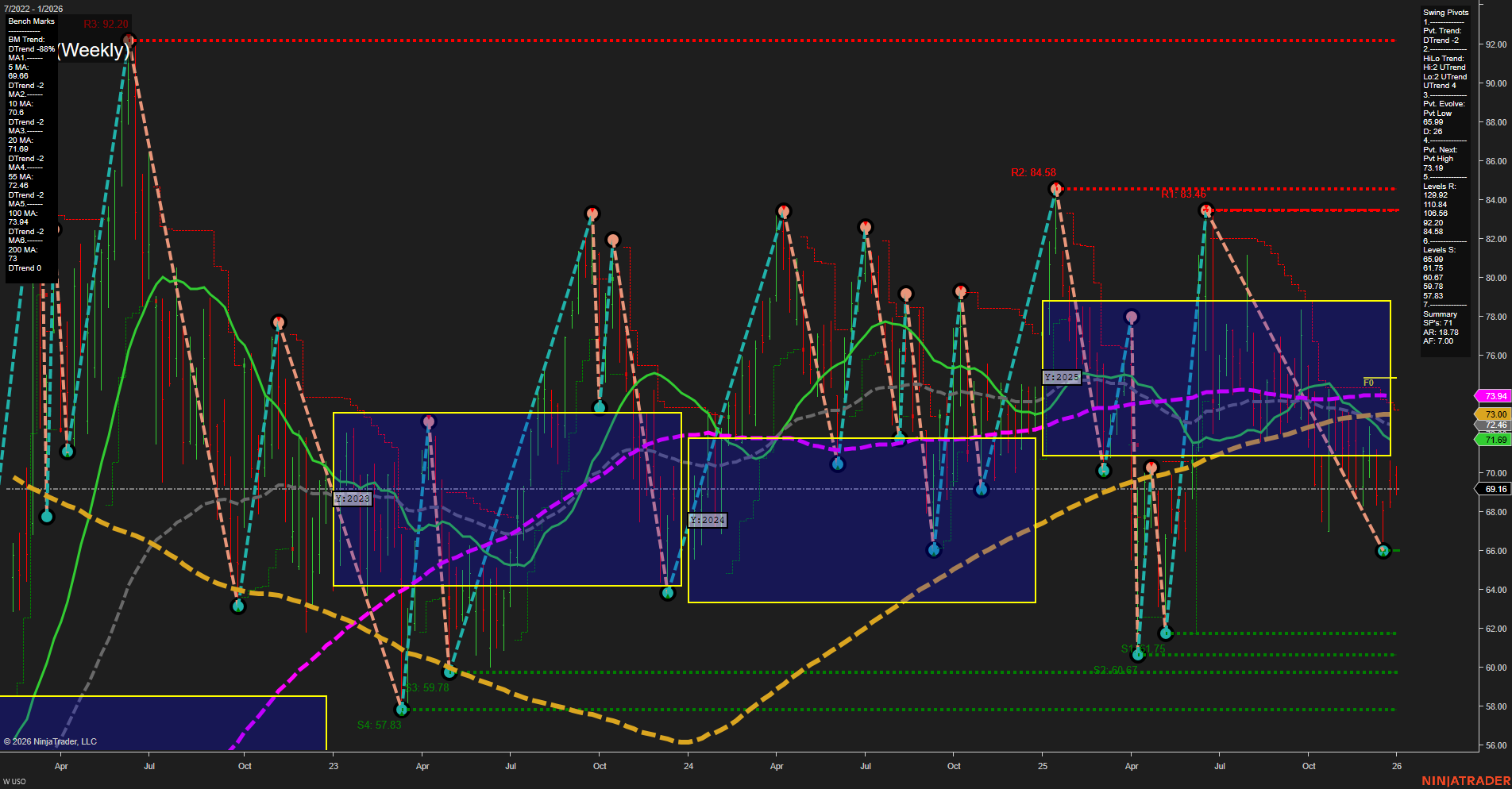

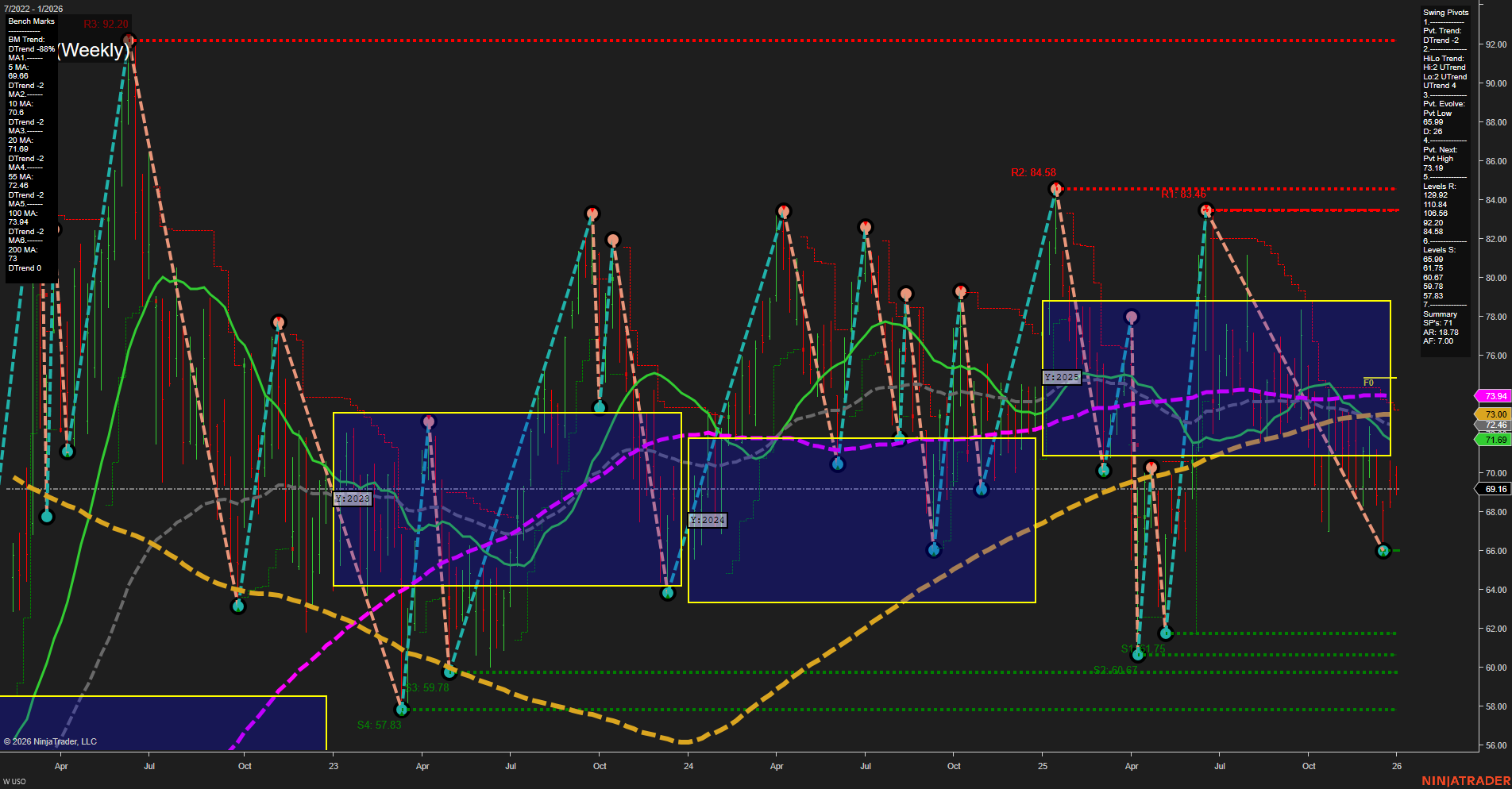

USO United States Oil Fund LP Weekly Chart Analysis: 2026-Jan-02 07:14 CT

Price Action

- Last: 69.16,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 69.16,

- 4. Pvt. Next: Pvt high 73.19,

- 5. Levels R: 83.26, 84.58, 92.20,

- 6. Levels S: 69.16, 61.75, 60.75, 59.78, 57.83, 52.61.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 70.68 Down Trend,

- (Intermediate-Term) 10 Week: 71.68 Down Trend,

- (Long-Term) 20 Week: 71.69 Down Trend,

- (Long-Term) 55 Week: 73.94 Down Trend,

- (Long-Term) 100 Week: 73.00 Down Trend,

- (Long-Term) 200 Week: 70.00 Down Trend.

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The USO weekly chart shows a market in a broad consolidation phase, with price action contained within a neutral zone (NTZ) for much of the past year. The most recent swing pivot is a new low at 69.16, confirming a short-term downtrend, while intermediate-term HiLo pivots still reflect an uptrend, suggesting some underlying support. All key moving averages (5, 10, 20, 55, 100, 200 week) are trending down and price is below these benchmarks, reinforcing a bearish long-term structure. Resistance is stacked well above current price (83.26, 84.58, 92.20), while support levels cluster just below (69.16, 61.75, 60.75, 59.78, 57.83, 52.61), indicating risk of further downside if current support fails. Momentum is slow and bars are medium, reflecting a lack of strong directional conviction. Overall, the chart suggests a market in a corrective or distribution phase, with short-term pressure to the downside, but intermediate-term structure not yet fully broken. The environment is characterized by choppy, range-bound action with a bearish tilt, and no clear breakout or reversal signal present.

Chart Analysis ATS AI Generated: 2026-01-02 07:14 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.