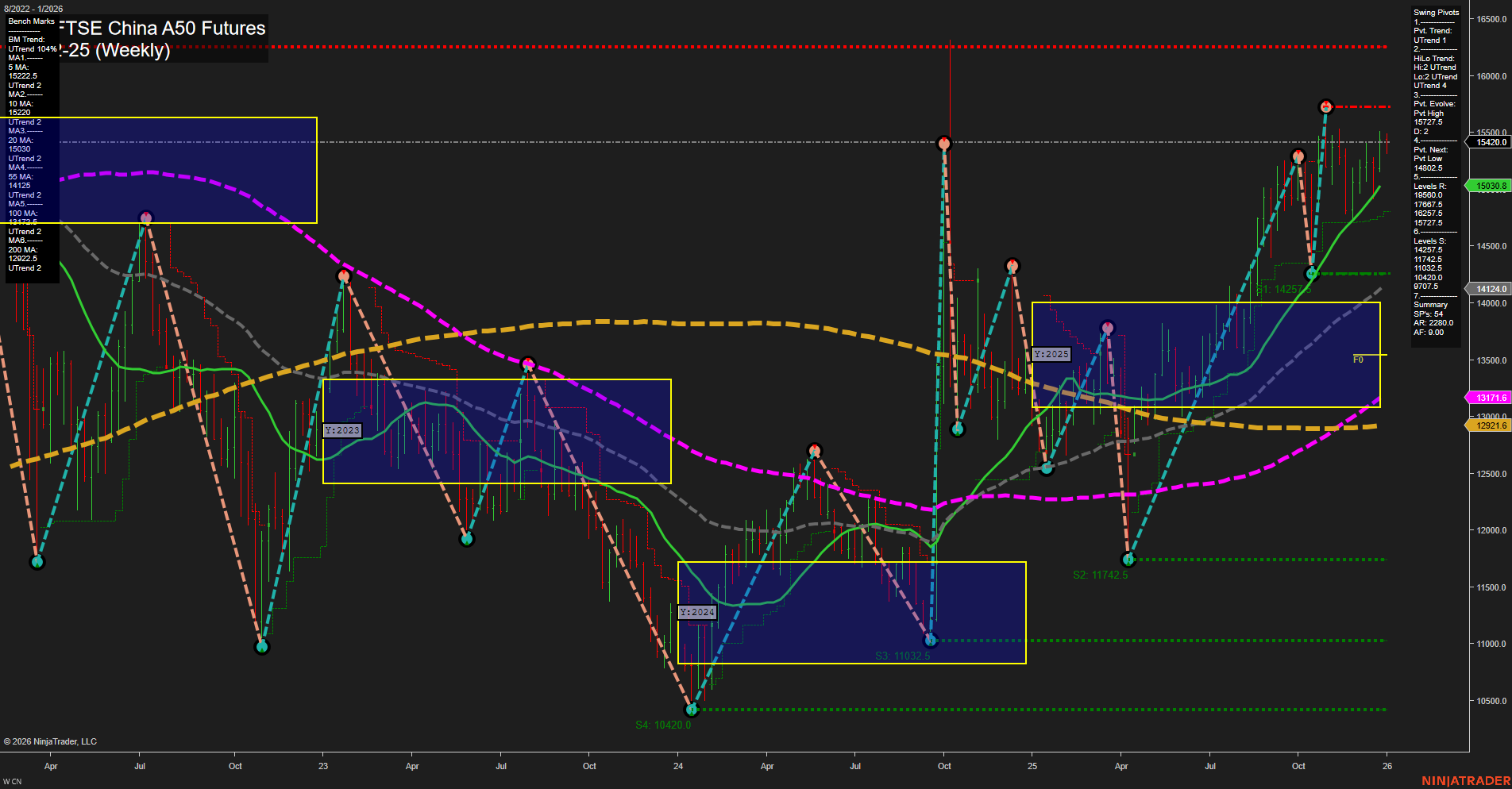

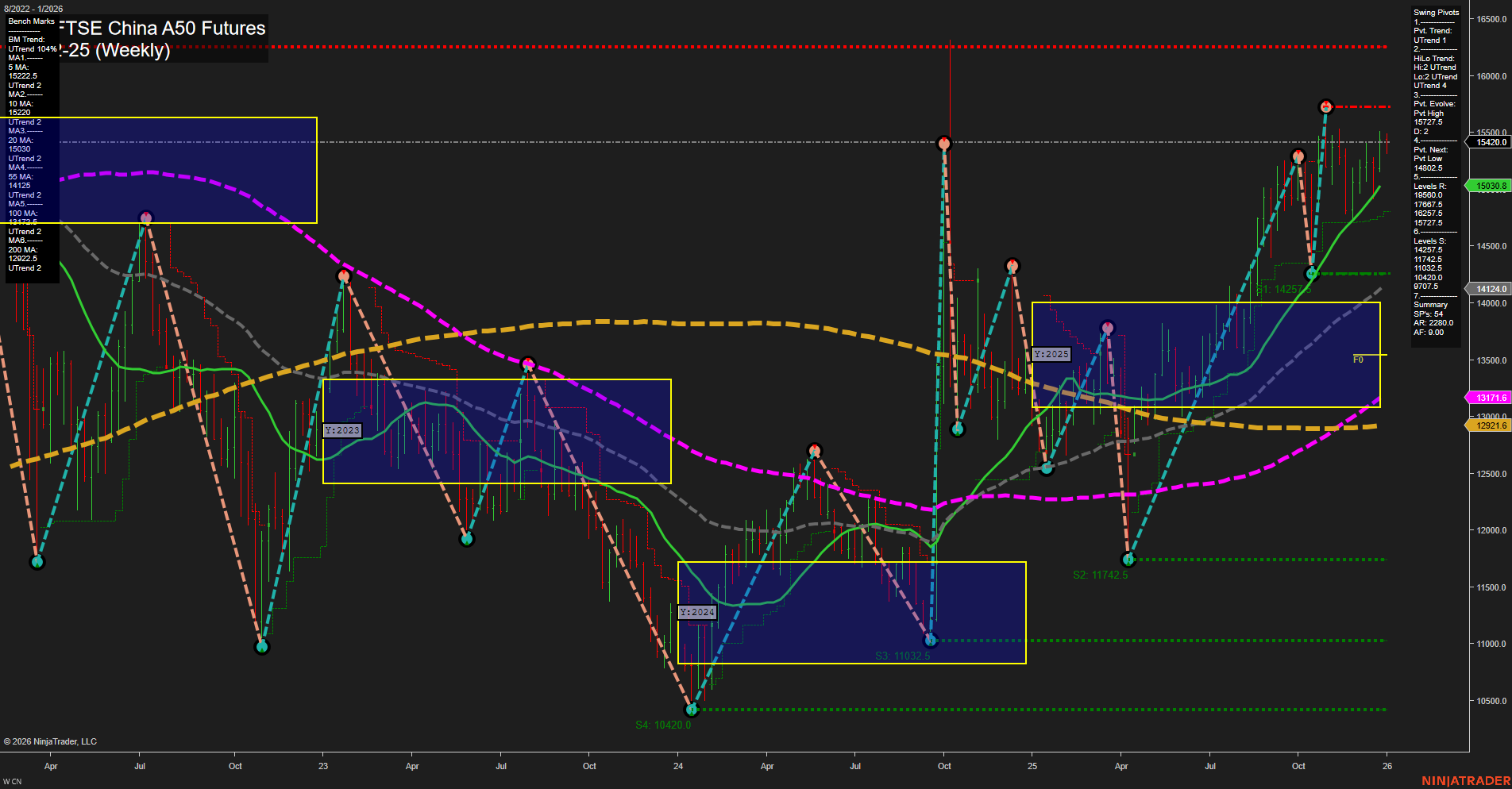

CN SGX FTSE China A50 Futures Weekly Chart Analysis: 2026-Jan-04 18:03 CT

Price Action

- Last: 15,420,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 15,427,

- 4. Pvt. Next: Pvt low 14,025,

- 5. Levels R: 15,427, 15,402, 14,927,

- 6. Levels S: 14,025, 11,742, 11,032, 10,420.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 15,224 Up Trend,

- (Intermediate-Term) 10 Week: 14,852 Up Trend,

- (Long-Term) 20 Week: 15,030.8 Up Trend,

- (Long-Term) 55 Week: 13,171.6 Up Trend,

- (Long-Term) 100 Week: 12,920.6 Up Trend,

- (Long-Term) 200 Week: 13,530 Down Trend.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The CN SGX FTSE China A50 Futures weekly chart shows a market that has recently experienced a strong upward swing, with price action holding above key moving averages and swing pivot resistance levels. The short- and intermediate-term trends are both up, supported by a series of higher highs and higher lows, and all major moving averages (except the 200-week) are trending upward, confirming broad-based momentum. The most recent swing pivot is a high at 15,427, with the next significant support at 14,025, indicating a wide range for potential retracement or consolidation. The price is currently trading within a neutral zone on the yearly and session fib grids, suggesting a pause or digestion phase after the recent rally. Overall, the technical structure favors continued bullishness, but the proximity to resistance and the neutral fib grid bias may lead to some consolidation or sideways movement before the next directional move. Volatility remains moderate, and the market is not showing signs of exhaustion or reversal at this stage.

Chart Analysis ATS AI Generated: 2026-01-04 18:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.