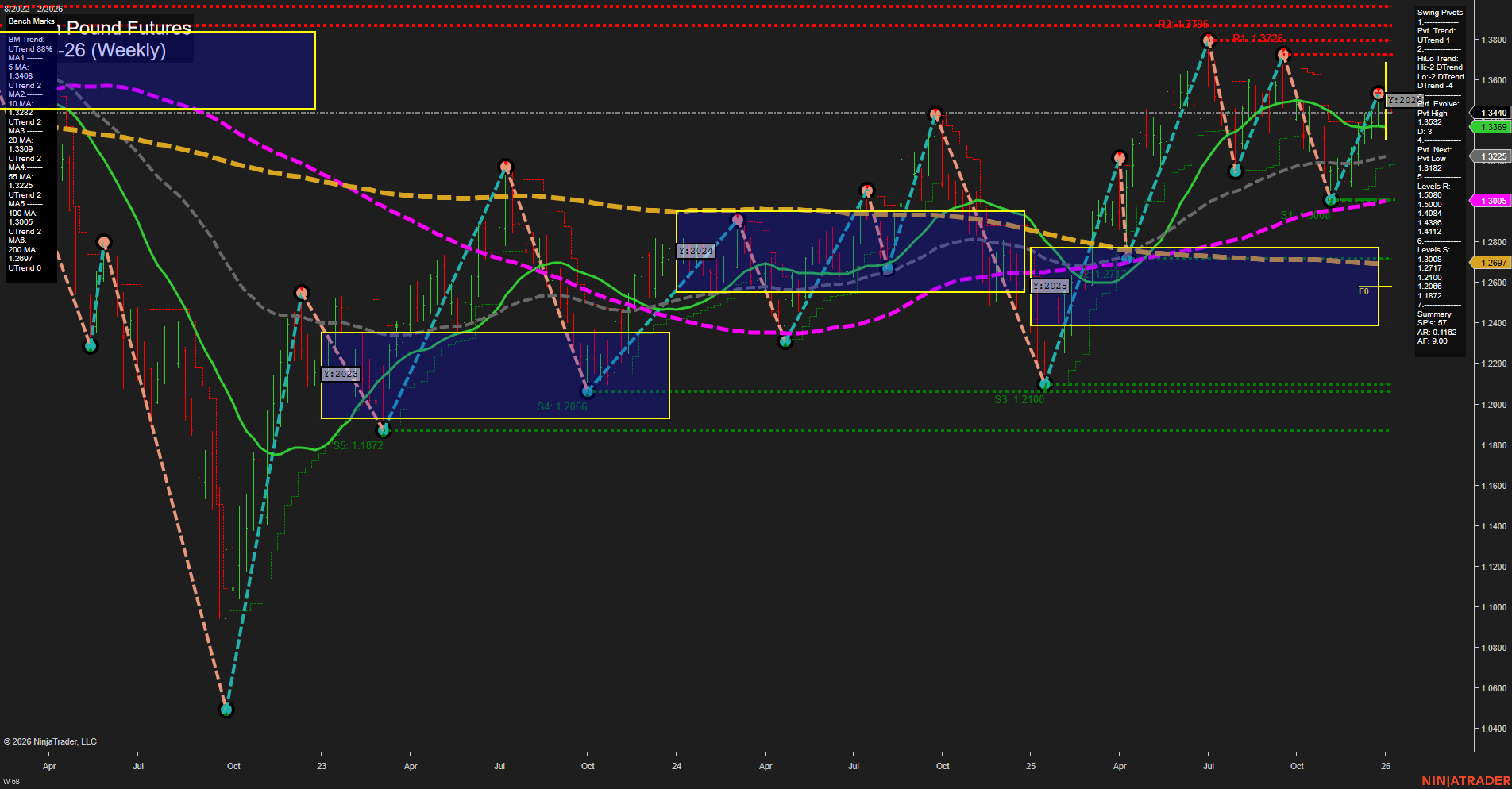

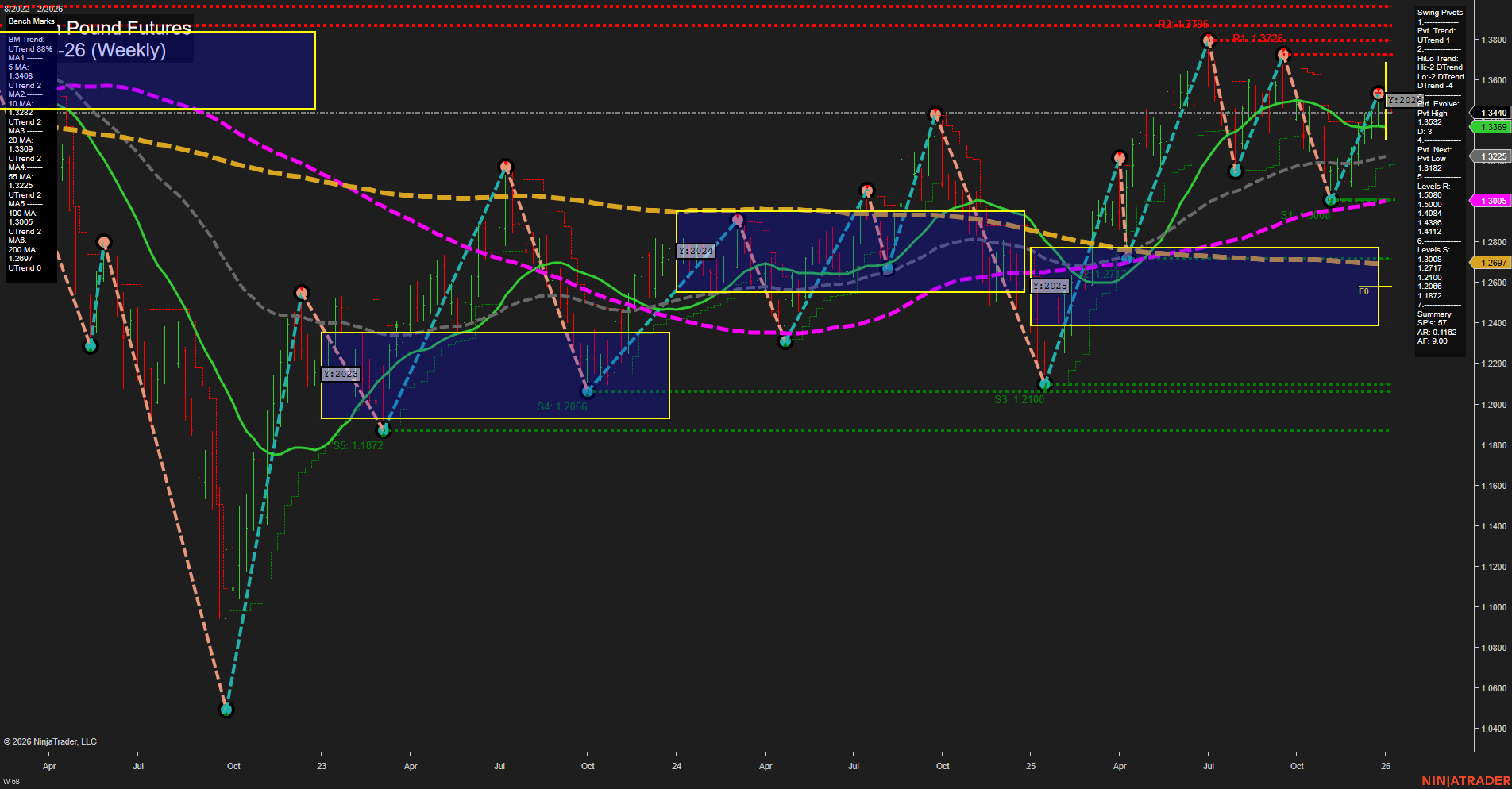

6B British Pound Futures Weekly Chart Analysis: 2026-Jan-04 18:00 CT

Price Action

- Last: 1.3440,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -46%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: -9%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: -3%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 1.3528,

- 4. Pvt. Next: Pvt low 1.3225,

- 5. Levels R: 1.3796, 1.3725, 1.3528,

- 6. Levels S: 1.3225, 1.3066, 1.2710, 1.2187.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.3408 Down Trend,

- (Intermediate-Term) 10 Week: 1.3369 Down Trend,

- (Long-Term) 20 Week: 1.3225 Up Trend,

- (Long-Term) 55 Week: 1.3005 Up Trend,

- (Long-Term) 100 Week: 1.2697 Up Trend,

- (Long-Term) 200 Week: 1.2182 Up Trend.

Recent Trade Signals

- 02 Jan 2026: Short 6B 03-26 @ 1.3475 Signals.USAR-WSFG

- 30 Dec 2025: Short 6B 03-26 @ 1.3465 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The 6B British Pound Futures are currently experiencing a short- and intermediate-term downtrend, as indicated by the negative WSFG and MSFG readings, both showing price below their respective NTZ/F0% levels. Swing pivot analysis confirms a dominant downtrend, with the most recent pivot high at 1.3528 and the next key support at 1.3225. Resistance levels are stacked above at 1.3528, 1.3725, and 1.3796, while support extends down to 1.2187. Weekly moving averages for the 5- and 10-week periods are trending down, reinforcing the bearish short- and intermediate-term outlook. However, the longer-term moving averages (20, 55, 100, and 200 week) remain in uptrends, suggesting underlying bullish structure on a macro basis. Recent trade signals have triggered short entries, aligning with the prevailing short-term momentum. The market appears to be in a corrective phase within a larger bullish cycle, with price action showing medium-sized bars and average momentum, indicating controlled selling rather than panic. The setup suggests a market in retracement or consolidation mode, with potential for further downside in the near term before any significant long-term reversal or continuation of the broader uptrend.

Chart Analysis ATS AI Generated: 2026-01-04 18:01 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.