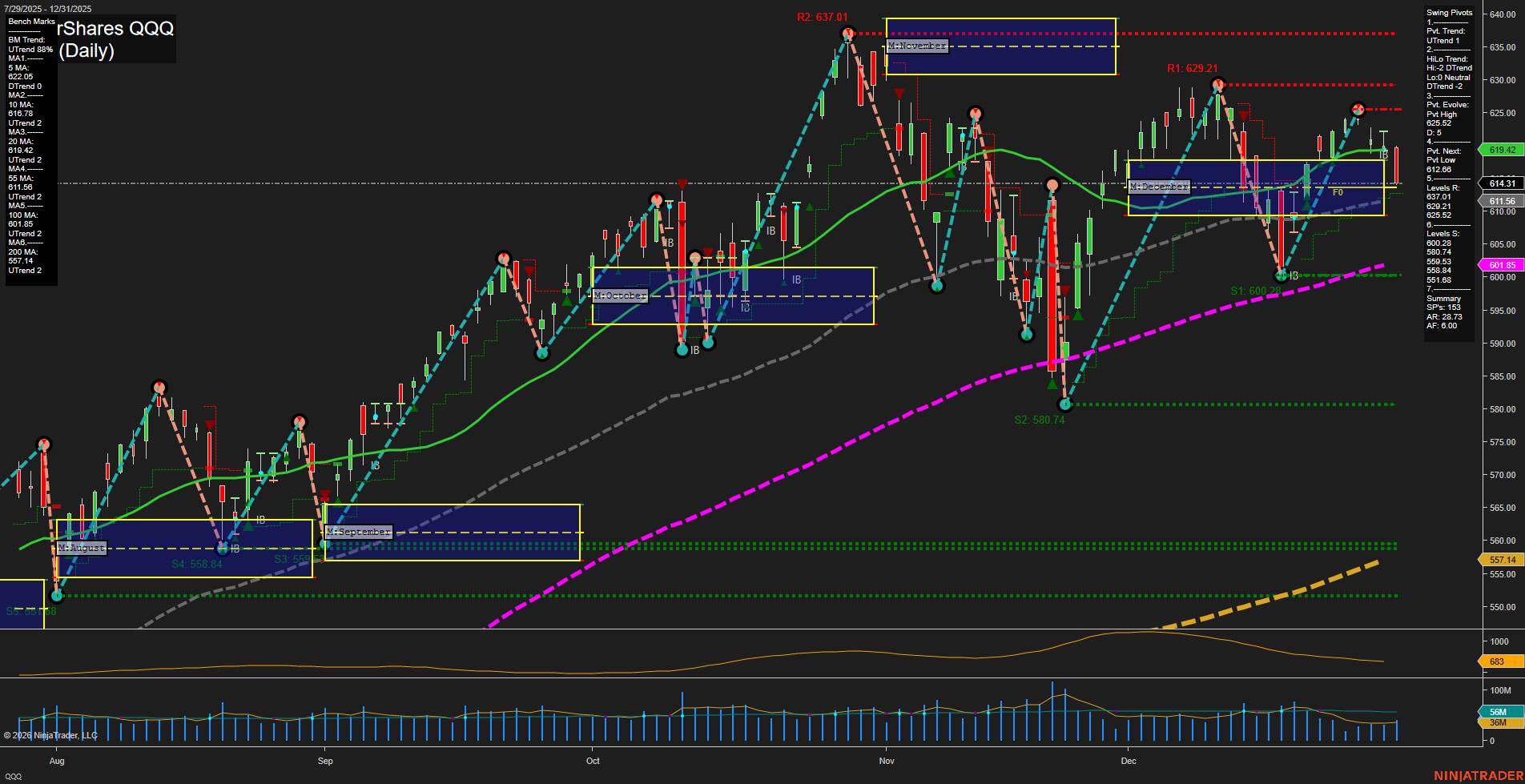

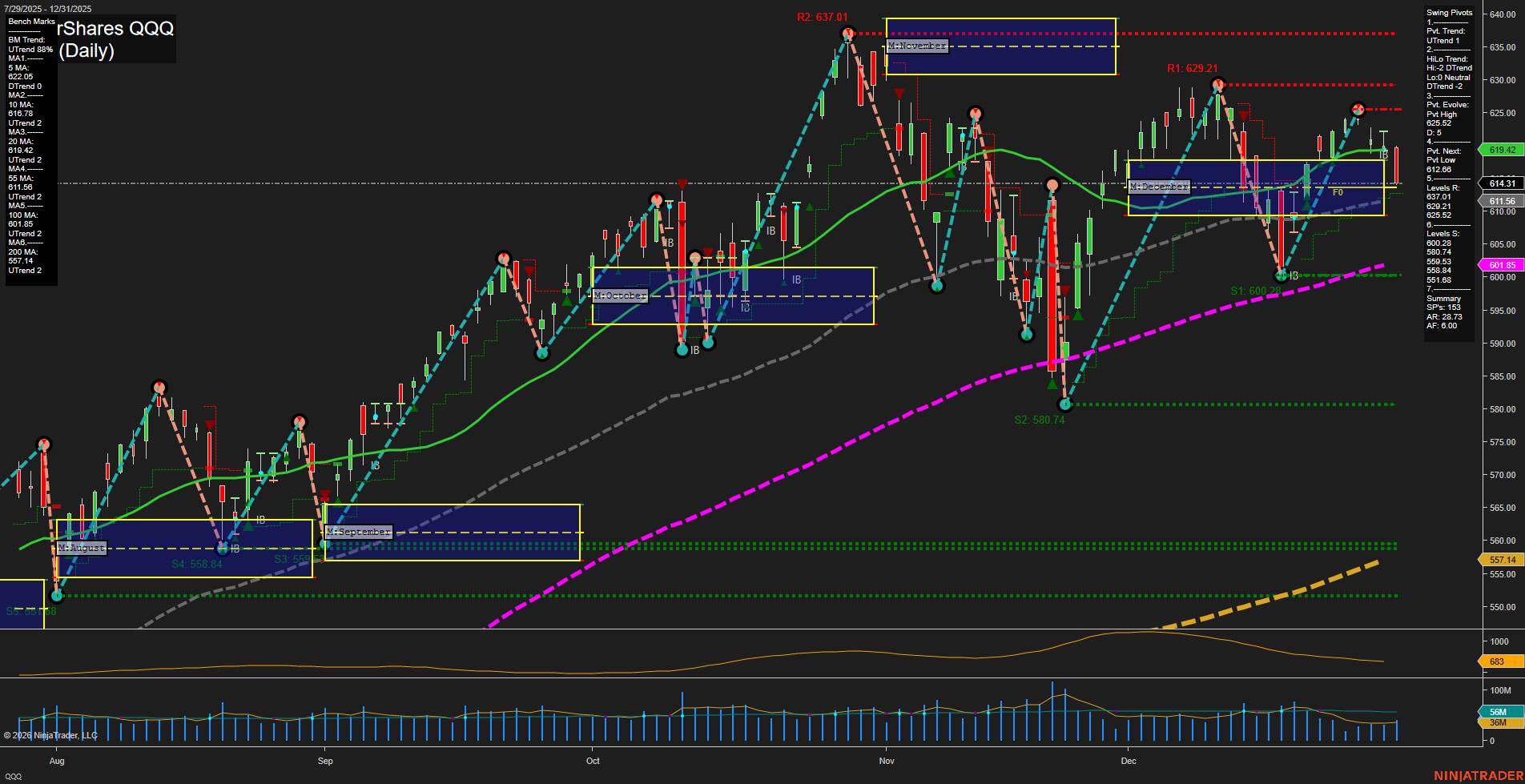

QQQ PowerShares QQQ Daily Chart Analysis: 2026-Jan-02 07:10 CT

Price Action

- Last: 619.42,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2026

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 629.21,

- 4. Pvt. Next: Pvt low 612.68,

- 5. Levels R: 637.01, 629.21,

- 6. Levels S: 600.29, 580.74, 558.84, 551.68.

Daily Benchmarks

- (Short-Term) 5 Day: 614.31 Up Trend,

- (Short-Term) 10 Day: 611.56 Up Trend,

- (Intermediate-Term) 20 Day: 619.42 Up Trend,

- (Intermediate-Term) 55 Day: 601.85 Up Trend,

- (Long-Term) 100 Day: 557.14 Up Trend,

- (Long-Term) 200 Day: 567.14 Up Trend.

Additional Metrics

- ATR: 733,

- VOLMA: 32,709,273.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The QQQ daily chart shows a market in a medium-range consolidation after a strong upward move, with price currently at 619.42. Short-term momentum is average, and the most recent swing pivot trend is up, though the intermediate-term HiLo trend has shifted to down, indicating some recent corrective action or pullback. Price is trading above all key moving averages, with the 5, 10, 20, 55, 100, and 200-day benchmarks all in uptrends, supporting a bullish long-term structure. Resistance is clustered near recent highs at 629.21 and 637.01, while support is layered below at 600.29, 580.74, and further down. The ATR suggests moderate volatility, and volume is steady but not elevated. The neutral stance of the session fib grids (weekly, monthly, yearly) reflects a lack of clear directional bias in the broader context, with price consolidating near the upper end of the recent range. Overall, the chart reflects a bullish bias in the short and long term, but with intermediate-term caution as the market digests gains and tests support levels. No clear breakout or breakdown is evident, and the market appears to be in a pause or digestion phase after a strong rally, awaiting a catalyst for the next directional move.

Chart Analysis ATS AI Generated: 2026-01-02 07:10 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.