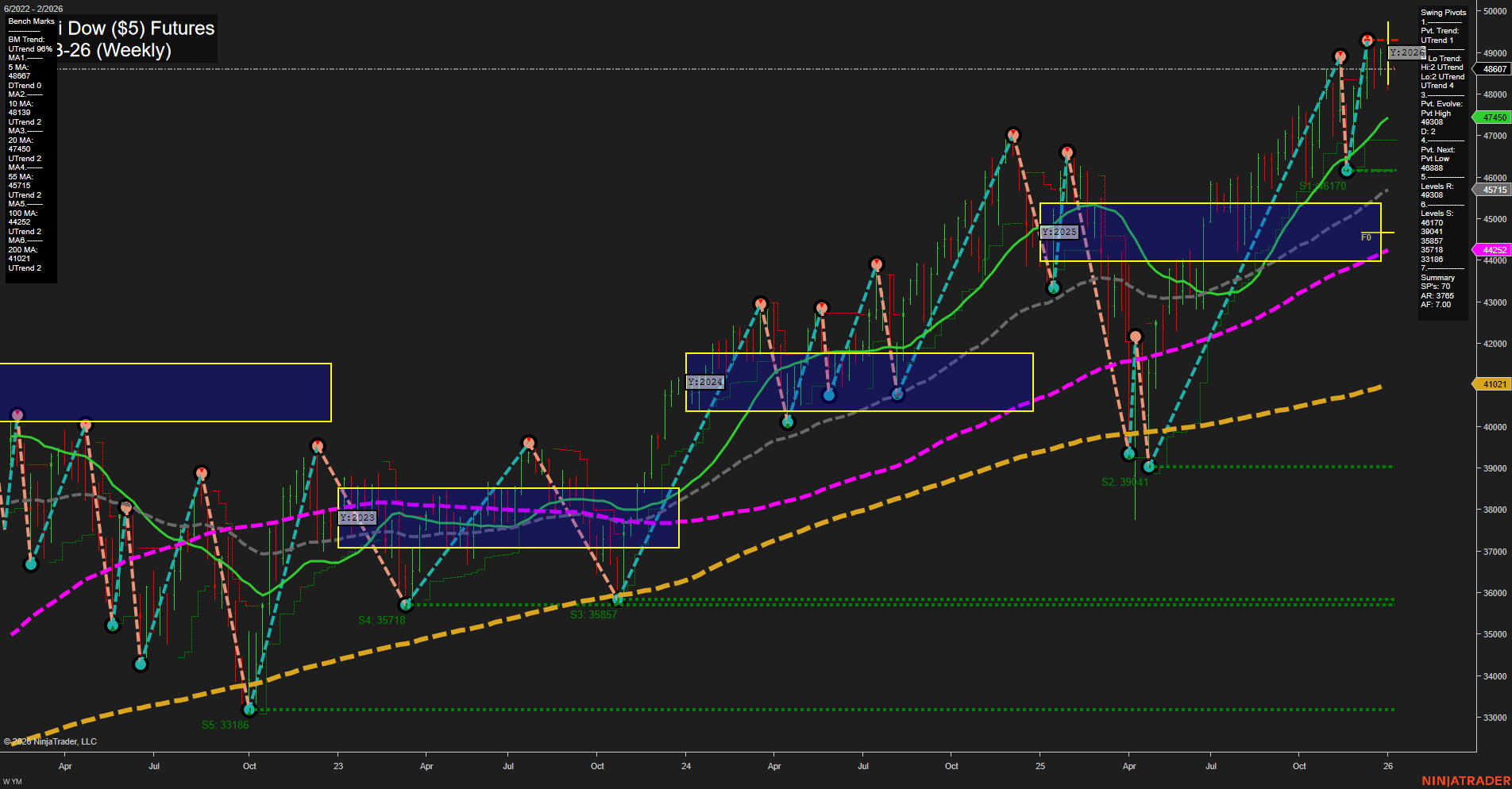

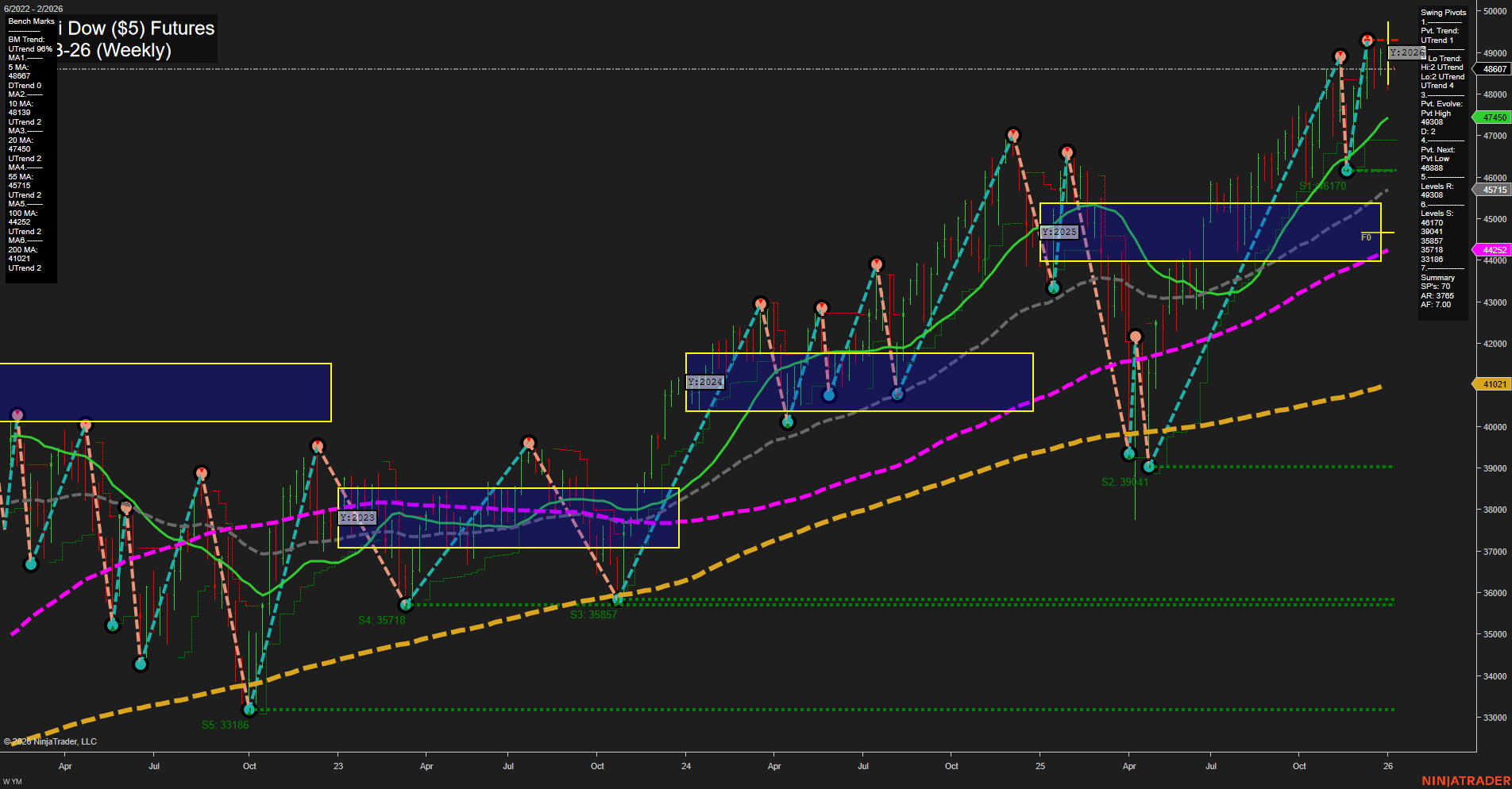

YM E-mini Dow ($5) Futures Weekly Chart Analysis: 2026-Jan-04 18:12 CT

Price Action

- Last: 47,515,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -45%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: 12%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: -5%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 49,048,

- 4. Pvt. Next: Pvt low 45,688,

- 5. Levels R: 49,048, 48,607, 47,888, 47,617,

- 6. Levels S: 45,688, 43,986, 39,441, 35,857, 35,718, 33,186.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 48,607 Down Trend,

- (Intermediate-Term) 10 Week: 47,888 Down Trend,

- (Long-Term) 20 Week: 47,450 Up Trend,

- (Long-Term) 55 Week: 44,252 Up Trend,

- (Long-Term) 100 Week: 42,365 Up Trend,

- (Long-Term) 200 Week: 41,021 Up Trend.

Recent Trade Signals

- 02 Jan 2026: Long YM 03-26 @ 48,615 Signals.USAR-MSFG

- 29 Dec 2025: Short YM 03-26 @ 48,744 Signals.USAR.TR120

- 29 Dec 2025: Short YM 03-26 @ 48,841 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The YM E-mini Dow ($5) Futures weekly chart shows a market in transition. Price action is consolidating below recent highs, with medium-sized bars and average momentum, suggesting a pause after a strong rally. The short-term Weekly Session Fib Grid (WSFG) trend is down, with price below the NTZ center, indicating some near-term weakness or corrective action. However, the swing pivot structure remains in an uptrend for both short- and intermediate-term, with the most recent pivot high at 49,048 and next support at 45,688. Intermediate-term Monthly Session Fib Grid (MSFG) is up, and the recent long signal aligns with this, while the long-term Yearly Session Fib Grid (YSFG) is slightly negative, reflecting a potential for broader consolidation or a pullback phase. Moving averages show mixed signals: short-term MAs are trending down, but all long-term MAs (20, 55, 100, 200 week) are still in uptrends, supporting a bullish bias on larger timeframes. Recent trade signals reflect this mixed environment, with both long and short entries triggered in the past week. Overall, the market is in a consolidation phase with a bullish intermediate-term structure, but short-term caution is warranted as price digests gains and tests support levels.

Chart Analysis ATS AI Generated: 2026-01-04 18:13 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.