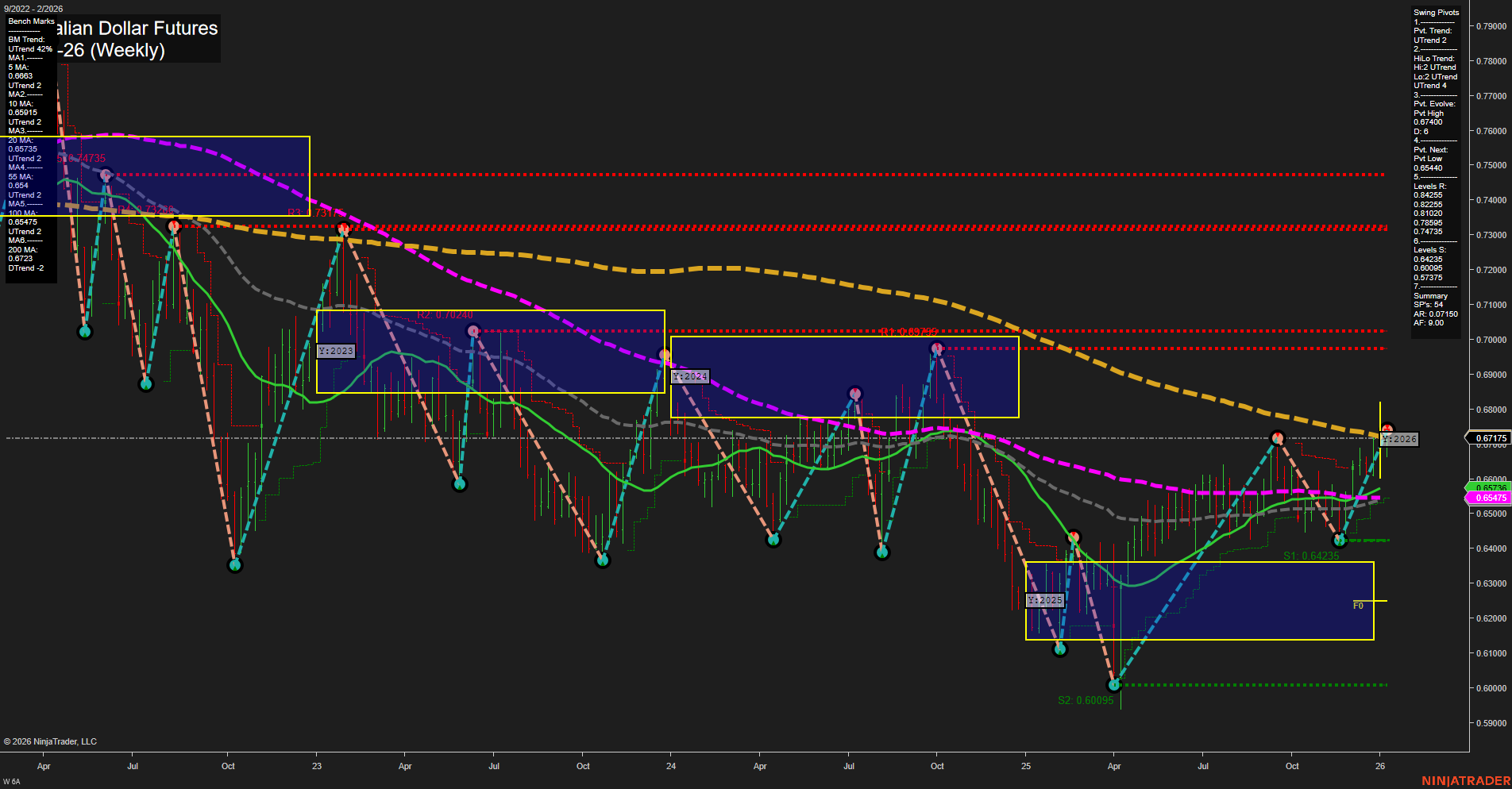

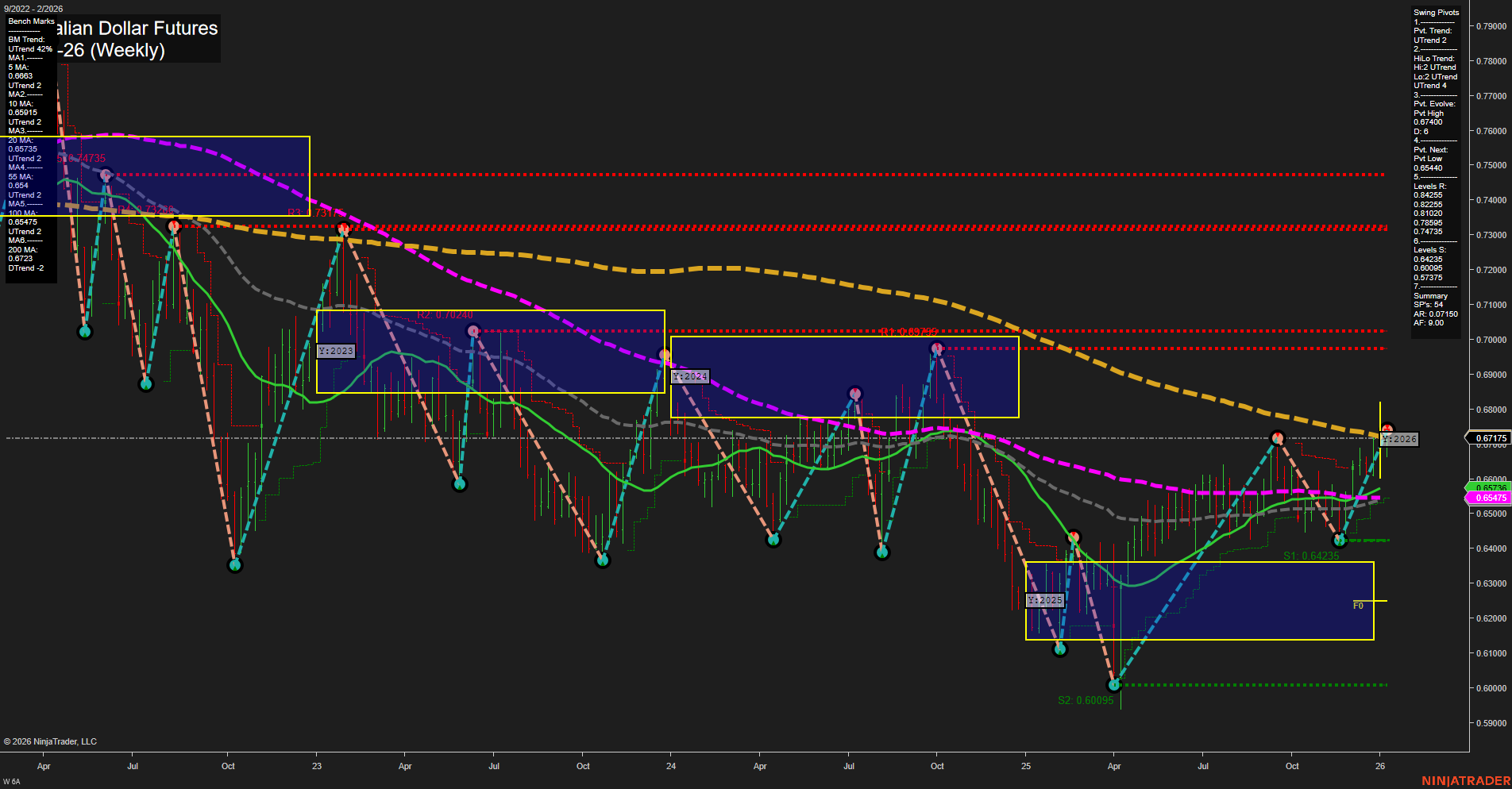

6A Australian Dollar Futures Weekly Chart Analysis: 2026-Jan-06 07:00 CT

Price Action

- Last: 0.67175,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 0.67140,

- 4. Pvt. Next: Pvt Low 0.65440,

- 5. Levels R: 0.74735, 0.73785, 0.72255, 0.68255, 0.67140,

- 6. Levels S: 0.65440, 0.65005, 0.60095.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.6633 Up Trend,

- (Intermediate-Term) 10 Week: 0.6615 Up Trend,

- (Long-Term) 20 Week: 0.6575 Up Trend,

- (Long-Term) 55 Week: 0.6547 Up Trend,

- (Long-Term) 100 Week: 0.6603 Down Trend,

- (Long-Term) 200 Week: 0.6873 Down Trend.

Recent Trade Signals

- 05 Jan 2026: Long 6A 03-26 @ 0.6716 Signals.USAR-MSFG

- 05 Jan 2026: Long 6A 03-26 @ 0.67085 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The 6A Australian Dollar Futures weekly chart shows a notable shift in momentum, with price recently breaking above several key moving averages and swing resistance levels. Both short-term and intermediate-term swing pivot trends have turned upward, supported by a series of higher lows and a recent pivot high at 0.67140. The price is currently trading above the 5, 10, 20, and 55-week moving averages, all of which are in uptrends, indicating a strengthening bullish bias in the medium-term. However, the 100 and 200-week moving averages remain in downtrends, suggesting that the longer-term structure is still neutral and has not fully transitioned to a bullish phase. The recent trade signals confirm renewed buying interest, aligning with the upward swing pivot structure. Resistance levels above are clustered between 0.68255 and 0.74735, while support is established at 0.65440 and lower. The overall environment reflects a market in recovery mode, with potential for further upside if momentum persists, but with longer-term resistance and trend structure still to be overcome for a sustained bullish cycle.

Chart Analysis ATS AI Generated: 2026-01-06 07:01 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.