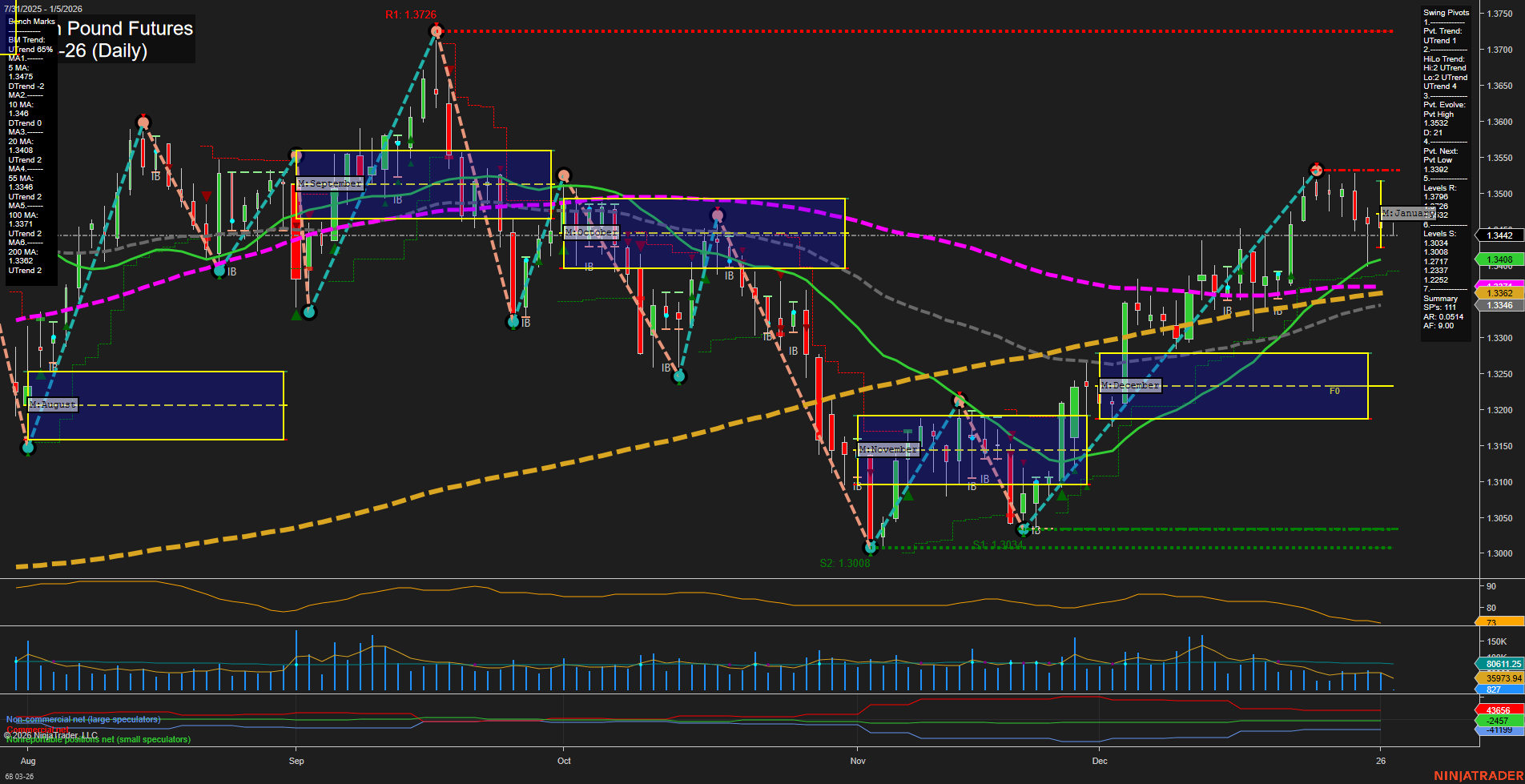

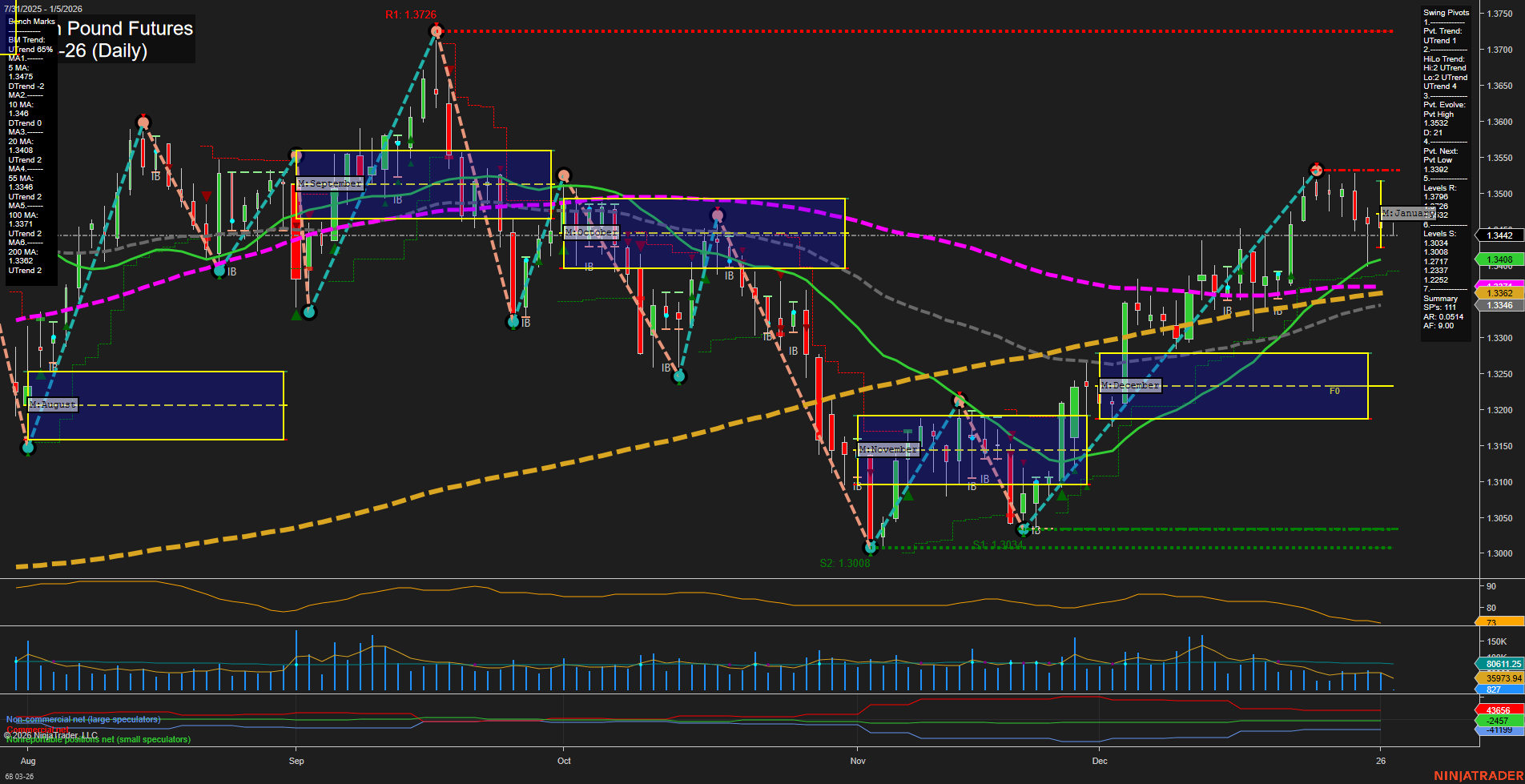

6B British Pound Futures Daily Chart Analysis: 2026-Jan-04 18:00 CT

Price Action

- Last: 1.3442,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -46%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: -9%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: -3%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 1.3492,

- 4. Pvt. Next: Pvt Low 1.3382,

- 5. Levels R: 1.3726, 1.3492,

- 6. Levels S: 1.3346, 1.3008.

Daily Benchmarks

- (Short-Term) 5 Day: 1.3408 Up Trend,

- (Short-Term) 10 Day: 1.3362 Up Trend,

- (Intermediate-Term) 20 Day: 1.3346 Up Trend,

- (Intermediate-Term) 55 Day: 1.3237 Up Trend,

- (Long-Term) 100 Day: 1.3282 Up Trend,

- (Long-Term) 200 Day: 1.3134 Up Trend.

Additional Metrics

Recent Trade Signals

- 02 Jan 2026: Short 6B 03-26 @ 1.3475 Signals.USAR-WSFG

- 30 Dec 2025: Short 6B 03-26 @ 1.3465 Signals.USAR.TR120

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Neutral,

- Long-Term: Neutral.

Key Insights Summary

The 6B British Pound Futures daily chart shows a market in transition, with price action currently consolidating after a recent upswing. Despite the short-term and intermediate-term swing pivot trends both registering as uptrends, the price is trading just below the most recent swing high and is sandwiched between resistance at 1.3492 and support at 1.3346. All benchmark moving averages from short to long-term are in uptrends, indicating underlying bullish structure, but the price is now below the NTZ center lines for the weekly, monthly, and yearly session fib grids, all of which are trending down. This suggests a loss of upward momentum and a possible shift to a more neutral or corrective phase. Recent trade signals have triggered short entries, reflecting the market's hesitation at resistance and the potential for a pullback or range-bound action. Volatility and volume remain moderate, with no signs of a breakout or breakdown. Overall, the market is in a neutral stance across all timeframes, with traders watching for a decisive move above resistance or a breakdown below support to confirm the next directional swing.

Chart Analysis ATS AI Generated: 2026-01-04 18:00 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.