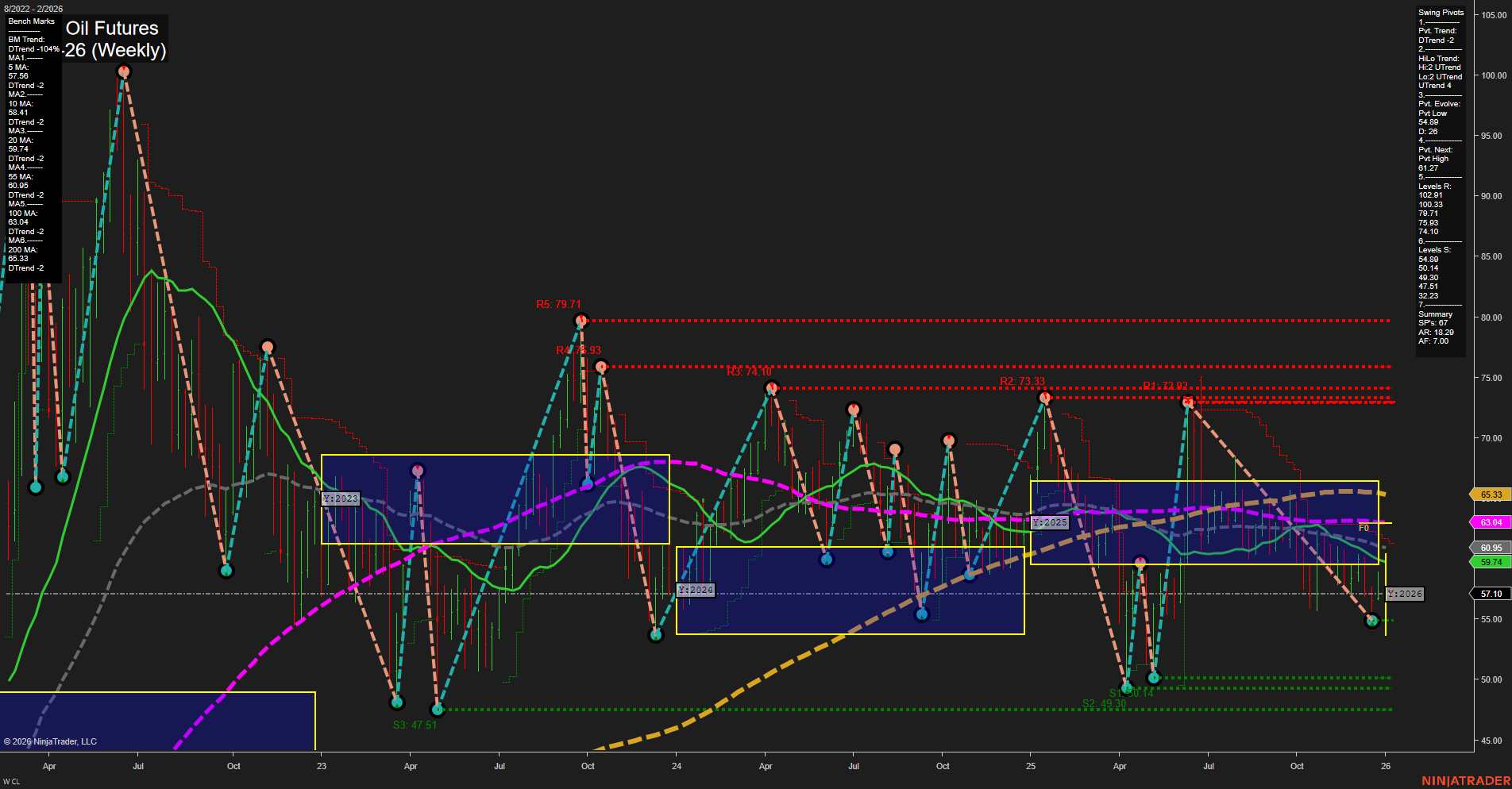

CL Crude Oil Futures are currently trading at 57.10, with medium-sized bars and slow momentum, indicating a lack of strong directional conviction. The short-term WSFG trend is up, with price above the NTZ center, but the swing pivot trend is down, and recent short-term signals have flipped bearish. Intermediate-term MSFG and benchmarks are both trending down, with price below the monthly NTZ and all key moving averages sloping lower, confirming a bearish bias. The long-term YSFG trend is technically up, but all major long-term moving averages (20, 55, 100, 200 week) are in downtrends, reinforcing a broader bearish environment. Swing pivots show the most recent evolution at a low (54.08), with the next potential pivot high at 61.27, and significant resistance overhead in the 71–79 range. Support is clustered just below current price, with 54.08 as the nearest key level. The market has recently generated short signals on both the weekly and monthly frameworks, while the last long signal failed to hold. Overall, the chart reflects a market in a corrective or retracement phase within a larger downtrend, with potential for further downside unless a strong reversal develops. Volatility remains moderate, and price action is choppy within a broad range, suggesting continued two-way trade and the need for confirmation before any sustained directional move.