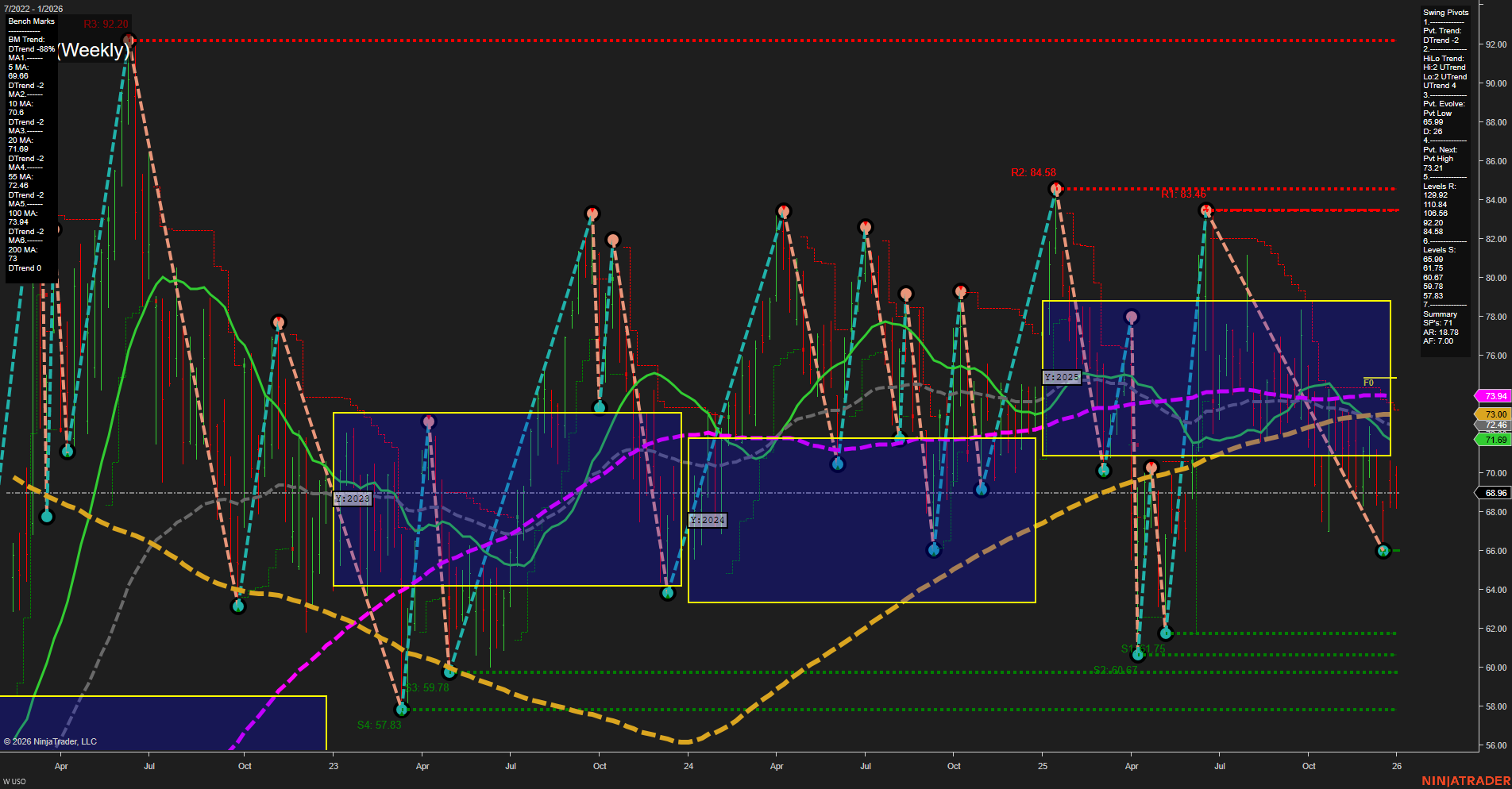

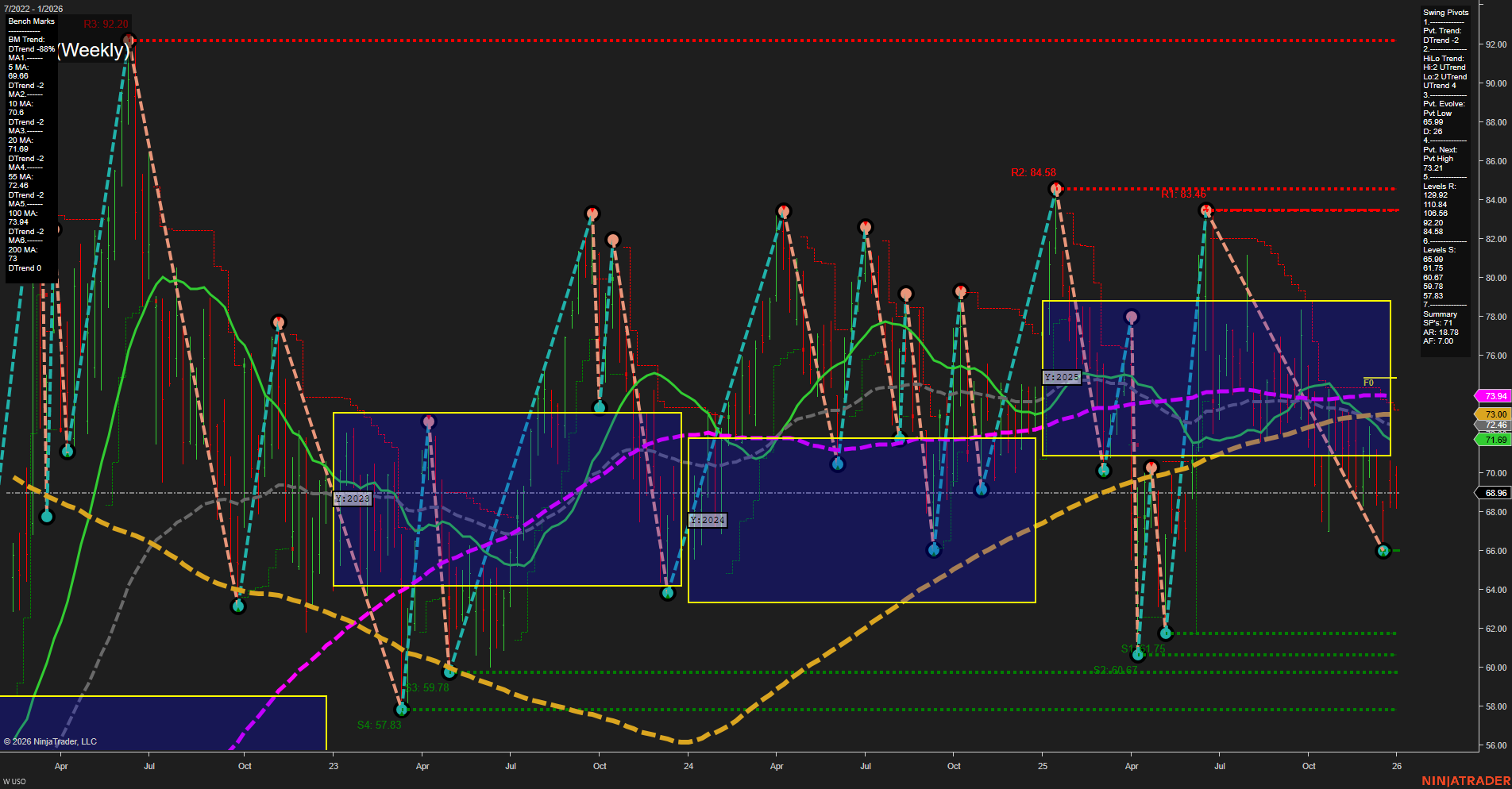

USO United States Oil Fund LP Weekly Chart Analysis: 2026-Jan-04 18:12 CT

Price Action

- Last: 68.96,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 68.96,

- 4. Pvt. Next: Pvt high 73.21,

- 5. Levels R: 92.20, 84.58, 83.26, 80.04, 74.88, 73.21, 73.00, 71.69, 66.75, 60.75,

- 6. Levels S: 59.78, 57.83, 57.17, 56.17.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 70.08 Down Trend,

- (Intermediate-Term) 10 Week: 71.68 Down Trend,

- (Long-Term) 20 Week: 71.69 Down Trend,

- (Long-Term) 55 Week: 73.94 Down Trend,

- (Long-Term) 100 Week: 73.00 Down Trend,

- (Long-Term) 200 Week: 70.00 Down Trend.

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The USO weekly chart reflects a market in a broad consolidation phase, with price action contained within the yearly NTZ (neutral zone) and momentum remaining slow. The most recent swing pivot is a low at 68.96, with the next potential resistance at 73.21. Short-term trend is down, as confirmed by the swing pivot trend and all benchmark moving averages pointing lower, while intermediate-term HiLo trend remains up, suggesting some underlying support. Long-term structure is bearish, with price below all major moving averages and resistance levels stacked above. The market has repeatedly tested support in the high 50s to low 60s, while failing to break above the mid-70s, indicating a range-bound environment with a bearish tilt. No clear breakout or reversal signals are present, and the overall technical landscape suggests continued choppy action with a downside bias unless a significant catalyst emerges.

Chart Analysis ATS AI Generated: 2026-01-04 18:12 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.