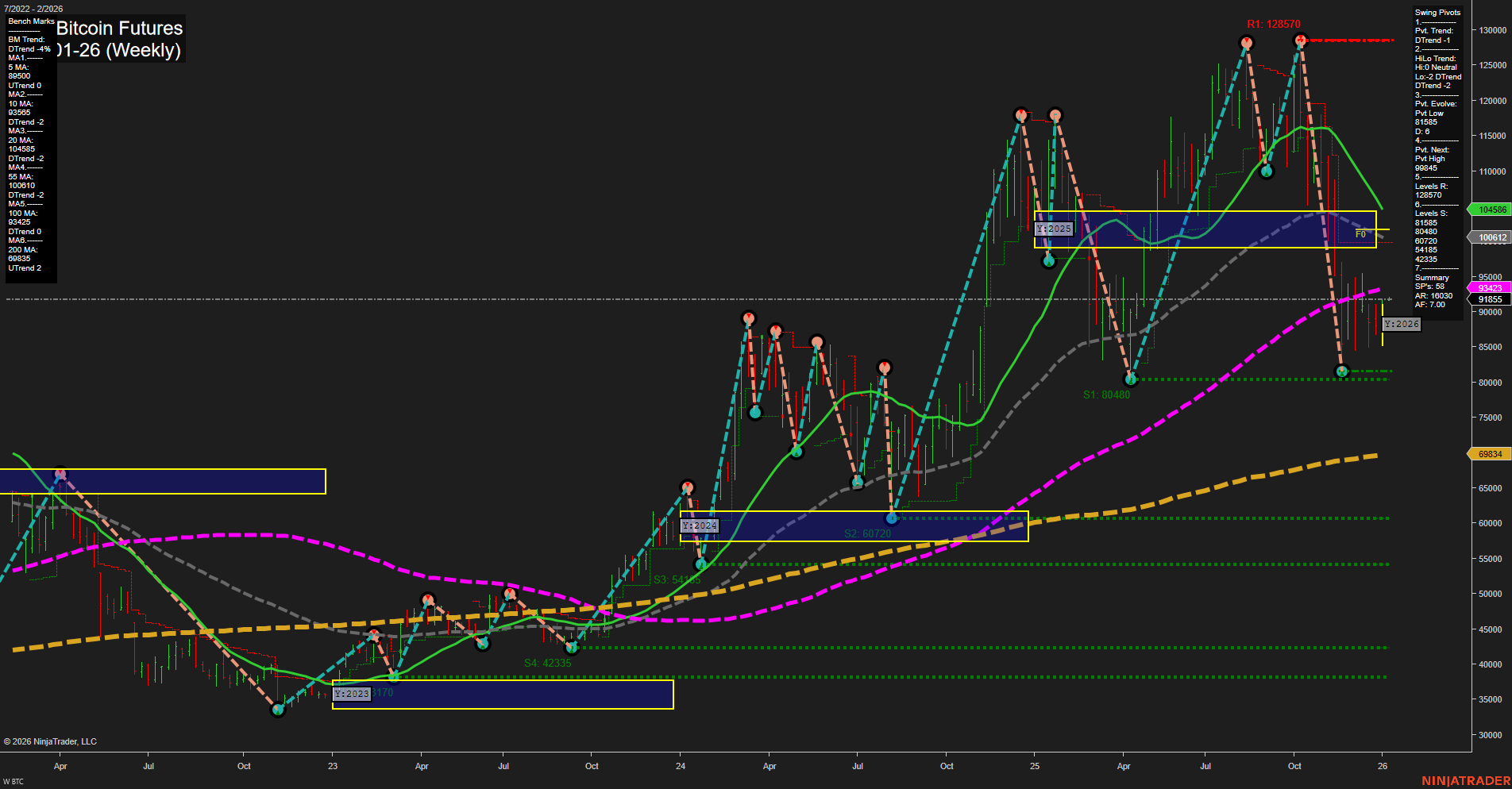

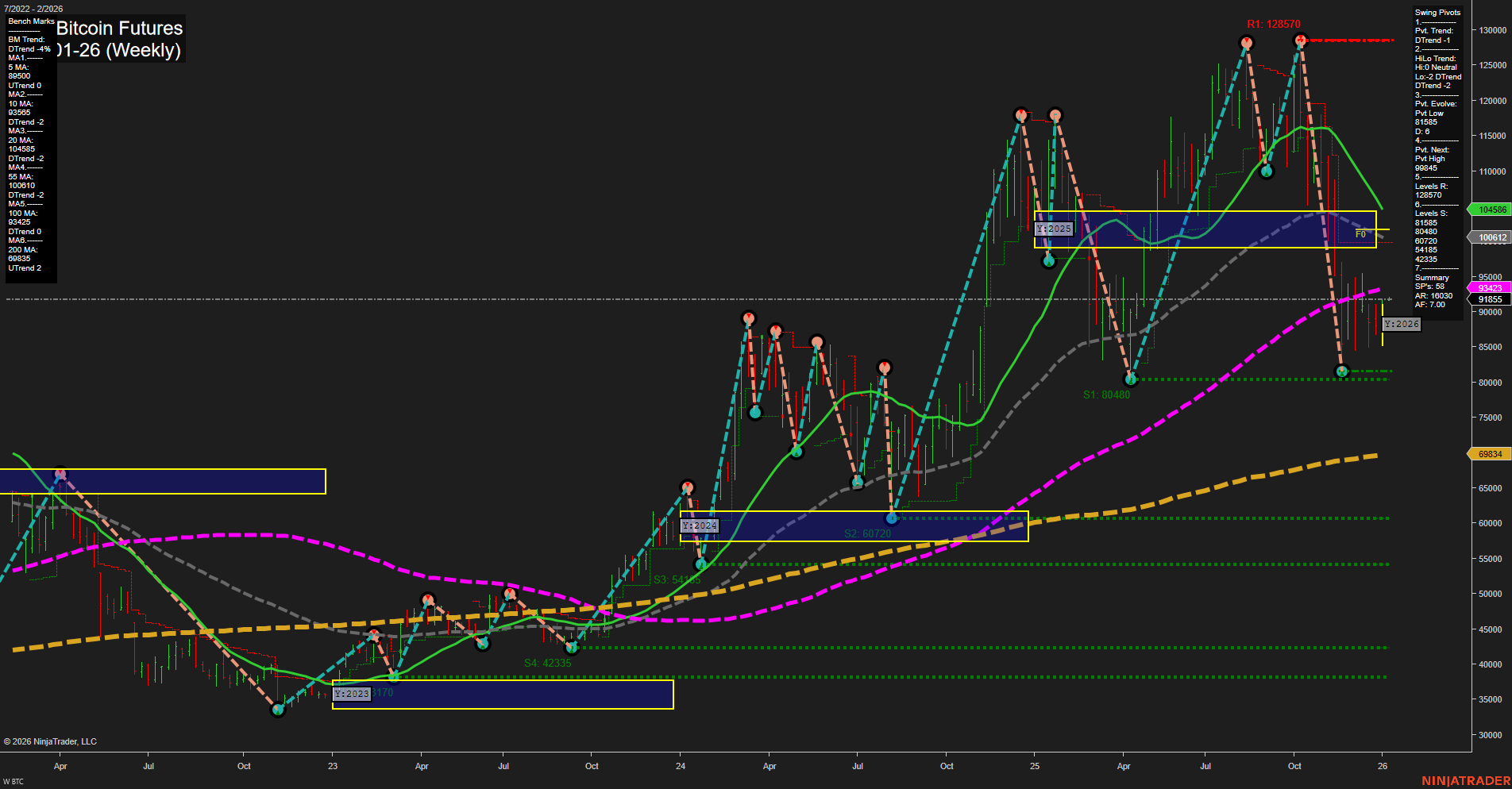

BTC CME Bitcoin Futures Weekly Chart Analysis: 2026-Jan-04 18:02 CT

Price Action

- Last: 100612,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 83%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: 15%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 13%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 91855,

- 4. Pvt. Next: Pvt high 128570,

- 5. Levels R: 128570, 104585, 98740, 94730,

- 6. Levels S: 91855, 80480, 60720, 54355, 42335.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 95800 Down Trend,

- (Intermediate-Term) 10 Week: 93425 Down Trend,

- (Long-Term) 20 Week: 104585 Down Trend,

- (Long-Term) 55 Week: 95090 Up Trend,

- (Long-Term) 100 Week: 84245 Up Trend,

- (Long-Term) 200 Week: 68834 Up Trend.

Recent Trade Signals

- 02 Jan 2026: Long BTC 01-26 @ 89720 Signals.USAR.TR120

- 02 Jan 2026: Long BTC 01-26 @ 89465 Signals.USAR-WSFG

- 29 Dec 2025: Long BTC 01-26 @ 90745 Signals.USAR-MSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

BTC CME Bitcoin Futures are currently consolidating after a significant rally, with price action showing medium-sized bars and slow momentum. The short-term and intermediate-term swing pivot trends are both down, indicating a corrective phase or pullback within a broader uptrend. However, all major Fibonacci grid trends (weekly, monthly, yearly) remain up, and price is holding above key NTZ/F0% levels, suggesting underlying bullish structure. The 5 and 10 week moving averages are trending down, reflecting recent weakness, but longer-term benchmarks (55, 100, 200 week) are still in uptrends, supporting a positive long-term outlook. Resistance is clustered near 104585 and 128570, while support is established at 91855 and lower. Recent trade signals have triggered new long entries, aligning with the overall bullish bias for the year. The market appears to be in a consolidation or retracement phase, potentially setting up for a continuation of the larger uptrend if support levels hold and momentum returns.

Chart Analysis ATS AI Generated: 2026-01-04 18:02 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.