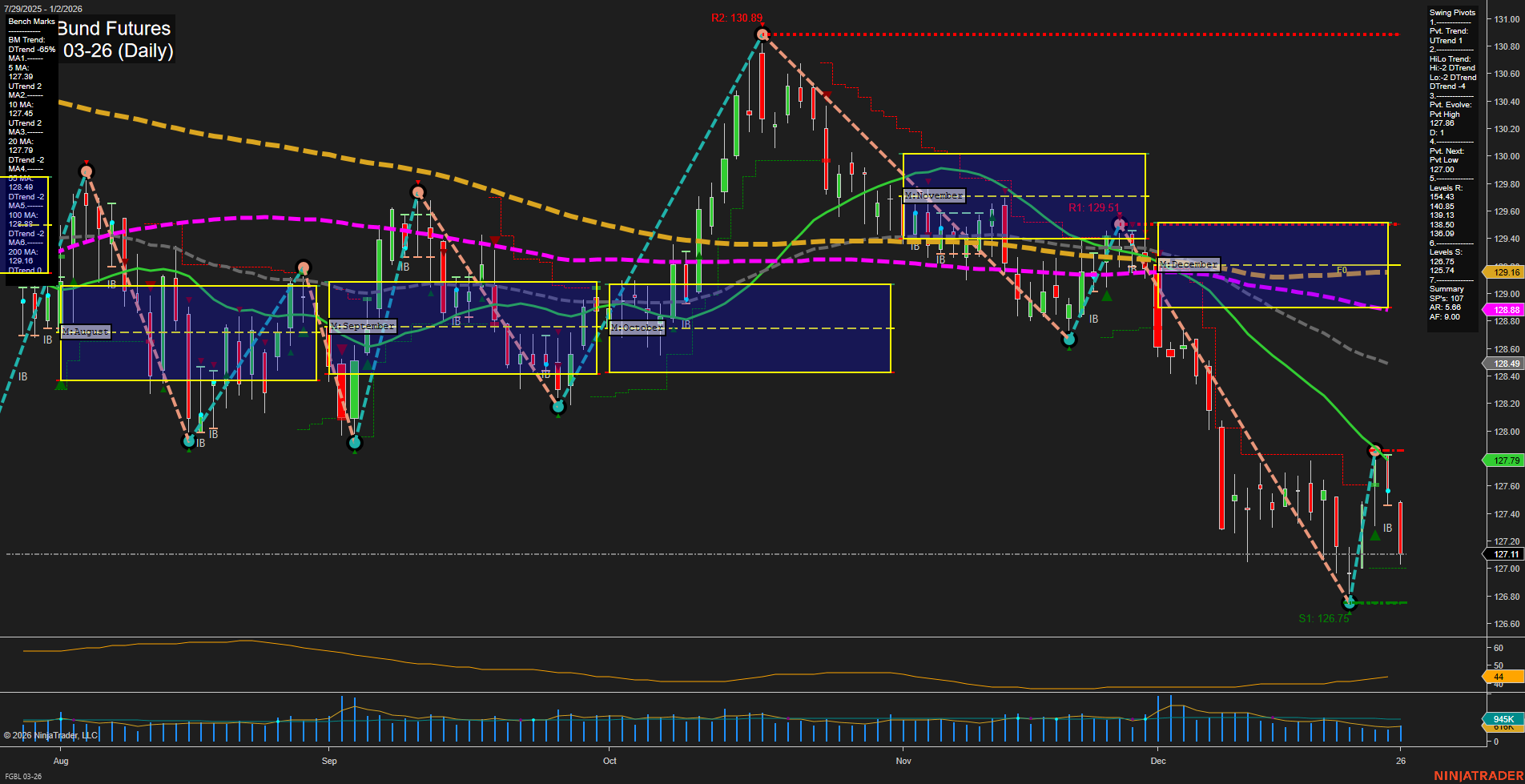

The FGBL Euro-Bund Futures daily chart shows a market in a corrective phase after a pronounced downtrend. Price action is currently consolidating near 127.79, with medium-sized bars and slow momentum, indicating a pause after recent volatility. All major session fib grid trends (weekly, monthly, yearly) remain decisively down, with price trading below their respective NTZ/F0% levels, confirming persistent bearish pressure across timeframes. Swing pivots reveal a short-term uptrend (UTrend) as the market attempts a bounce from recent lows, but the intermediate-term trend (HiLo Trend) remains down, suggesting that any recovery may be counter-trend in nature. Resistance levels are stacked above at 128.49, 129.51, and 130.89, while support is found at 126.75 and 125.74, highlighting a narrow range for potential mean reversion or further breakdown. All benchmark moving averages (5, 10, 20, 55, 100, 200 day) are trending down, reinforcing the dominant bearish structure. The ATR indicates moderate volatility, and volume remains robust, supporting the significance of recent moves. Recent trade signals have triggered short entries, aligning with the prevailing downtrend on both short- and intermediate-term signals. Overall, the market is in a corrective bounce within a broader bearish context. The short-term rating is neutral due to the current pivot uptrend and consolidation, but intermediate- and long-term outlooks remain bearish. The technical landscape suggests the market is at a decision point: either a continuation of the downtrend if resistance holds, or a deeper retracement if buyers can sustain momentum above key resistance levels.