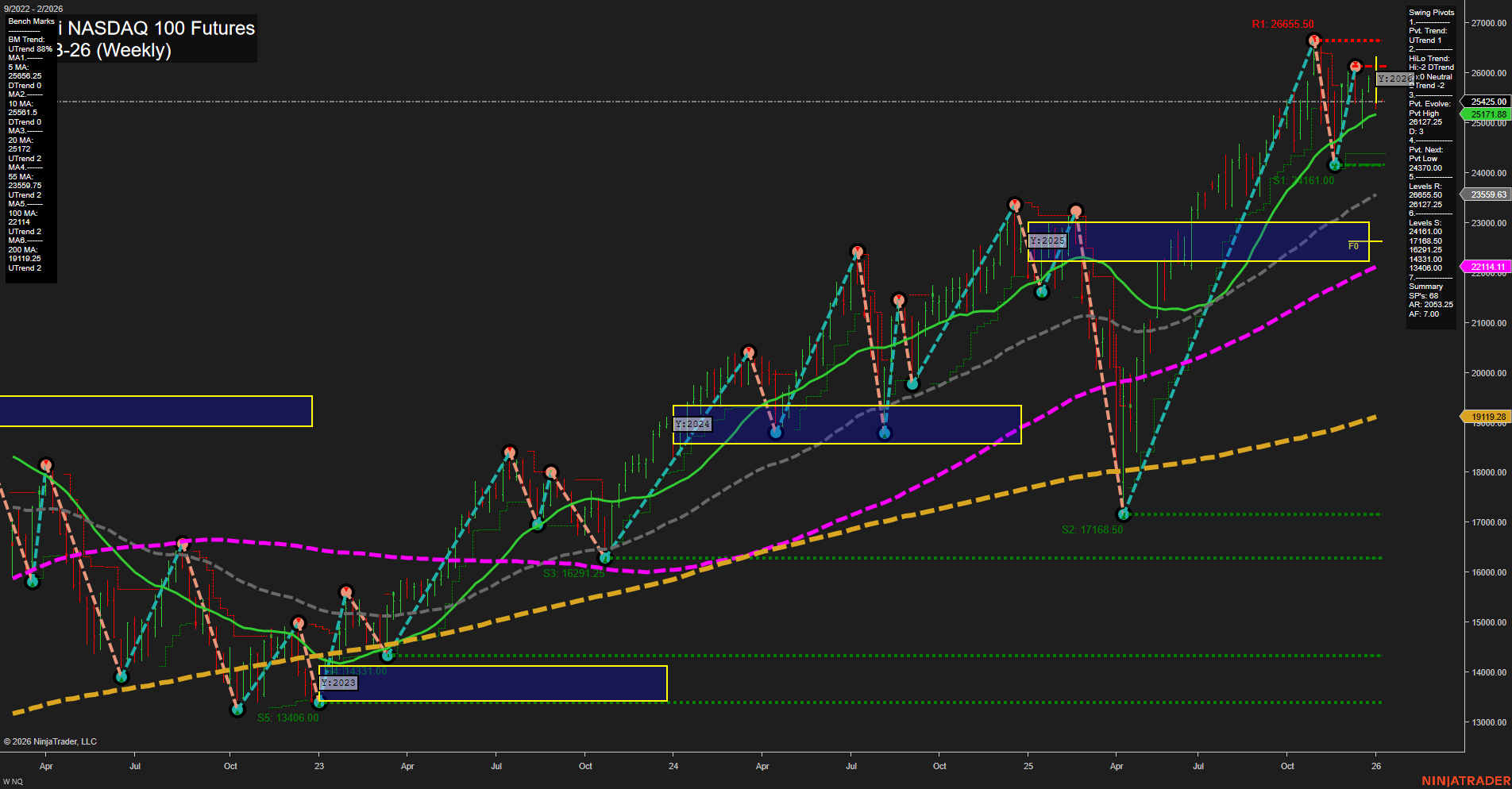

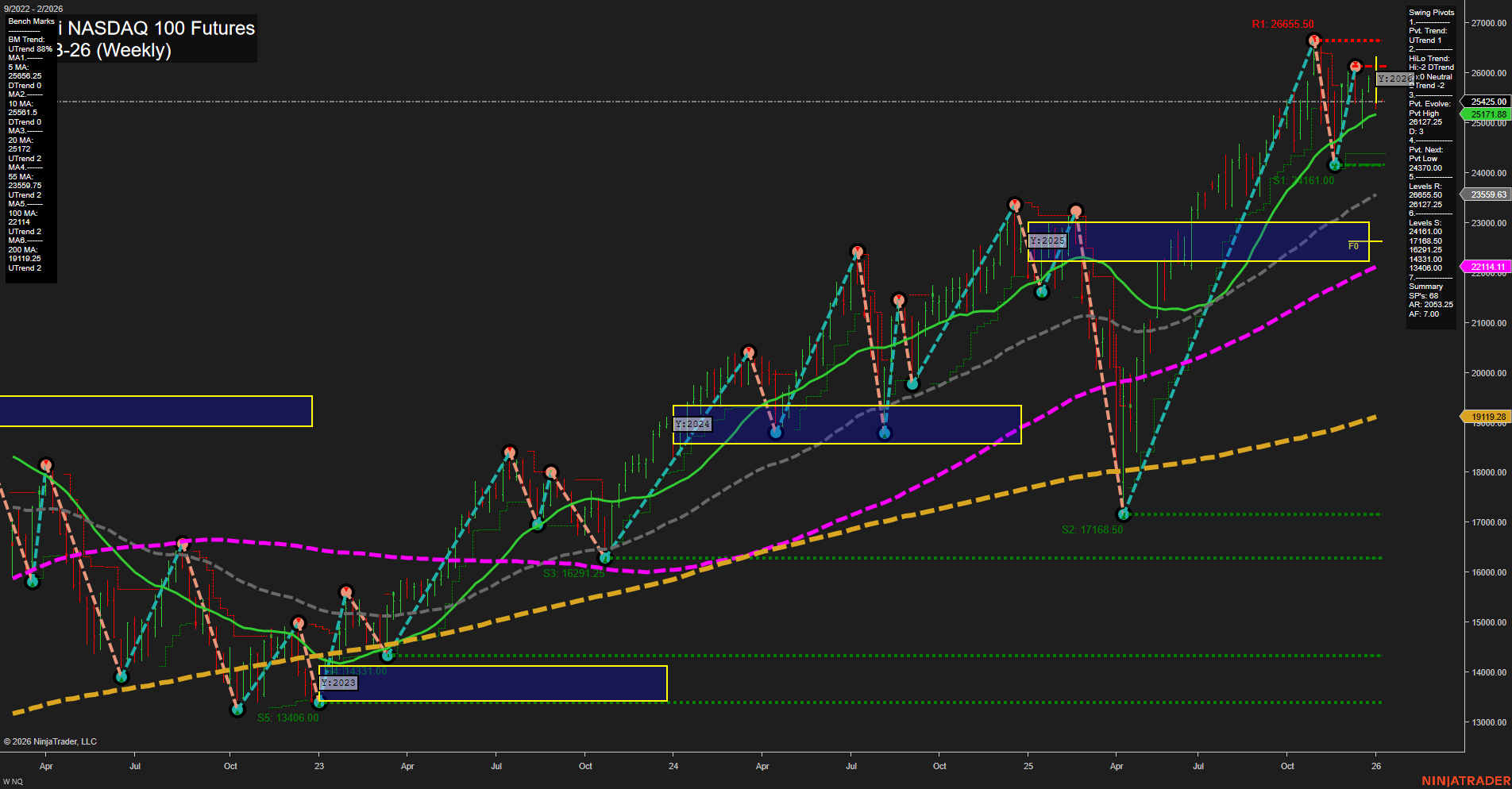

NQ E-mini NASDAQ 100 Futures Weekly Chart Analysis: 2026-Jan-04 18:08 CT

Price Action

- Last: 25171.88,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -75%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: -1%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: -9%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt High 26655.50,

- 4. Pvt. Next: Pvt Low 24131.00,

- 5. Levels R: 26655.50, 26127.25, 26065.50, 24730.00,

- 6. Levels S: 24131.00, 17168.50, 16291.25, 13406.00.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 25469.25 Down Trend,

- (Intermediate-Term) 10 Week: 25620.0 Down Trend,

- (Long-Term) 20 Week: 25456.00 Down Trend,

- (Long-Term) 55 Week: 22114.11 Up Trend,

- (Long-Term) 100 Week: 24114.00 Up Trend,

- (Long-Term) 200 Week: 19119.28 Up Trend.

Recent Trade Signals

- 02 Jan 2026: Short NQ 03-26 @ 25294.5 Signals.USAR-MSFG

- 02 Jan 2026: Short NQ 03-26 @ 25294.5 Signals.USAR.TR120

- 30 Dec 2025: Short NQ 03-26 @ 25744.5 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

The NQ E-mini NASDAQ 100 Futures weekly chart is showing a notable shift in momentum after a prolonged uptrend. Price action has recently turned lower, with the last price closing below all key short- and intermediate-term moving averages, and momentum is slow, indicating a lack of strong buying interest. The Weekly, Monthly, and Yearly Session Fib Grids all show price below their respective NTZ/F0% levels, confirming a downward bias across all timeframes. Swing pivots indicate the most recent structure is a pivot high at 26655.50, with the next key support at 24131.00. Resistance levels are stacked above, suggesting overhead supply. The intermediate and short-term moving averages are trending down, while the longer-term 55, 100, and 200 week MAs remain in uptrends, reflecting that the primary bull trend is being tested but not yet reversed. Recent trade signals have all been to the short side, aligning with the current bearish tone in the short and intermediate term. Overall, the market is in a corrective phase within a larger uptrend, with the potential for further downside or consolidation as it tests key support levels. The environment is characterized by a transition from bullish momentum to a more defensive, corrective posture, with volatility likely to remain elevated as the market digests recent highs and seeks direction.

Chart Analysis ATS AI Generated: 2026-01-04 18:08 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.