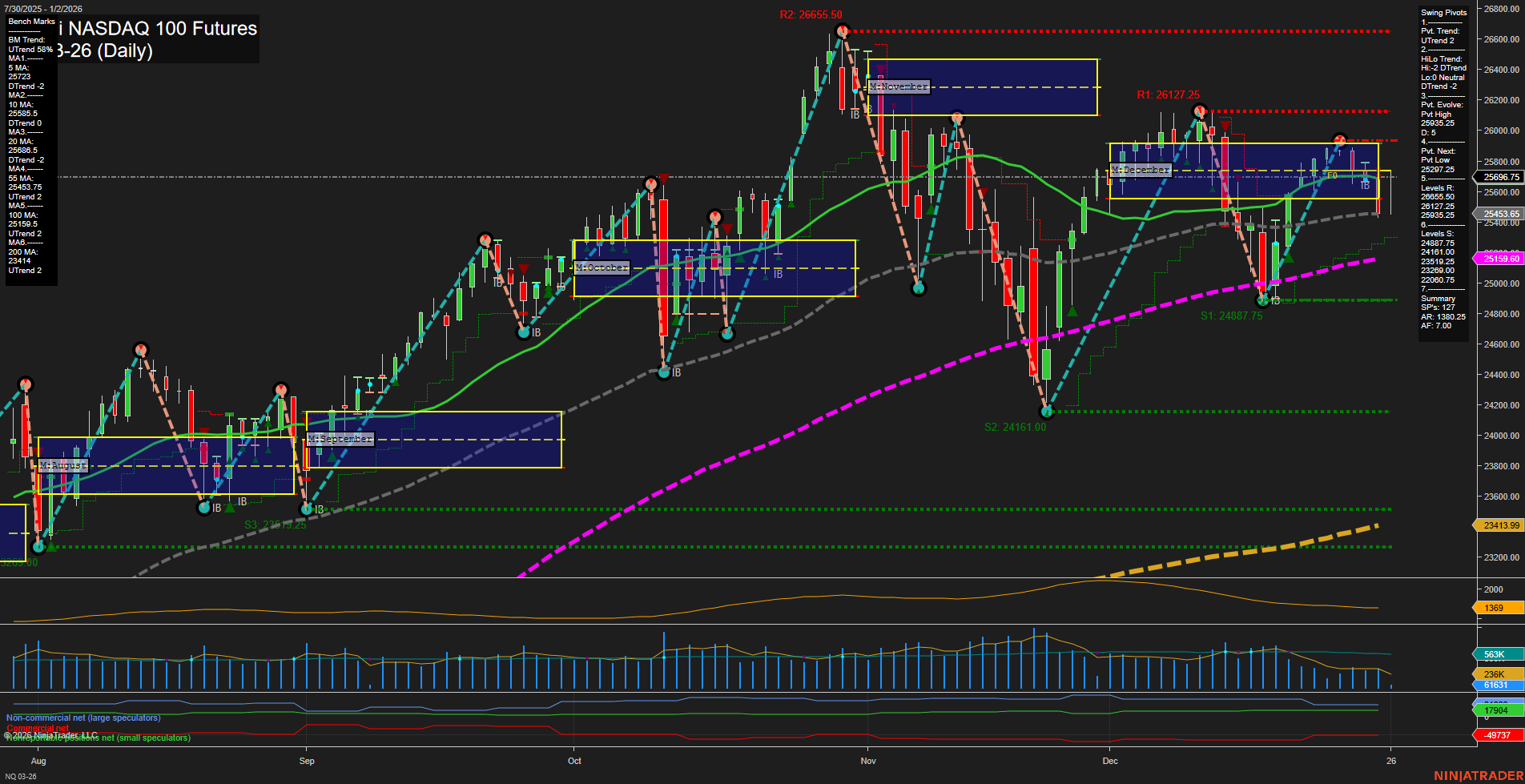

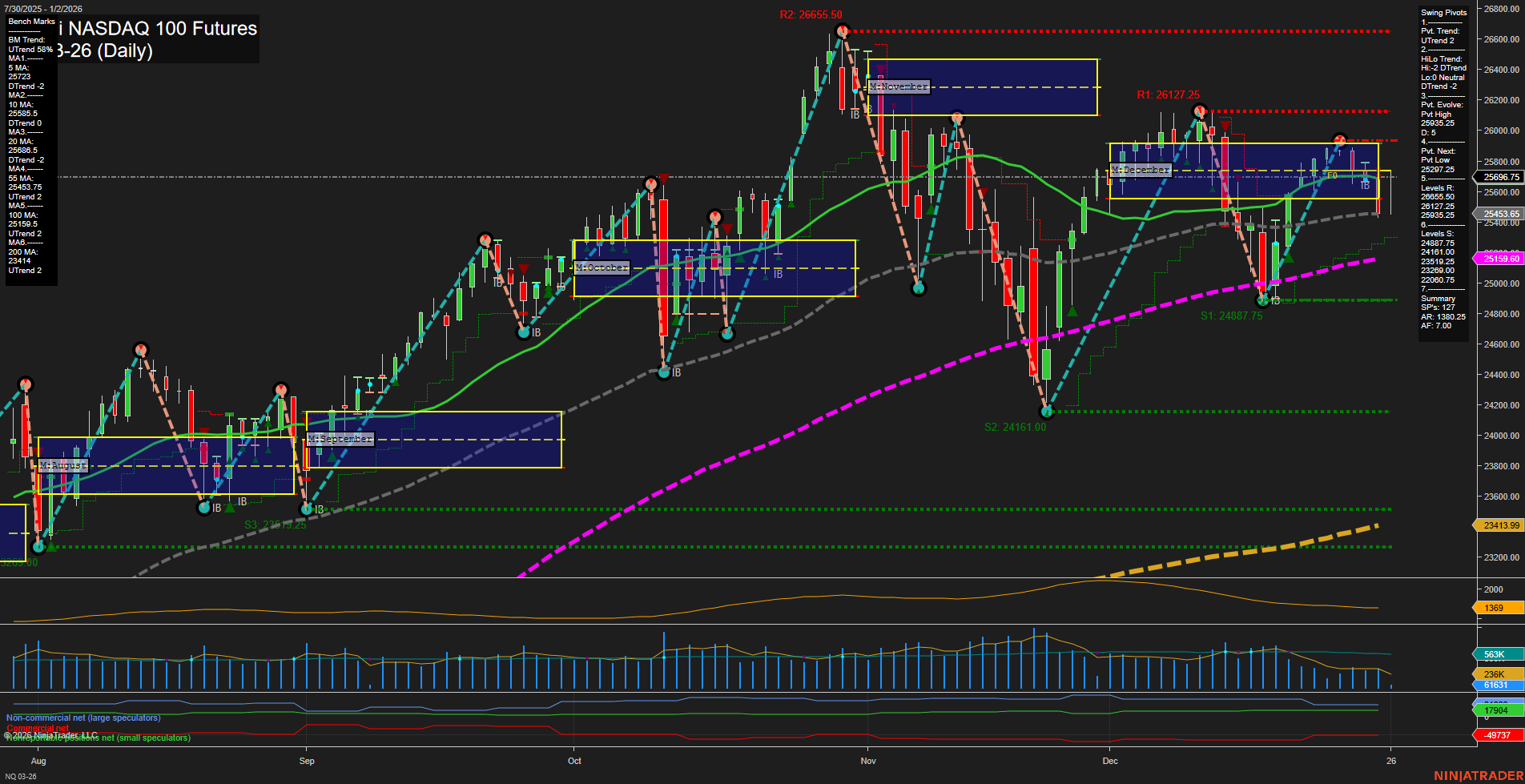

NQ E-mini NASDAQ 100 Futures Daily Chart Analysis: 2026-Jan-02 07:09 CT

Price Action

- Last: 25696.75,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: -28%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: 13%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: 79%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt Low 24887.75,

- 4. Pvt. Next: Pvt High 25963.25,

- 5. Levels R: 26127.25, 25963.25, 25655.5,

- 6. Levels S: 24887.75, 24161.00, 23280.00, 22006.75.

Daily Benchmarks

- (Short-Term) 5 Day: 25723 Up Trend,

- (Short-Term) 10 Day: 25685.5 Up Trend,

- (Intermediate-Term) 20 Day: 25453.25 Up Trend,

- (Intermediate-Term) 55 Day: 24817.05 Up Trend,

- (Long-Term) 100 Day: 23413.99 Up Trend,

- (Long-Term) 200 Day: 25159.69 Up Trend.

Additional Metrics

- ATR: 1618,

- VOLMA: 626746.

Recent Trade Signals

- 02 Jan 2026: Long NQ 03-26 @ 25709 Signals.USAR-MSFG

- 02 Jan 2026: Long NQ 03-26 @ 25709 Signals.USAR.TR120

- 30 Dec 2025: Short NQ 03-26 @ 25744.5 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The NQ E-mini NASDAQ 100 Futures daily chart shows a market in transition. Price action is currently near the 25700 level with medium-sized bars and average momentum, indicating neither strong buying nor selling pressure. Short-term (weekly) structure is weak, with price below the WSFG NTZ and a downtrend bias, but the swing pivot trend has shifted to an uptrend, suggesting a possible short-term bounce or recovery attempt. Intermediate and long-term trends remain bullish, supported by the MSFG and YSFG both showing price above their respective NTZ levels and uptrend designations. All benchmark moving averages from short to long-term are trending upward, reinforcing the underlying bullish structure. Key resistance levels are clustered just above current price, while support is well-defined below, with the most recent swing low at 24887.75. Recent trade signals reflect this mixed environment, with a short signal late December quickly followed by new long signals as the new year begins, highlighting the choppy and rotational nature of the current market. Volatility remains moderate, and volume is steady. Overall, the market is consolidating after a pullback, with the potential for further upside if resistance is cleared, but short-term caution is warranted until a decisive breakout or breakdown occurs.

Chart Analysis ATS AI Generated: 2026-01-02 07:10 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.