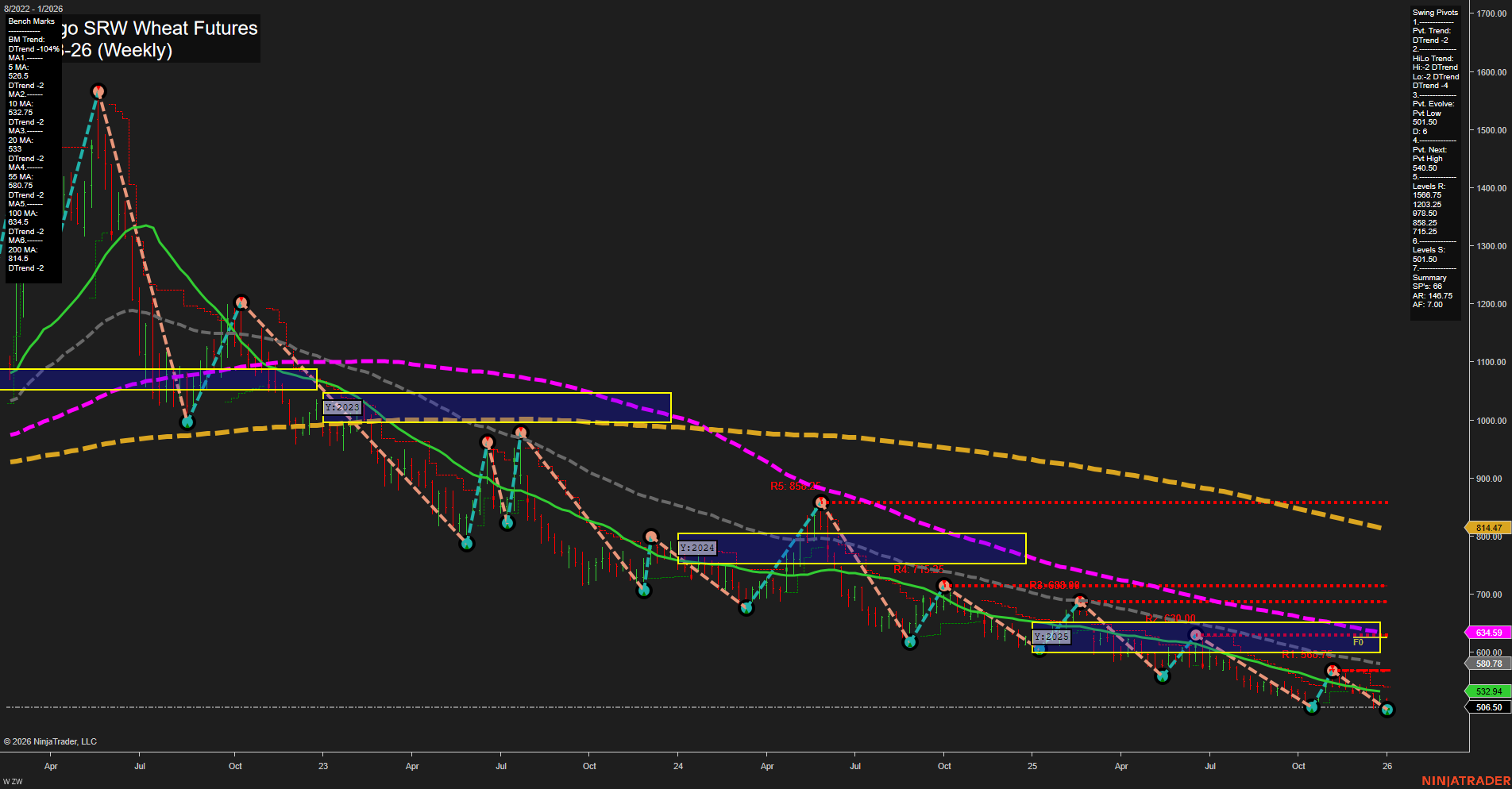

The ZW Chicago SRW Wheat Futures weekly chart continues to reflect a persistent bearish environment across all timeframes. Price action is subdued, with small bars and slow momentum, indicating a lack of strong buying interest and a continuation of the prevailing downtrend. The Weekly Session Fib Grid (WSFG) and Yearly Session Fib Grid (YSFG) both show price well below their respective NTZ/F0% levels, reinforcing the downward bias. The Monthly Session Fib Grid (MSFG) is slightly positive, but this is overshadowed by the dominant long-term and short-term downtrends. Swing pivot analysis confirms the downward structure, with the most recent pivot low at 501.50 and the next significant resistance at 640.50. All major resistance levels remain well above current price, while support is thin and close by, suggesting limited downside cushion. All benchmark moving averages from 5-week to 200-week are trending lower, further validating the entrenched bearish sentiment. Recent trade signals also align with the broader trend, with a short entry triggered at the start of January. Overall, the market is characterized by persistent selling pressure, lower highs, and lower lows, with no technical evidence yet of a reversal or significant bounce. The environment remains unfavorable for bullish swing setups, and the technical landscape suggests continued caution for any counter-trend strategies.