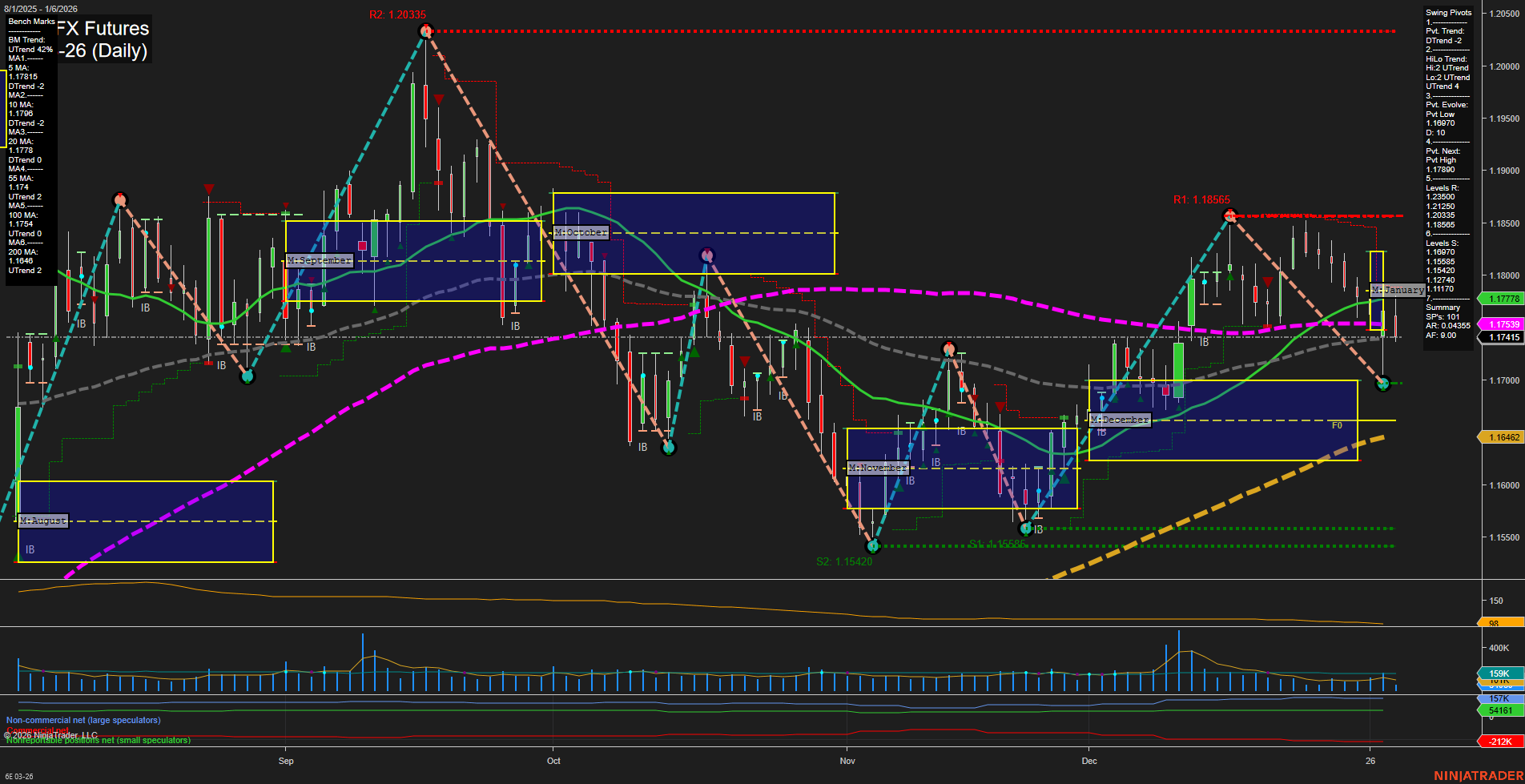

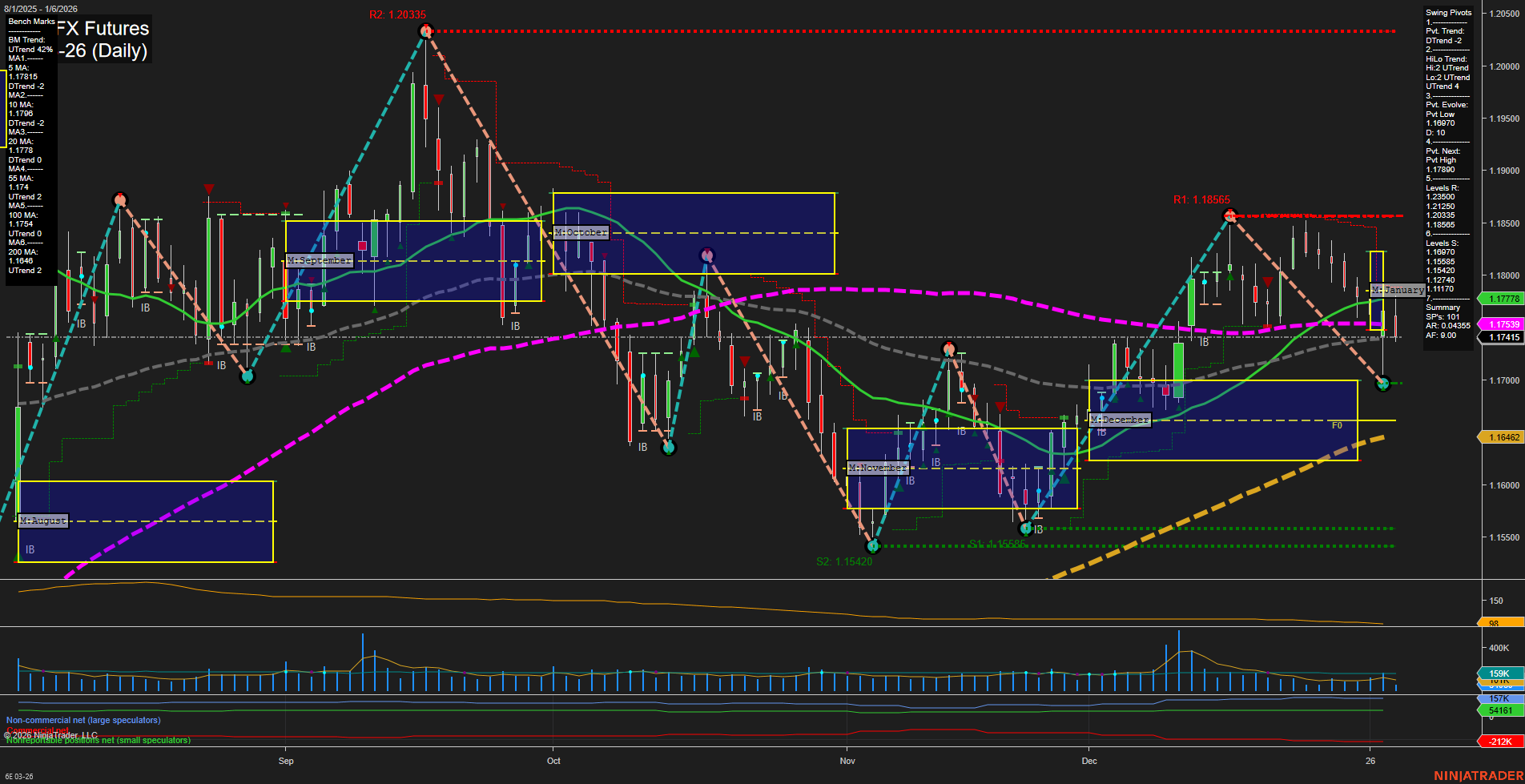

6E Euro FX Futures Daily Chart Analysis: 2026-Jan-06 07:02 CT

Price Action

- Last: 1.17415,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -2%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: -17%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: -6%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt Low 1.17170,

- 4. Pvt. Next: Pvt High 1.17880,

- 5. Levels R: 1.18565, 1.20335,

- 6. Levels S: 1.17170, 1.15520.

Daily Benchmarks

- (Short-Term) 5 Day: 1.17815 Down Trend,

- (Short-Term) 10 Day: 1.1764 Down Trend,

- (Intermediate-Term) 20 Day: 1.17778 Down Trend,

- (Intermediate-Term) 55 Day: 1.17415 Down Trend,

- (Long-Term) 100 Day: 1.16462 Up Trend,

- (Long-Term) 200 Day: 1.16642 Up Trend.

Additional Metrics

Recent Trade Signals

- 06 Jan 2026: Long 6E 03-26 @ 1.1755 Signals.USAR-WSFG

- 05 Jan 2026: Long 6E 03-26 @ 1.1763 Signals.USAR.TR120

- 05 Jan 2026: Short 6E 03-26 @ 1.17195 Signals.USAR.TR720

- 05 Jan 2026: Short 6E 03-26 @ 1.1727 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The 6E Euro FX Futures daily chart shows a market under pressure, with price action currently below all key session fib grid levels (weekly, monthly, yearly), and a slow momentum environment. The short-term trend is bearish, confirmed by the downward direction of the 5, 10, 20, and 55-day moving averages, as well as the most recent swing pivot trend (DTrend). Intermediate-term signals are mixed: while the HiLo trend remains up, the monthly fib grid and moving averages are trending down, suggesting a possible transition or consolidation phase. Long-term structure is bearish, with price below the yearly fib grid and a recent short signal from the long-term trade system. Volatility (ATR) and volume (VOLMA) are moderate, indicating neither a breakout nor a collapse scenario. The market is currently testing support at 1.17170, with resistance at 1.17880 and 1.18565 above. Recent trade signals show both long and short entries, reflecting the choppy, indecisive nature of the current environment. Overall, the chart suggests a market in a corrective or retracement phase within a broader bearish context, with potential for further downside if support fails, but also the possibility of a short-term bounce if buyers defend current levels.

Chart Analysis ATS AI Generated: 2026-01-06 07:02 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.