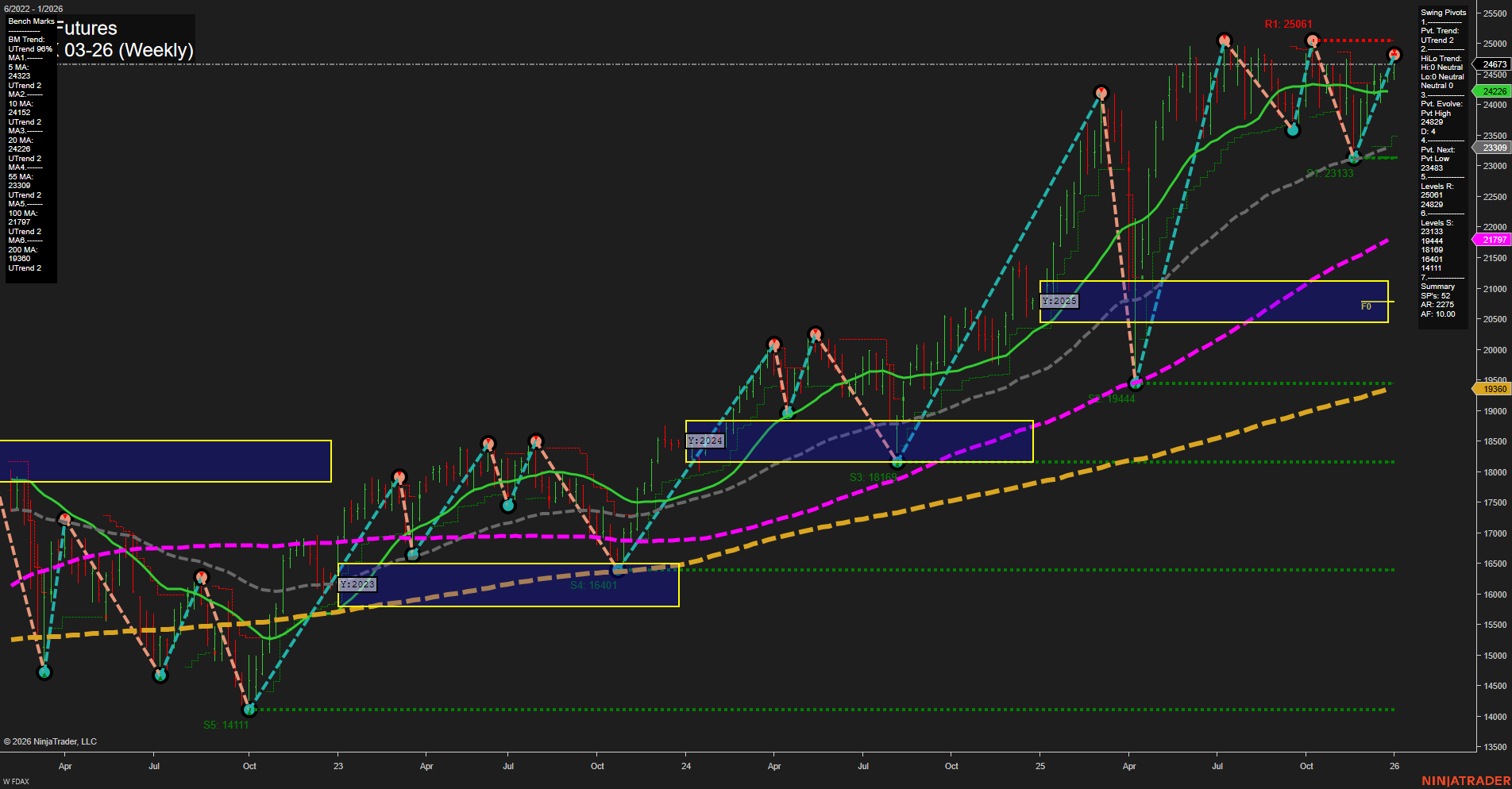

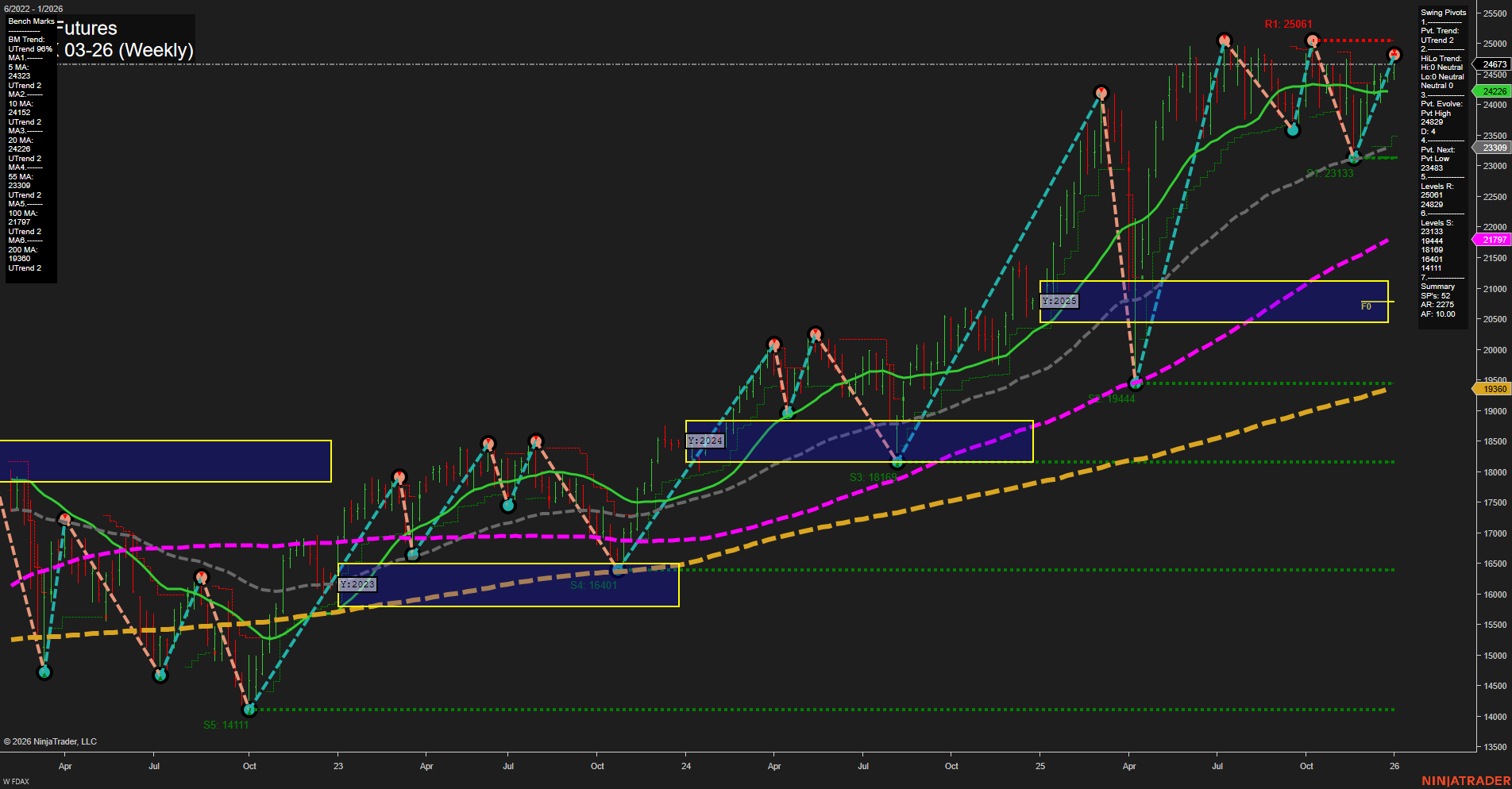

FDAX DAX Futures Weekly Chart Analysis: 2026-Jan-04 18:05 CT

Price Action

- Last: 24,571,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 44%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: 4%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 115%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt low 23,133,

- 4. Pvt. Next: Pvt high 25,061,

- 5. Levels R: 25,061,

- 6. Levels S: 23,133, 19,444, 18,104, 16,401, 14,111.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 24,283 Up Trend,

- (Intermediate-Term) 10 Week: 24,226 Up Trend,

- (Long-Term) 20 Week: 23,390 Up Trend,

- (Long-Term) 55 Week: 21,797 Up Trend,

- (Long-Term) 100 Week: 21,167 Up Trend,

- (Long-Term) 200 Week: 19,360 Up Trend.

Recent Trade Signals

- 30 Dec 2025: Long FDAX 03-26 @ 24,571 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The FDAX DAX Futures weekly chart shows a strong bullish structure in both the short- and long-term timeframes, with price action consistently above key Fibonacci grid levels and all major moving averages trending upward. The most recent swing pivot low at 23,133 has held, and the next resistance is at the recent swing high of 25,061. The intermediate-term trend is neutral, reflecting some consolidation or sideways movement after a strong rally, but the overall structure remains constructive with higher lows and higher highs. The recent long signal aligns with the prevailing uptrend, and the market is trading well above all major support levels, indicating robust underlying strength. The technical landscape suggests a continuation of the broader uptrend, with any pullbacks likely to find support at the identified swing lows and moving averages.

Chart Analysis ATS AI Generated: 2026-01-04 18:05 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.