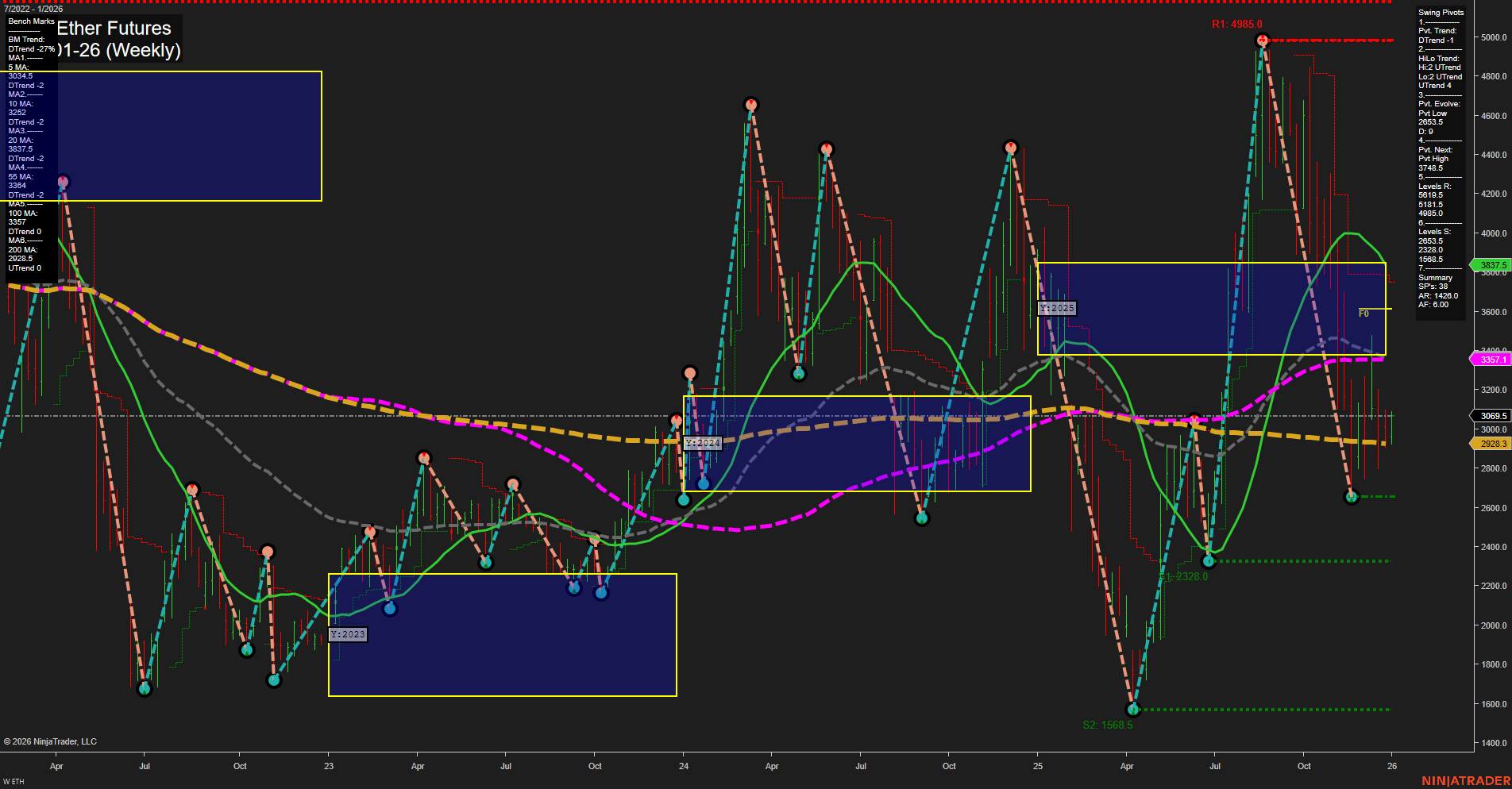

The current weekly chart for ETH CME Ether Futures shows a mixed environment for swing traders. Price action is consolidating with medium-sized bars and slow momentum, indicating a lack of strong directional conviction in the short term. The Weekly Session Fib Grid (WSFG) and Monthly Session Fib Grid (MSFG) both show price above their respective NTZ/F0% levels and are trending up, supporting a constructive short- to intermediate-term outlook. However, the Yearly Session Fib Grid (YSFG) remains in a downtrend with price below the yearly NTZ, reflecting persistent long-term weakness. Swing pivot analysis highlights a short-term downtrend (DTrend) but an intermediate-term uptrend (UTrend), with the most recent pivot low at 2328.0 and the next significant resistance at 4985.0. Key resistance levels are clustered above, while support is well below current price, suggesting a wide trading range and potential for volatility. All major moving averages except the 200-week are in downtrends, reinforcing the bearish long-term structure. The 200-week MA is just below current price and trending up, acting as a potential support zone. Recent trade signals have triggered long entries, aligning with the short- and intermediate-term uptrends, but these are counter to the prevailing long-term downtrend. Overall, the chart reflects a market in transition: short- and intermediate-term trends are improving, but the long-term context remains bearish. Swing traders may observe choppy, range-bound conditions with the potential for sharp moves as the market tests key resistance and support levels. The interplay between recovering shorter-term trends and entrenched long-term weakness suggests a period of consolidation or base-building, with volatility likely to persist as the market seeks direction.