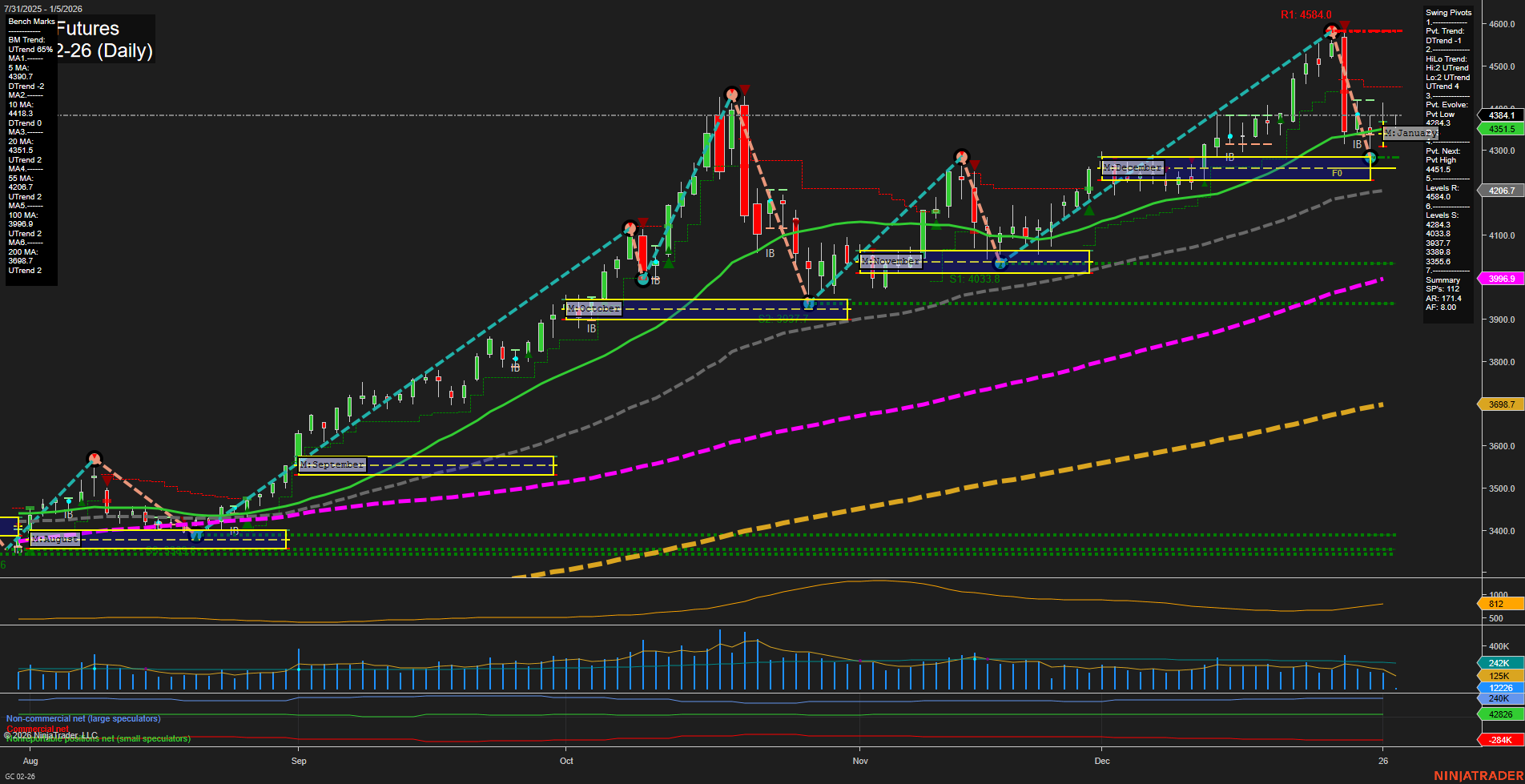

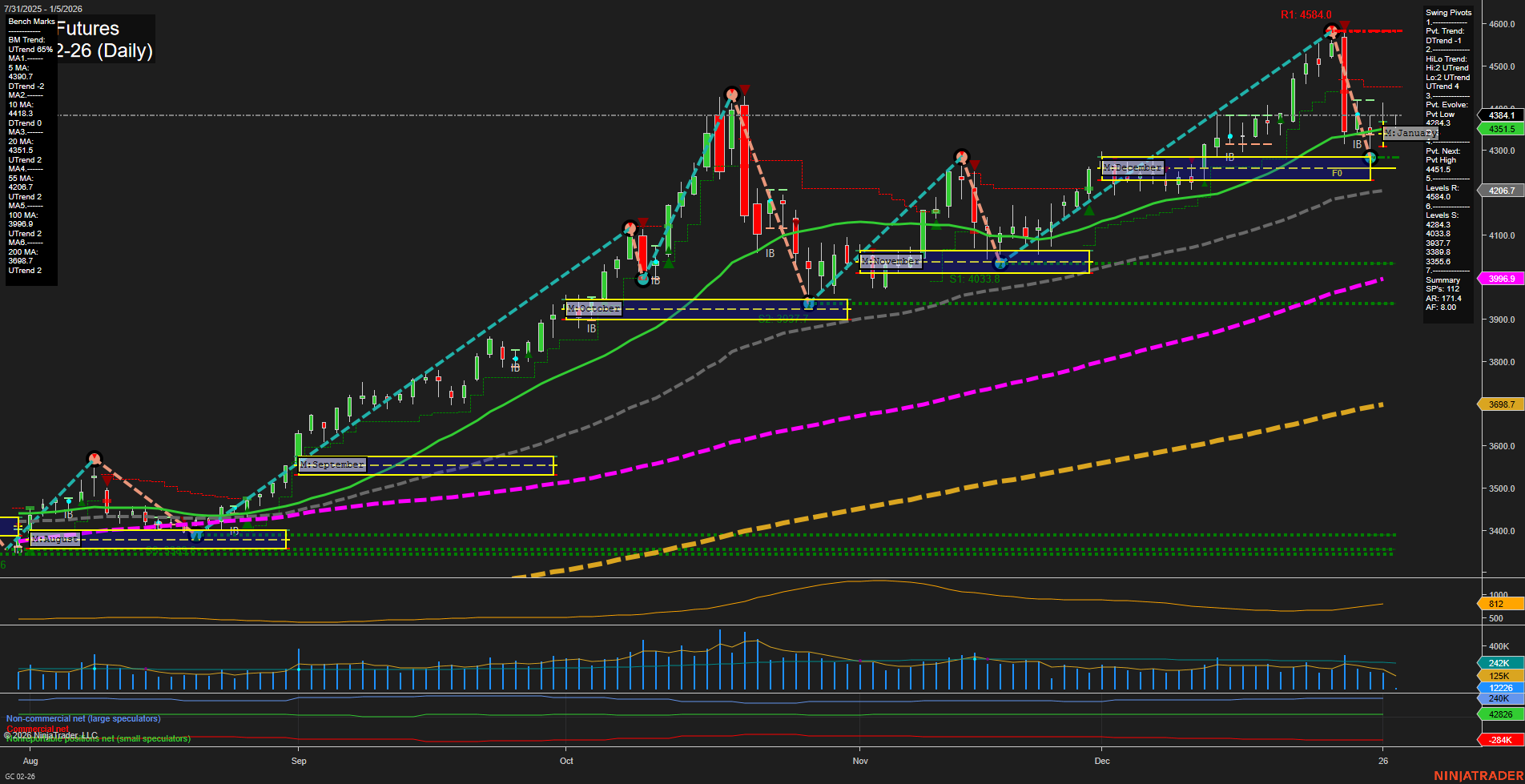

GC Gold Futures Daily Chart Analysis: 2026-Jan-04 18:06 CT

Price Action

- Last: 4384.1,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -127%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: 10%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: -36%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 4243.3,

- 4. Pvt. Next: Pvt high 4584.0,

- 5. Levels R: 4584.0, 4451.5, 4243.3, 4033.7, 3937.7, 3585.6,

- 6. Levels S: 4243.3, 4033.7, 3937.7, 3585.6.

Daily Benchmarks

- (Short-Term) 5 Day: 4390.7 Down Trend,

- (Short-Term) 10 Day: 4418.3 Down Trend,

- (Intermediate-Term) 20 Day: 4351.5 Up Trend,

- (Intermediate-Term) 55 Day: 4206.7 Up Trend,

- (Long-Term) 100 Day: 3996.9 Up Trend,

- (Long-Term) 200 Day: 3689.7 Up Trend.

Additional Metrics

Recent Trade Signals

- 02 Jan 2026: Long GC 02-26 @ 4408.4 Signals.USAR.TR120

- 02 Jan 2026: Long GC 02-26 @ 4398.9 Signals.USAR-MSFG

- 30 Dec 2025: Short GC 02-26 @ 4378.3 Signals.USAR.TR720

- 29 Dec 2025: Short GC 02-26 @ 4537.6 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bearish.

Key Insights Summary

Gold futures are currently experiencing a mixed environment across timeframes. Short-term price action has shifted to a downtrend, with the last price below key short-term moving averages and the weekly session fib grid indicating a downward bias. However, the intermediate-term trend remains up, supported by the monthly session fib grid and rising 20- and 55-day moving averages. The long-term outlook is less favorable, with the yearly session fib grid and price below the 100- and 200-day benchmarks, suggesting a broader bearish context. Recent trade signals reflect this volatility, with both long and short entries triggered in the past week. Volatility remains moderate, and volume is steady. The market appears to be in a corrective phase after a strong rally, with potential for further consolidation or a test of lower support levels before any sustained move resumes. Swing traders should note the divergence between short-term weakness and intermediate-term strength, as the market navigates a transition zone between trends.

Chart Analysis ATS AI Generated: 2026-01-04 18:06 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.