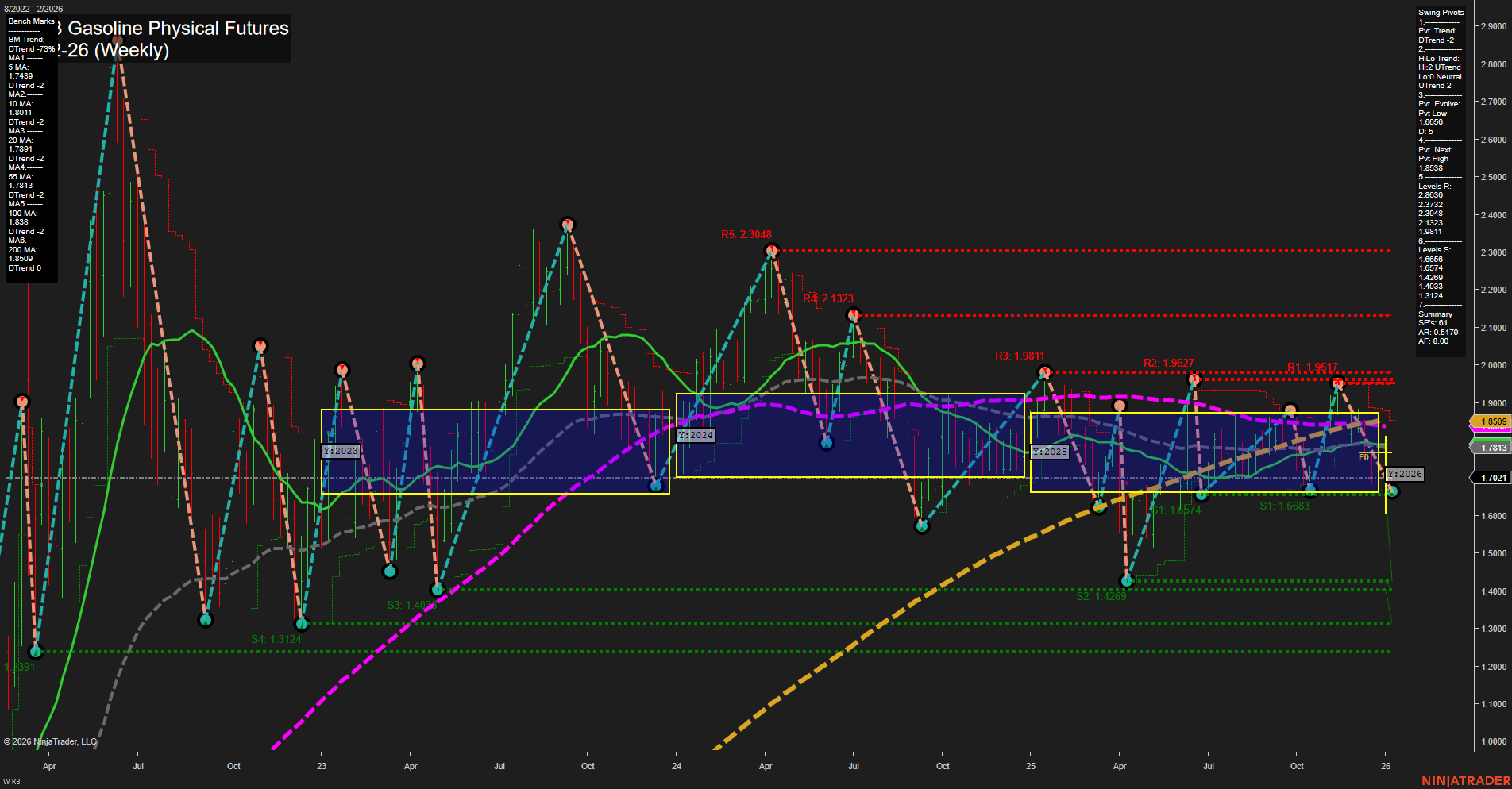

The weekly chart for RB RBOB Gasoline Physical Futures as of early January 2026 shows a market under pressure, with price action characterized by medium-sized bars and slow momentum, indicating a lack of strong directional conviction. All three session Fib grid trends (weekly, monthly, yearly) are pointing down, with price consistently below their respective NTZ/F0% levels, reinforcing a bearish bias across timeframes. The short-term swing pivot trend is down, but the intermediate-term HiLo trend remains up, suggesting some underlying support or a possible basing process. Key resistance levels are clustered above the current price, with the nearest at 1.859, while support is found at 1.668 and lower. Moving averages show a mixed picture: short-term (5 and 10 week) MAs are trending up, but all long-term benchmarks (20, 55, 100, 200 week) are in downtrends, highlighting a broader bearish structure despite recent short-term strength. Recent trade signals have triggered short entries, aligning with the prevailing downward momentum. Overall, the market is in a corrective or consolidative phase within a larger downtrend, with potential for further downside unless key resistance levels are reclaimed. Volatility appears contained, and the market is likely to remain choppy unless a decisive breakout or breakdown occurs.