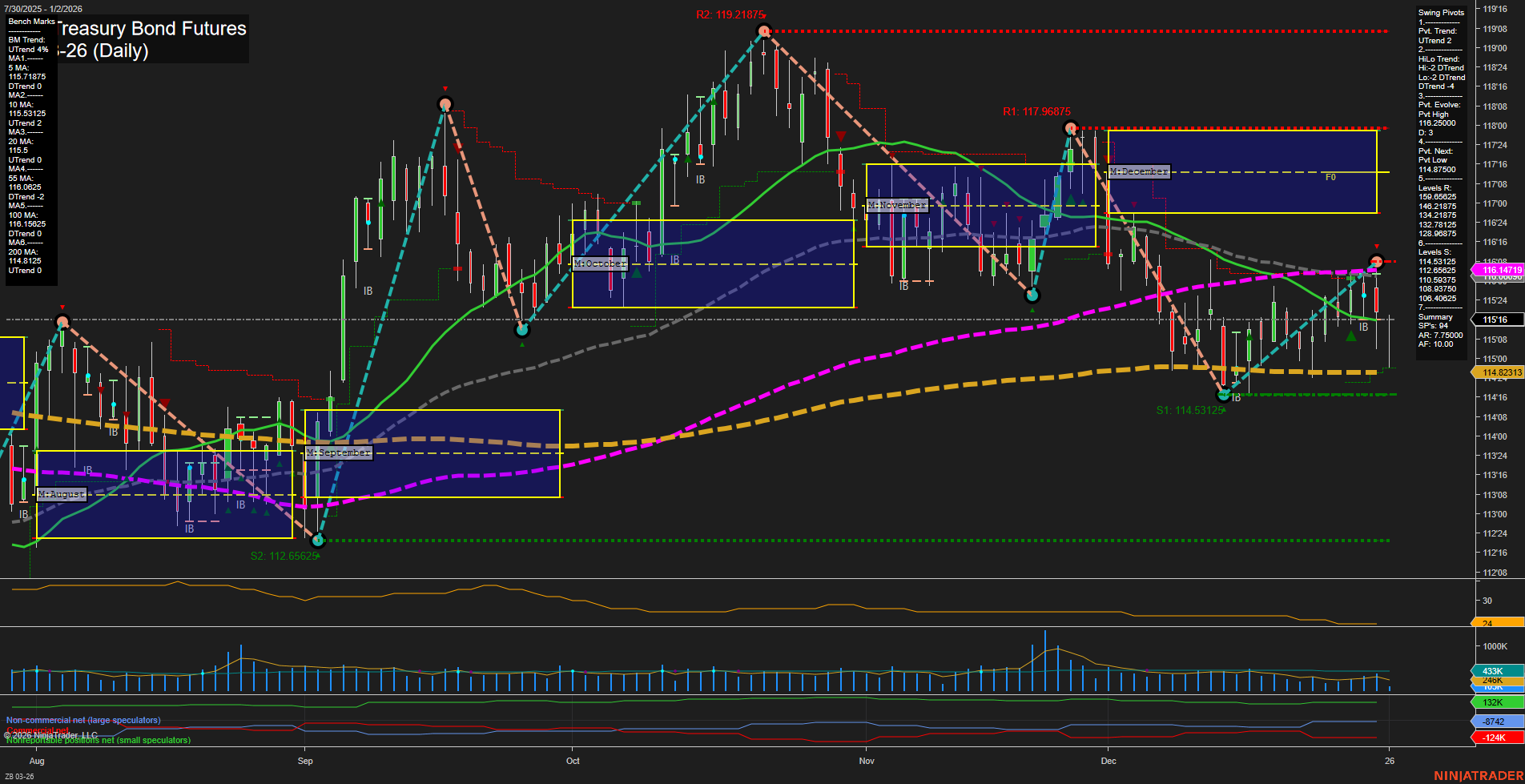

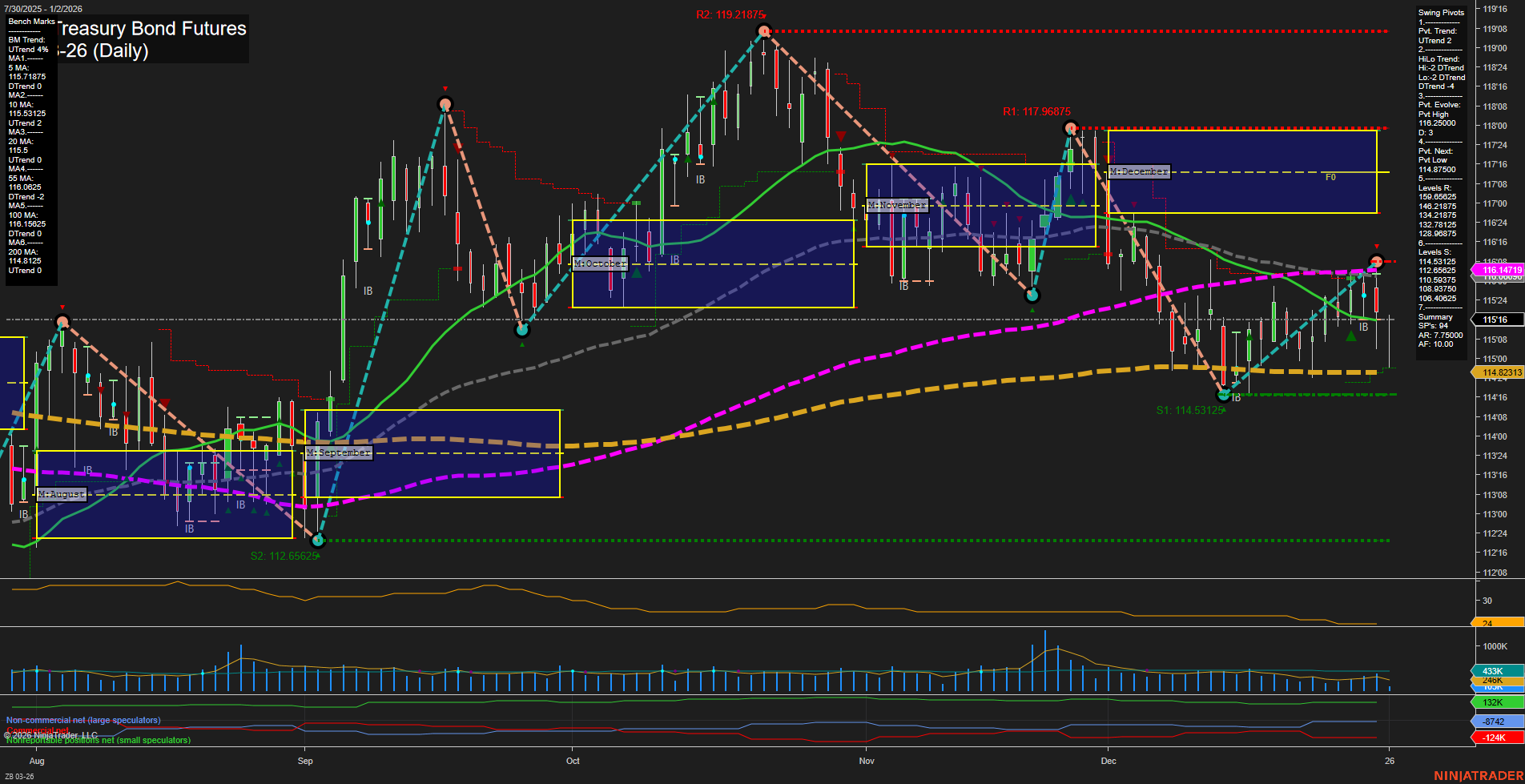

ZB U.S. Treasury Bond Futures Daily Chart Analysis: 2026-Jan-02 07:15 CT

Price Action

- Last: 116.1479,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 116.2000,

- 4. Pvt. Next: Pvt Low 114.8750,

- 5. Levels R: 117.96875, 119.21875,

- 6. Levels S: 114.87500, 114.53125, 112.65625.

Daily Benchmarks

- (Short-Term) 5 Day: 115.7873 Up Trend,

- (Short-Term) 10 Day: 115.3912 Up Trend,

- (Intermediate-Term) 20 Day: 116.0625 Up Trend,

- (Intermediate-Term) 55 Day: 116.8085 Down Trend,

- (Long-Term) 100 Day: 116.8623 Down Trend,

- (Long-Term) 200 Day: 114.8231 Up Trend.

Additional Metrics

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Neutral.

Key Insights Summary

The ZB U.S. Treasury Bond Futures daily chart currently reflects a market in transition. Short-term momentum is positive, with the 5, 10, and 20-day moving averages all trending upward and price holding above these benchmarks. The most recent swing pivot shows an uptrend, but the intermediate-term HiLo trend remains down, indicating that the broader move is still under pressure from previous declines. Resistance is established at 117.96875 and 119.21875, while support is clustered at 114.87500 and below, suggesting a defined trading range. The ATR and volume metrics indicate moderate volatility and participation. Overall, the short-term outlook is bullish, but the intermediate and long-term trends are neutral, reflecting a market that may be consolidating after a recent bounce. Swing traders should note the potential for continued range-bound action unless a breakout above resistance or breakdown below support occurs.

Chart Analysis ATS AI Generated: 2026-01-02 07:15 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.