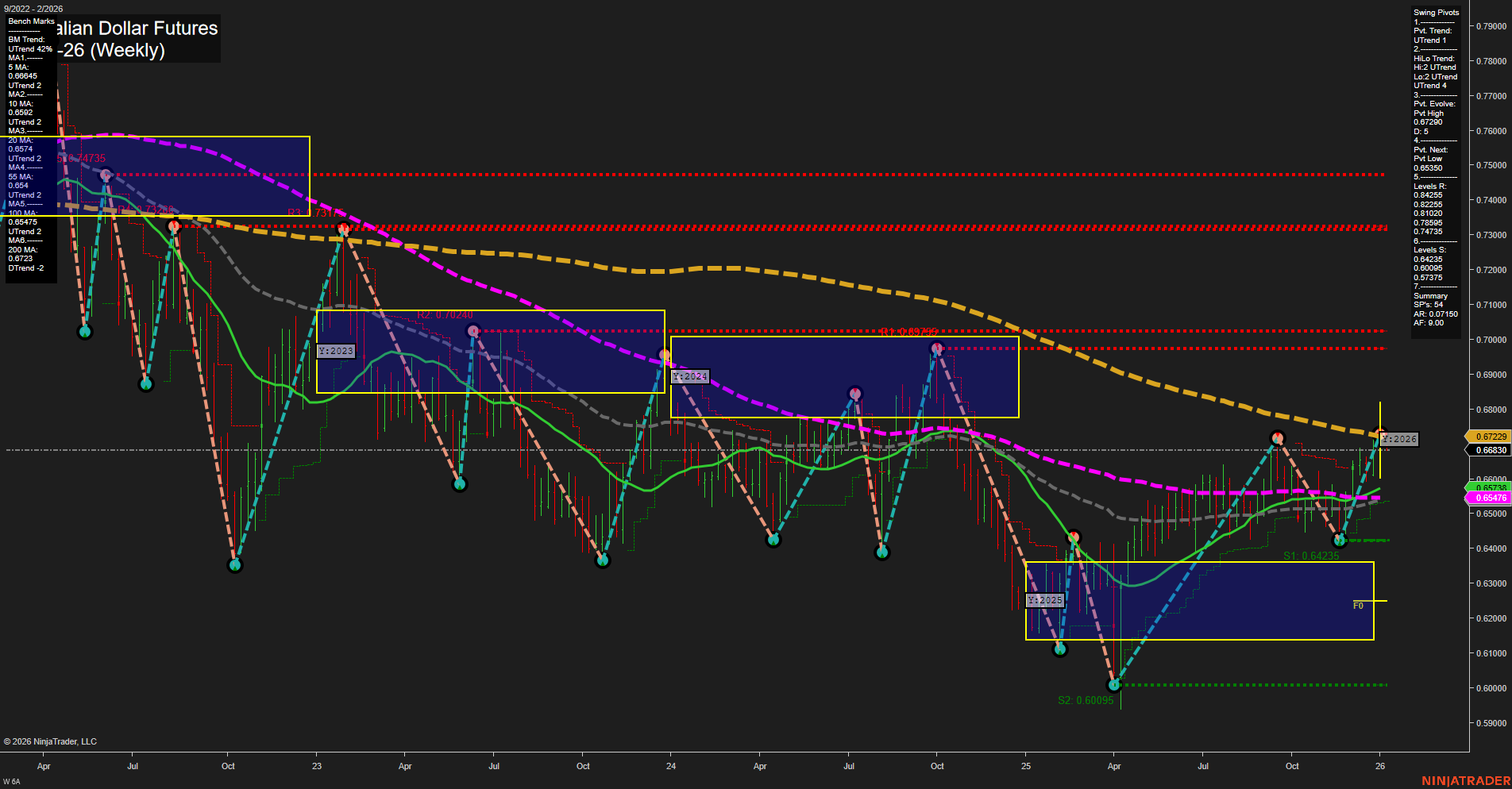

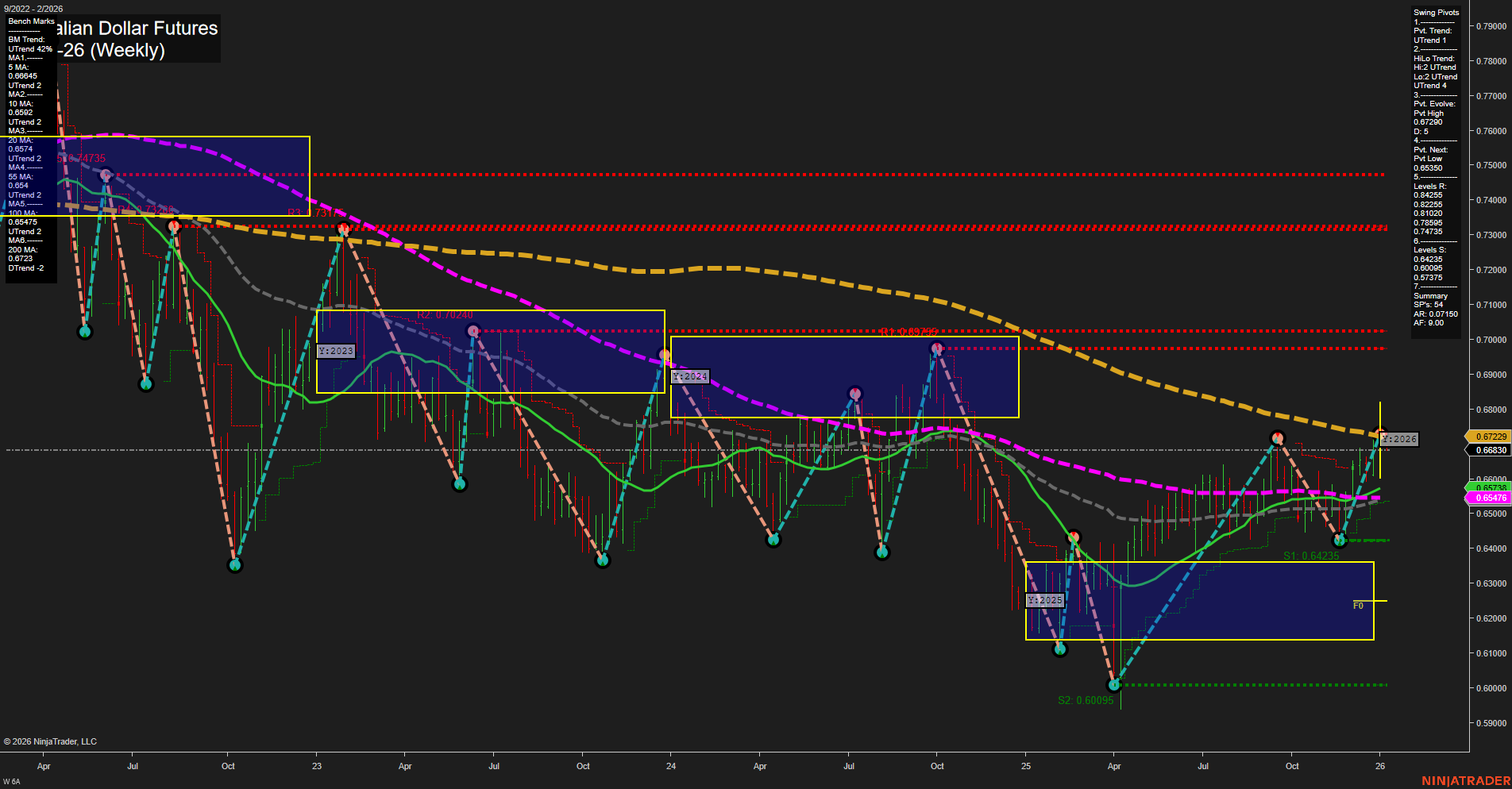

6A Australian Dollar Futures Weekly Chart Analysis: 2026-Jan-04 18:00 CT

Price Action

- Last: 0.66830,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 0.67229,

- 4. Pvt. Next: Pvt Low 0.65380,

- 5. Levels R: 0.67229, 0.66830, 0.66275, 0.65735,

- 6. Levels S: 0.65380, 0.65005, 0.64235, 0.60095.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.65772 Up Trend,

- (Intermediate-Term) 10 Week: 0.65000 Up Trend,

- (Long-Term) 20 Week: 0.65476 Up Trend,

- (Long-Term) 55 Week: 0.65005 Up Trend,

- (Long-Term) 100 Week: 0.65476 Down Trend,

- (Long-Term) 200 Week: 0.67229 Down Trend.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The 6A Australian Dollar Futures weekly chart shows a notable shift in momentum, with price recently breaking above several key moving averages and swing resistance levels. Both short-term and intermediate-term swing pivot trends have turned upward, supported by a series of higher lows and a recent push to a new pivot high at 0.67229. The majority of weekly benchmarks (5, 10, 20, and 55 week MAs) are now in uptrends, indicating strengthening bullish sentiment in the medium term, though the 100 and 200 week MAs remain in downtrends, reflecting lingering long-term overhead resistance. Price is currently consolidating just below the 200 week MA, suggesting a critical test of long-term resistance. The neutral stance of the session fib grids (WSFG, MSFG, YSFG) highlights a lack of clear directional bias from a broader perspective, but the recent price action and pivot structure favor a bullish outlook in the near to intermediate term. The market appears to be transitioning from a prolonged consolidation phase into a potential trend continuation, with volatility picking up and the possibility of further upside if resistance levels are decisively cleared.

Chart Analysis ATS AI Generated: 2026-01-04 18:00 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.