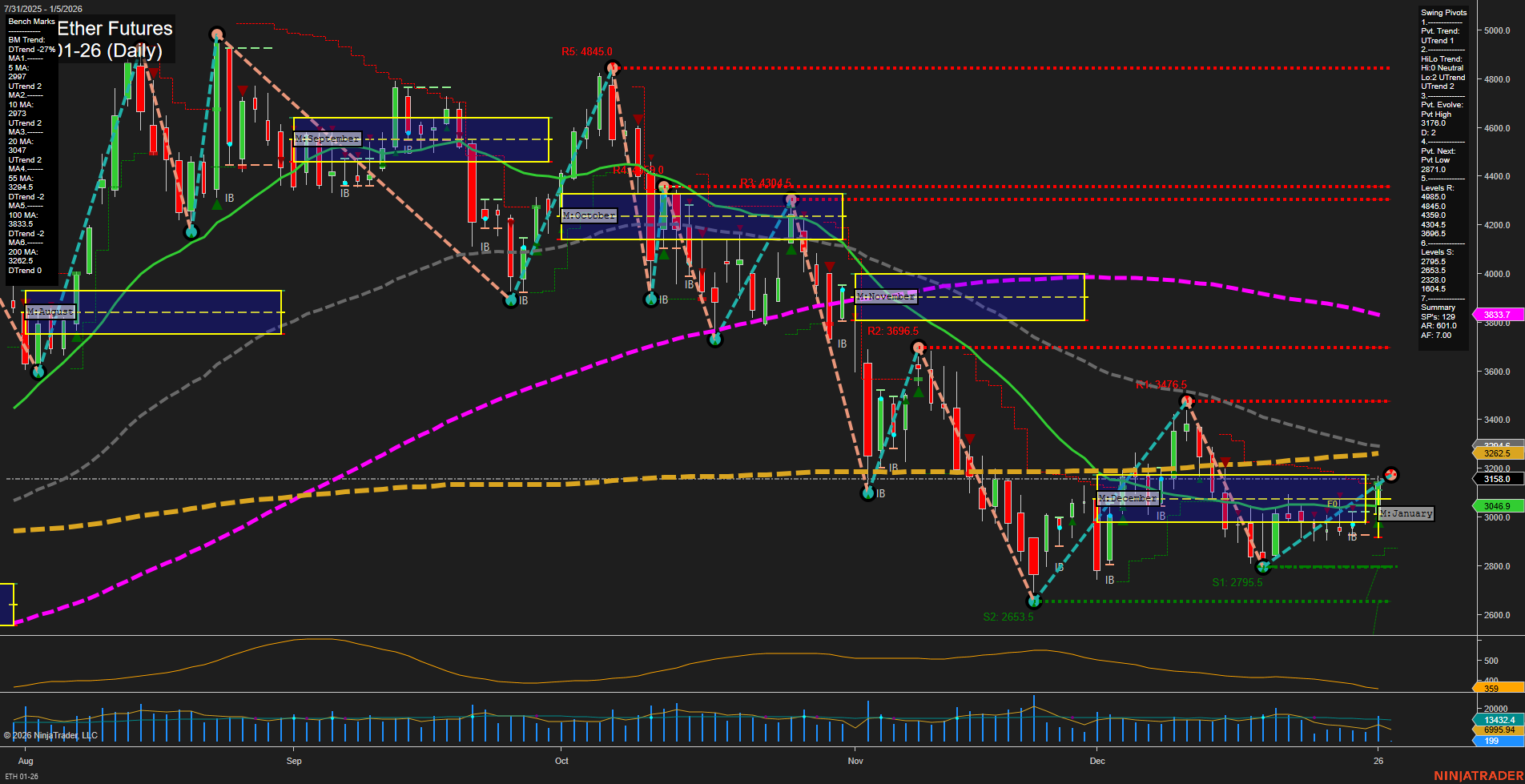

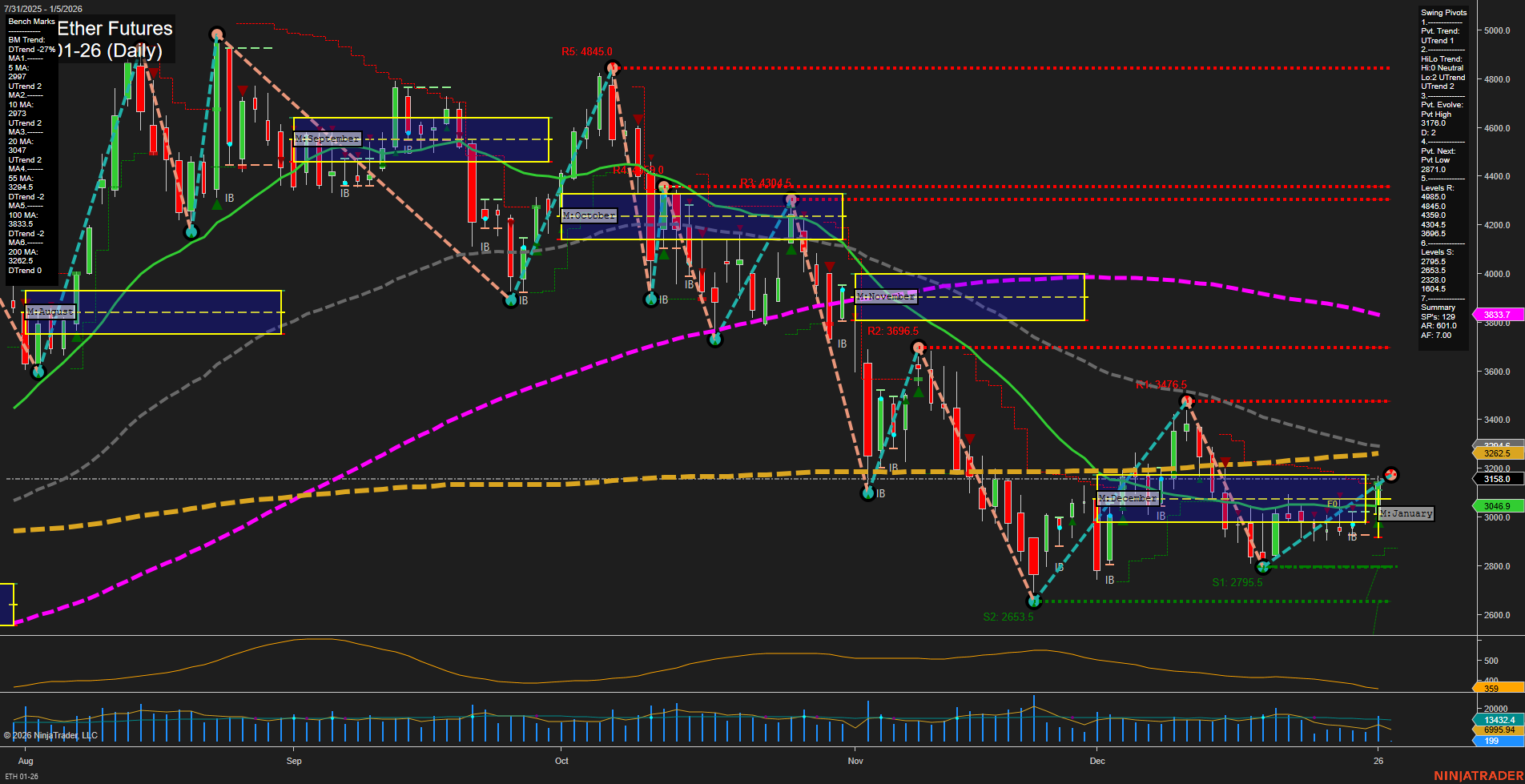

ETH CME Ether Futures Daily Chart Analysis: 2026-Jan-04 18:05 CT

Price Action

- Last: 3158.0,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 67%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: 12%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 8%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 3174.0,

- 4. Pvt. Next: Pvt low 2871.0,

- 5. Levels R: 4845.0, 4304.5, 3696.5, 3476.5, 3174.0,

- 6. Levels S: 2653.5, 2303.5, 1204.5.

Daily Benchmarks

- (Short-Term) 5 Day: 3127 Up Trend,

- (Short-Term) 10 Day: 3077 Up Trend,

- (Intermediate-Term) 20 Day: 3046.9 Up Trend,

- (Intermediate-Term) 55 Day: 3226.5 Down Trend,

- (Long-Term) 100 Day: 3333.7 Down Trend,

- (Long-Term) 200 Day: 3206.2 Down Trend.

Additional Metrics

Recent Trade Signals

- 02 Jan 2026: Long ETH 01-26 @ 3151.5 Signals.USAR-MSFG

- 02 Jan 2026: Long ETH 01-26 @ 3019.5 Signals.USAR-WSFG

- 29 Dec 2025: Long ETH 01-26 @ 3058 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

ETH CME Ether Futures are showing a notable shift in momentum, with price action breaking above key short- and intermediate-term moving averages and holding above the monthly and weekly session fib grid centers. The swing pivot structure has transitioned to an uptrend on both short- and intermediate-term timeframes, with the most recent pivot high at 3174.0 and the next key support at 2871.0. Resistance levels are stacked above, with significant overhead at 3476.5 and 3696.5, while support is well-defined below. The daily benchmarks confirm a bullish short-term bias, but intermediate and long-term moving averages remain in a downtrend, indicating the broader trend is still under pressure. Recent trade signals have triggered long entries, aligning with the current bullish momentum. Volatility (ATR) and volume (VOLMA) are elevated, suggesting active participation and potential for continued movement. Overall, the market is in a recovery phase with bullish short- and intermediate-term structure, but faces key resistance and remains neutral on the long-term trend until further confirmation.

Chart Analysis ATS AI Generated: 2026-01-04 18:05 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.