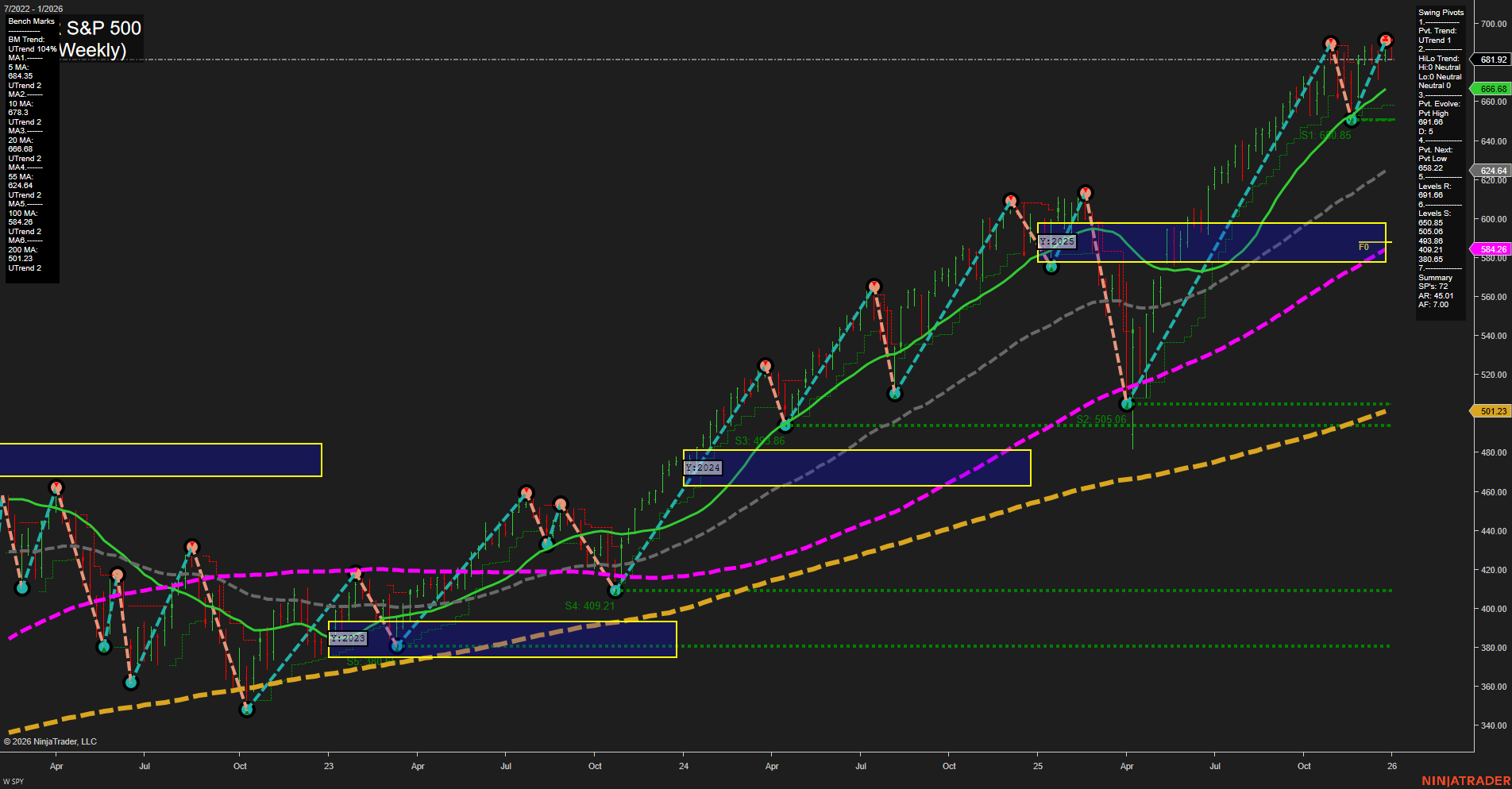

The S&P 500 futures weekly chart continues to show a strong uptrend across all timeframes, with price action making new highs and momentum holding steady at an average pace. All benchmark moving averages (from 5-week to 200-week) are trending upward, confirming broad-based strength and trend alignment. The most recent swing pivot is a new high at 681.92, with the next key support at 624.64, indicating a healthy distance from major support levels. Resistance levels are being set by new highs, while support levels are well below current price, suggesting the market is in a clear trend continuation phase. The neutral bias on the session fib grids (WSFG, MSFG, YSFG) reflects a lack of immediate overextension or retracement pressure, supporting the ongoing bullish structure. No significant reversal or topping patterns are present, and the market has avoided deep pullbacks, instead forming higher lows and higher highs. Volatility appears contained, and the absence of choppy or frothy price action points to a stable, trending environment. Overall, the technical landscape remains constructive for swing traders, with the trend firmly intact and no immediate signs of exhaustion or reversal.