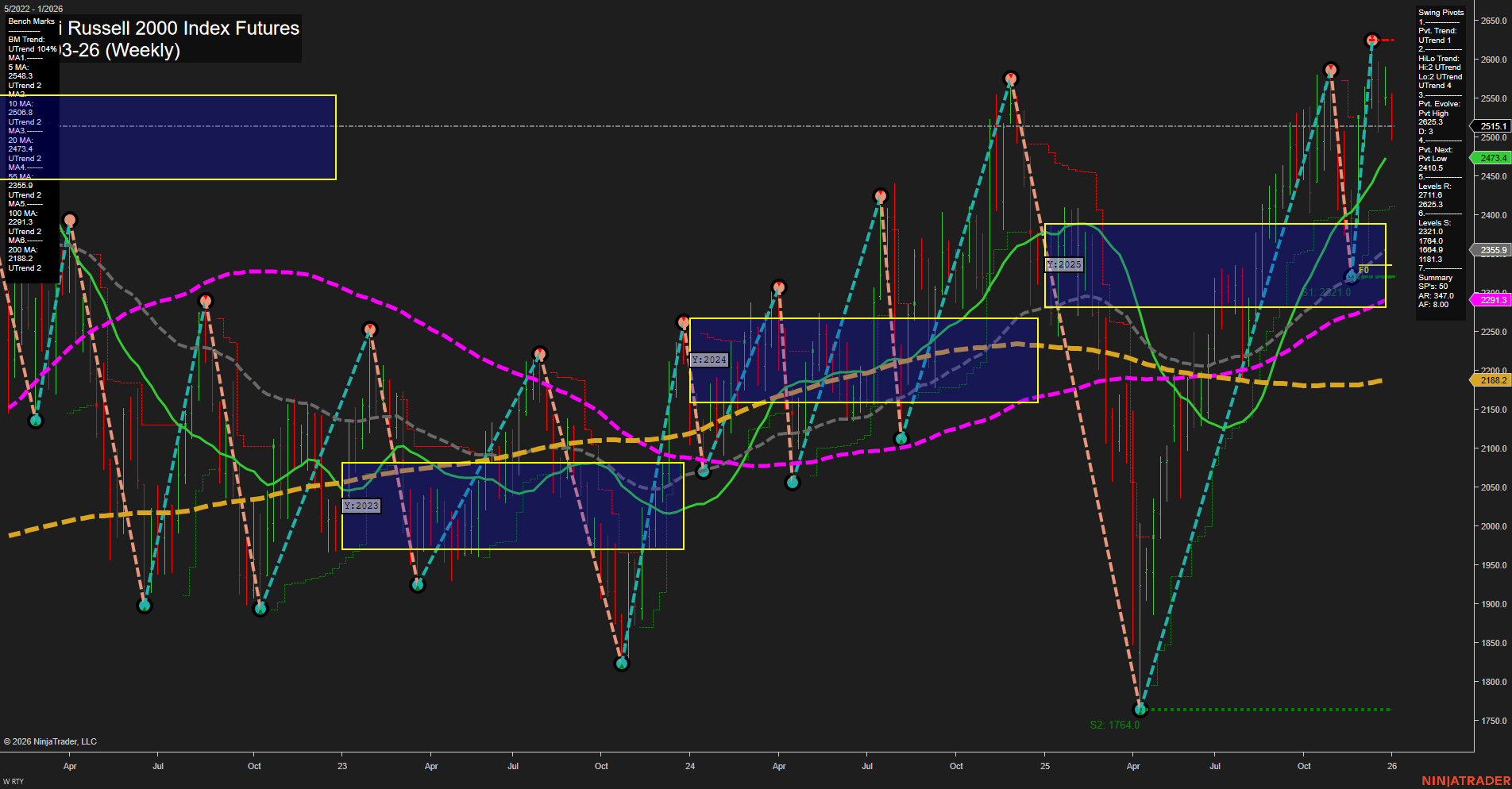

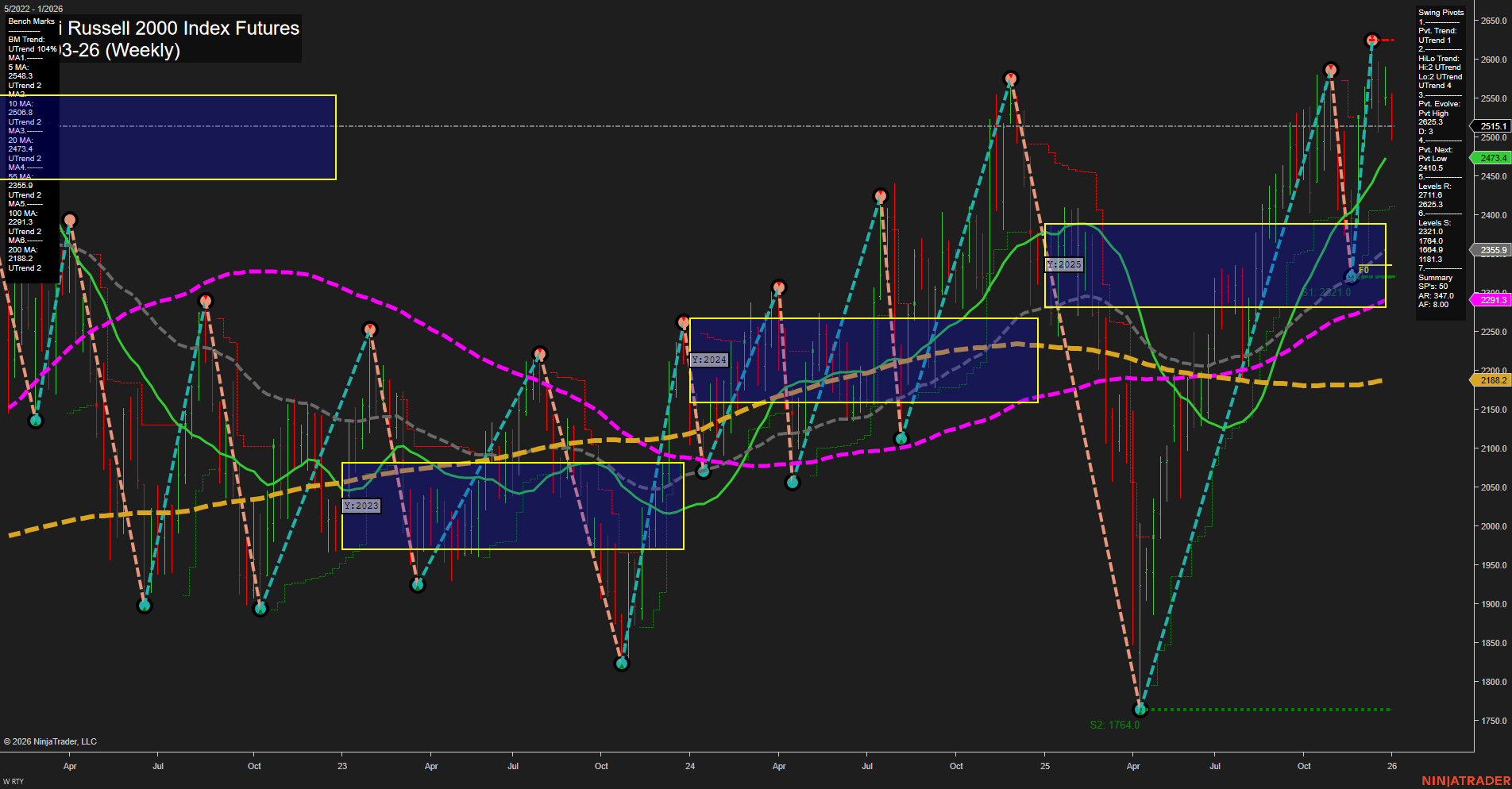

RTY E-mini Russell 2000 Index Futures Weekly Chart Analysis: 2026-Jan-02 07:11 CT

Price Action

- Last: 2473.4,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -48%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: 8%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 33%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 2511.5,

- 4. Pvt. Next: Pvt low 2355.9,

- 5. Levels R: 2511.5, 2463.3, 2261.5, 1780.4,

- 6. Levels S: 1764.0.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 2543.4 Up Trend,

- (Intermediate-Term) 10 Week: 2508.2 Up Trend,

- (Long-Term) 20 Week: 2473.4 Up Trend,

- (Long-Term) 55 Week: 2291.3 Up Trend,

- (Long-Term) 100 Week: 2291.3 Up Trend,

- (Long-Term) 200 Week: 2182.2 Up Trend.

Recent Trade Signals

- 30 Dec 2025: Short RTY 03-26 @ 2537 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The RTY weekly chart shows a complex interplay between short-term weakness and sustained intermediate- to long-term strength. Price action is currently below the weekly session fib grid (WSFG) neutral zone, indicating short-term downward pressure, which is confirmed by the recent short signal and a negative WSFG trend. However, both the monthly and yearly session fib grids (MSFG and YSFG) show price above their respective neutral zones, with uptrends in place, supported by all major moving averages trending higher. Swing pivots highlight a recent pivot high at 2511.5, with the next key support at 2355.9, suggesting a possible retracement or consolidation phase after a strong rally. The overall structure points to a market in a corrective pullback within a broader uptrend, with volatility and potential for both mean reversion and trend continuation setups as the new year unfolds.

Chart Analysis ATS AI Generated: 2026-01-02 07:12 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.