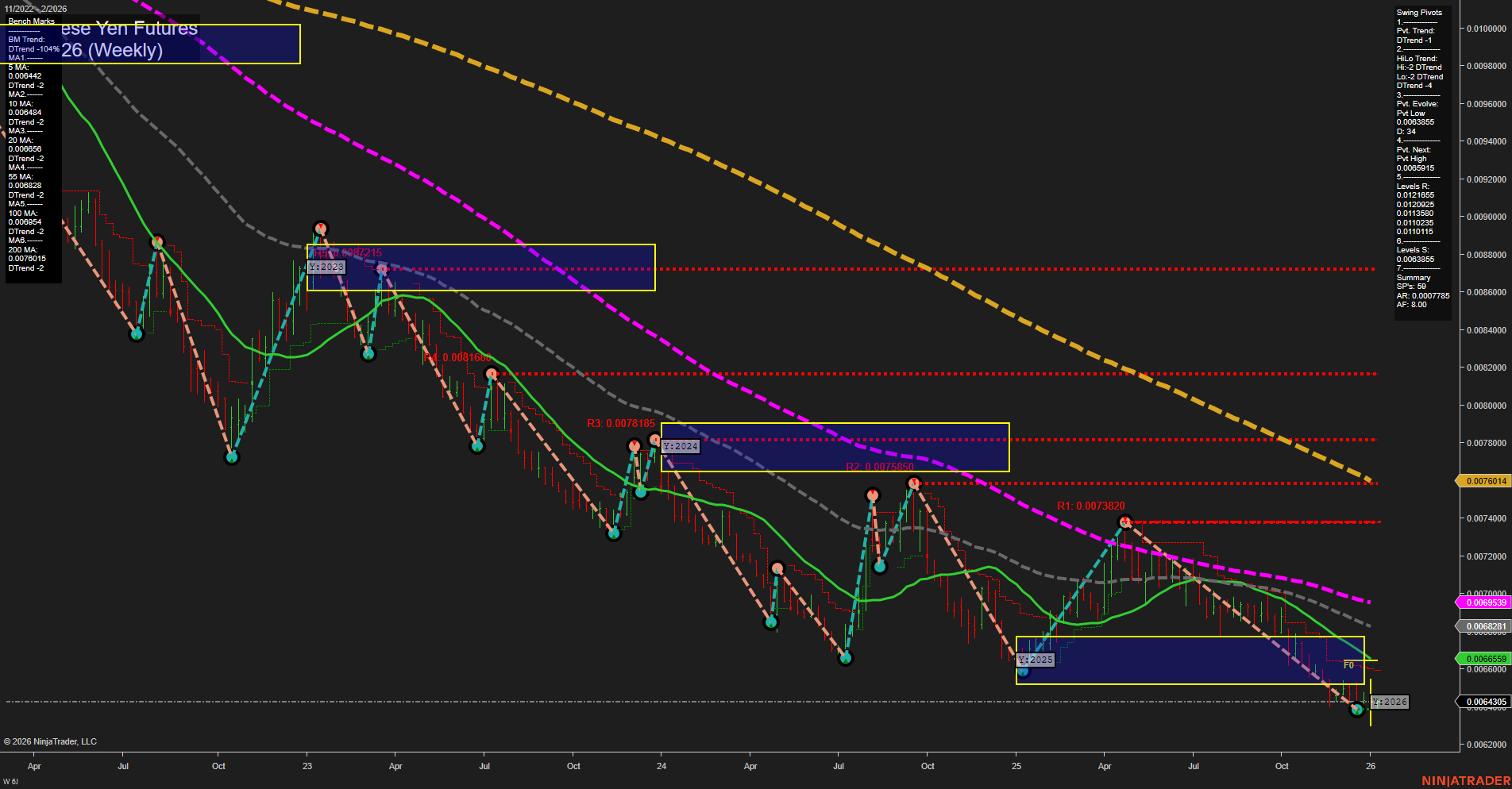

6J Japanese Yen Futures Weekly Chart Analysis: 2026-Jan-06 07:03 CT

Price Action

- Last: 0.0064305,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 14%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: 2%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 0%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 0.006385,

- 4. Pvt. Next: Pvt high 0.0068915,

- 5. Levels R: 0.0073820, 0.0078560, 0.0078185,

- 6. Levels S: 0.006385, 0.006125, 0.005955.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.0066281 Down Trend,

- (Intermediate-Term) 10 Week: 0.0066539 Down Trend,

- (Long-Term) 20 Week: 0.0068231 Down Trend,

- (Long-Term) 55 Week: 0.0069695 Down Trend,

- (Long-Term) 100 Week: 0.0070963 Down Trend,

- (Long-Term) 200 Week: 0.0076014 Down Trend.

Recent Trade Signals

- 06 Jan 2026: Long 6J 03-26 @ 0.0064335 Signals.USAR-WSFG

- 05 Jan 2026: Long 6J 03-26 @ 0.0064355 Signals.USAR.TR120

- 31 Dec 2025: Short 6J 03-26 @ 0.0064225 Signals.USAR-MSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The 6J Japanese Yen Futures weekly chart shows a market that has been in a persistent downtrend, as evidenced by the dominant downward direction of all major moving averages and the swing pivot trends. Price action is currently exhibiting slow momentum with medium-sized bars, suggesting a lack of strong conviction in either direction. While the short-term WSFG and MSFG trends have shifted to an upward bias with price just above the NTZ/F0% levels, the overall structure remains weak, with the most recent swing pivot trends and HiLo trends still pointing down. Key resistance levels are clustered well above the current price, while support is being tested near recent lows. Recent trade signals indicate some short-term attempts at a reversal, but the intermediate and long-term context remains bearish, with all major benchmarks trending lower. The market appears to be in a potential basing or consolidation phase after an extended decline, but confirmation of a sustained reversal is lacking. Swing traders should note the possibility of a short-term bounce within a broader bearish environment, with volatility likely to persist as the market tests support and resistance zones.

Chart Analysis ATS AI Generated: 2026-01-06 07:04 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.