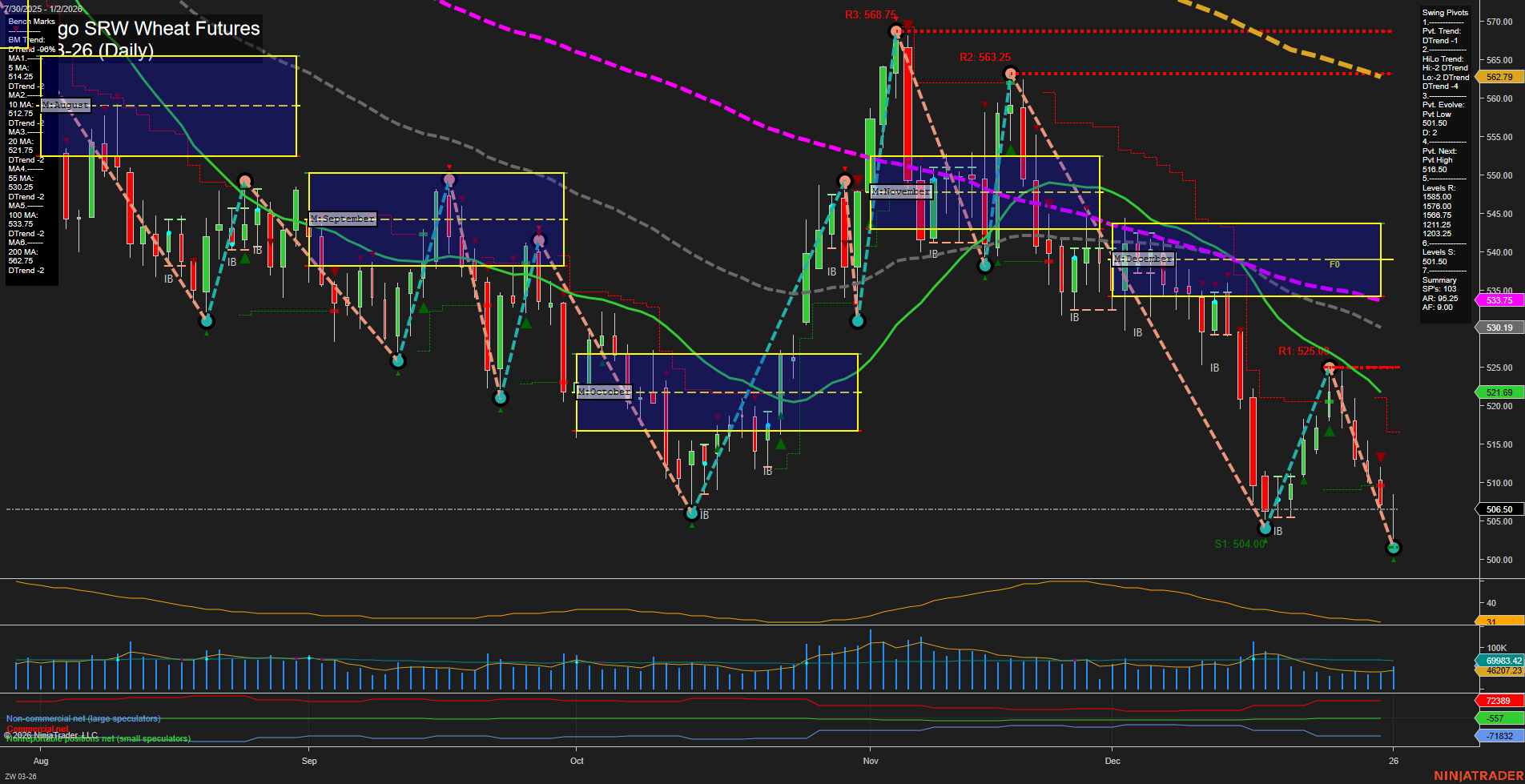

The ZW Chicago SRW Wheat Futures daily chart reflects a persistent bearish environment across all timeframes. Price action is subdued, with medium-sized bars and slow momentum, indicating a lack of aggressive buying or selling pressure. The short-term WSFG and long-term YSFG both show price below their respective NTZ/F0% levels, confirming a downward bias and trend. The intermediate-term MSFG is slightly positive, but price is only marginally above the monthly NTZ, suggesting any bullishness is weak and potentially corrective within a broader downtrend. Swing pivot analysis highlights a dominant downtrend, with the most recent pivot low at 504.00 and the next resistance at 516.50. Multiple resistance levels overhead (525.00, 563.25, 568.75) reinforce the challenge for any sustained upward move. All benchmark moving averages (5, 10, 20, 55, 100, 200 day) are trending down, further supporting the bearish structure. Volatility, as measured by ATR, remains moderate, and volume is steady but not elevated, indicating orderly rather than panic-driven trading. The most recent trade signal aligns with the prevailing trend, favoring the short side. Overall, the market is in a clear downtrend, with lower highs and lower lows dominating the chart. Any rallies are likely to encounter significant resistance, and the path of least resistance remains to the downside until a meaningful reversal in pivots or moving averages occurs.