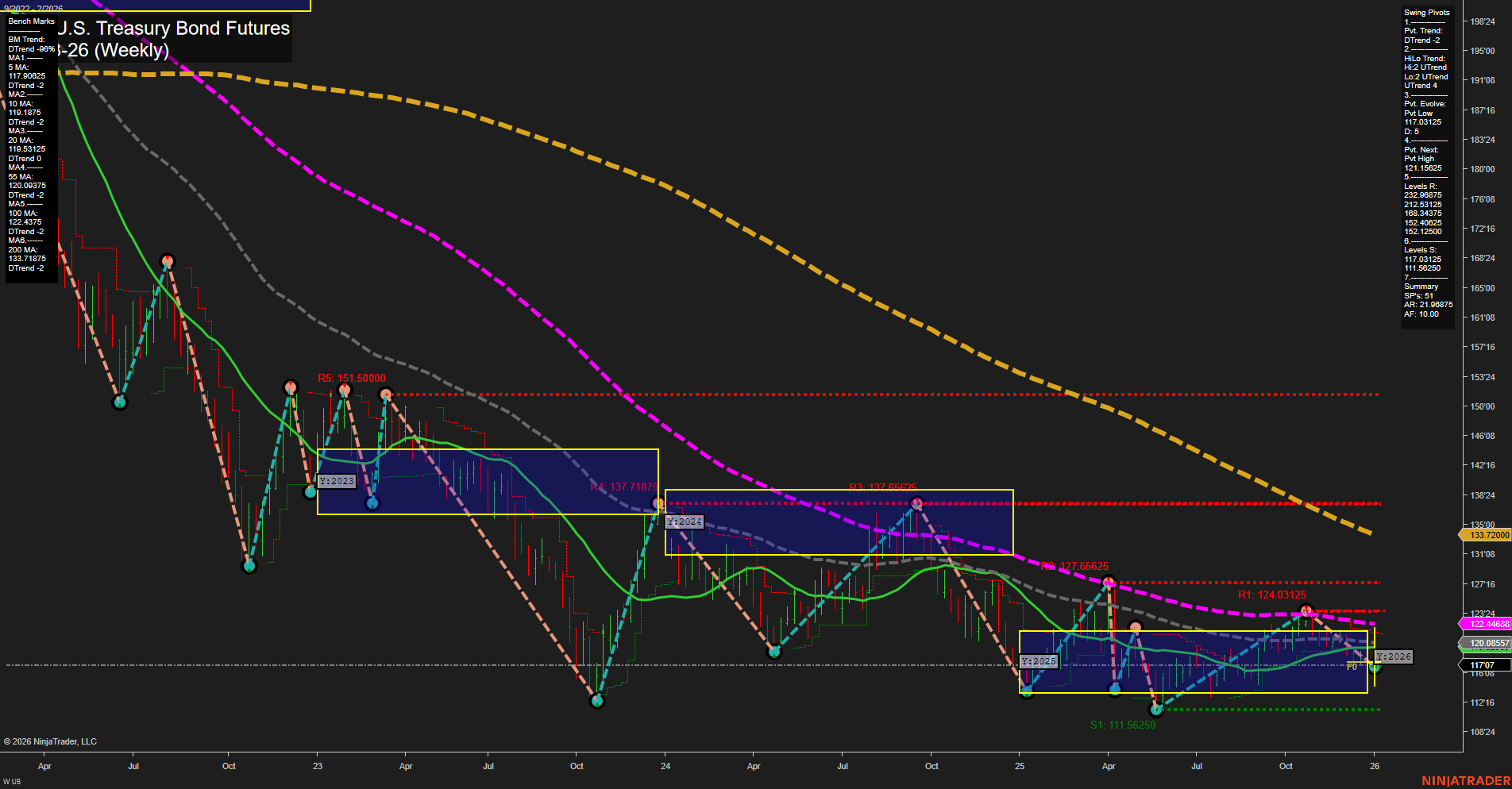

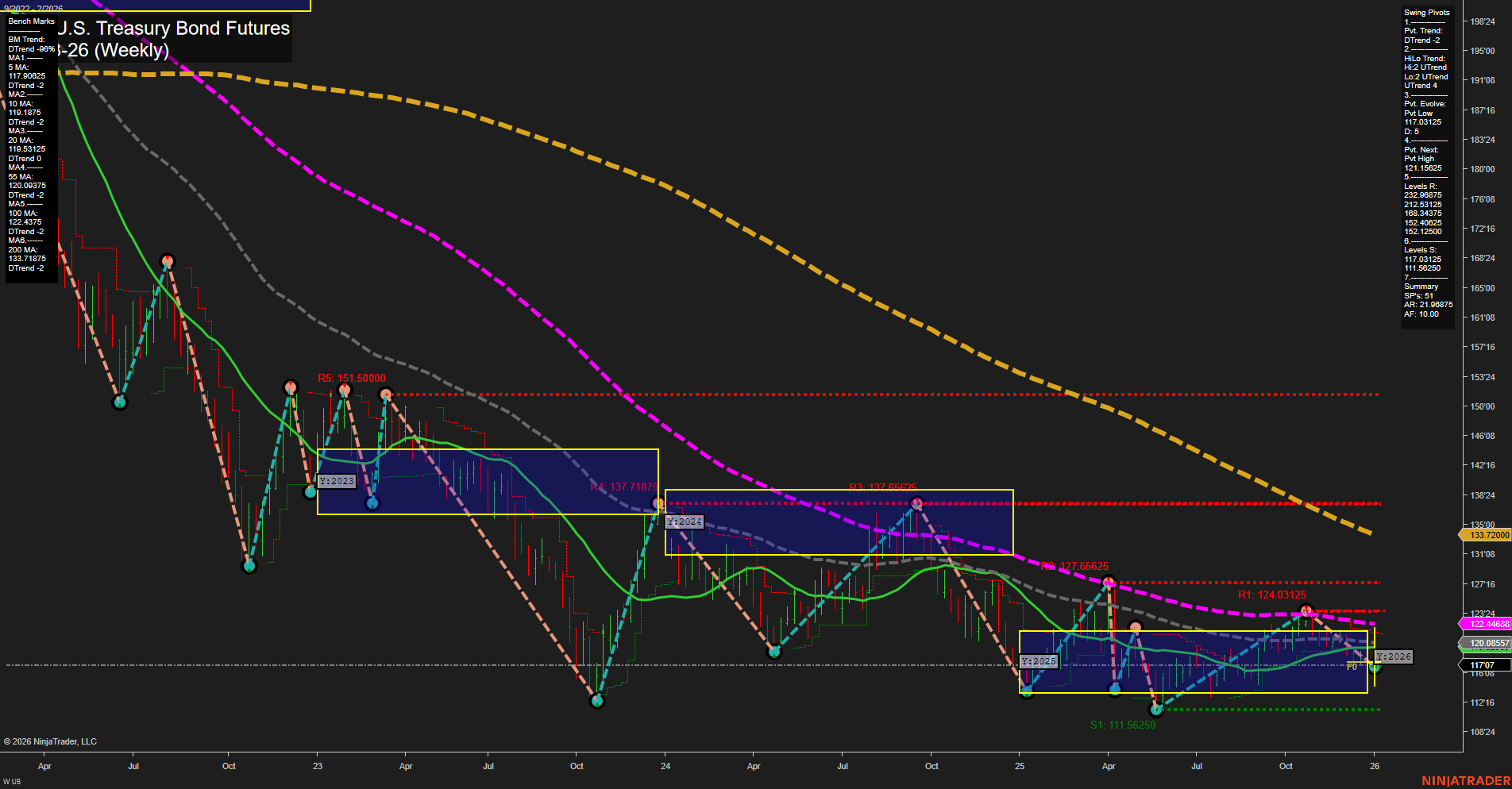

UB Ultra U.S. Treasury Bond Futures Weekly Chart Analysis: 2026-Jan-04 18:11 CT

Price Action

- Last: 117.0859375,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 0%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: -8%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: -3%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 111.5625,

- 4. Pvt. Next: Pvt high 124.03125,

- 5. Levels R: 137.65625, 137.71875, 151.5, 124.03125,

- 6. Levels S: 111.5625.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 120.08557 Down Trend,

- (Intermediate-Term) 10 Week: 122.44884 Down Trend,

- (Long-Term) 20 Week: 120.08557 Down Trend,

- (Long-Term) 55 Week: 133.72000 Down Trend,

- (Long-Term) 100 Week: 124.46875 Down Trend,

- (Long-Term) 200 Week: 151.50000 Down Trend.

Recent Trade Signals

- 31 Dec 2025: Short UB 03-26 @ 117.71875 Signals.USAR.TR120

- 31 Dec 2025: Short UB 03-26 @ 118 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The UB Ultra U.S. Treasury Bond Futures weekly chart reflects a market in a prolonged downtrend, with all major moving averages (from 5-week to 200-week) trending lower and price action consistently below key benchmarks. The most recent price action is characterized by medium-sized bars and slow momentum, indicating a lack of strong directional conviction in the short term. The Weekly Session Fib Grid (WSFG) shows a neutral stance, with price sitting at the center of the NTZ, while the Monthly and Yearly Session Fib Grids (MSFG, YSFG) both indicate price is below their respective NTZs, reinforcing a bearish bias for the intermediate and long term. Swing pivot analysis highlights a short-term downtrend, but the intermediate-term HiLo trend is up, suggesting some recent recovery or bounce within the broader downtrend. Key resistance levels remain well above current price, while support is established at the recent swing low. Recent trade signals have triggered short entries, aligning with the prevailing bearish structure. Overall, the chart suggests a market in consolidation at lower levels, with the dominant trend still to the downside, and any rallies so far have failed to break through major resistance or reverse the long-term trend.

Chart Analysis ATS AI Generated: 2026-01-04 18:12 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.