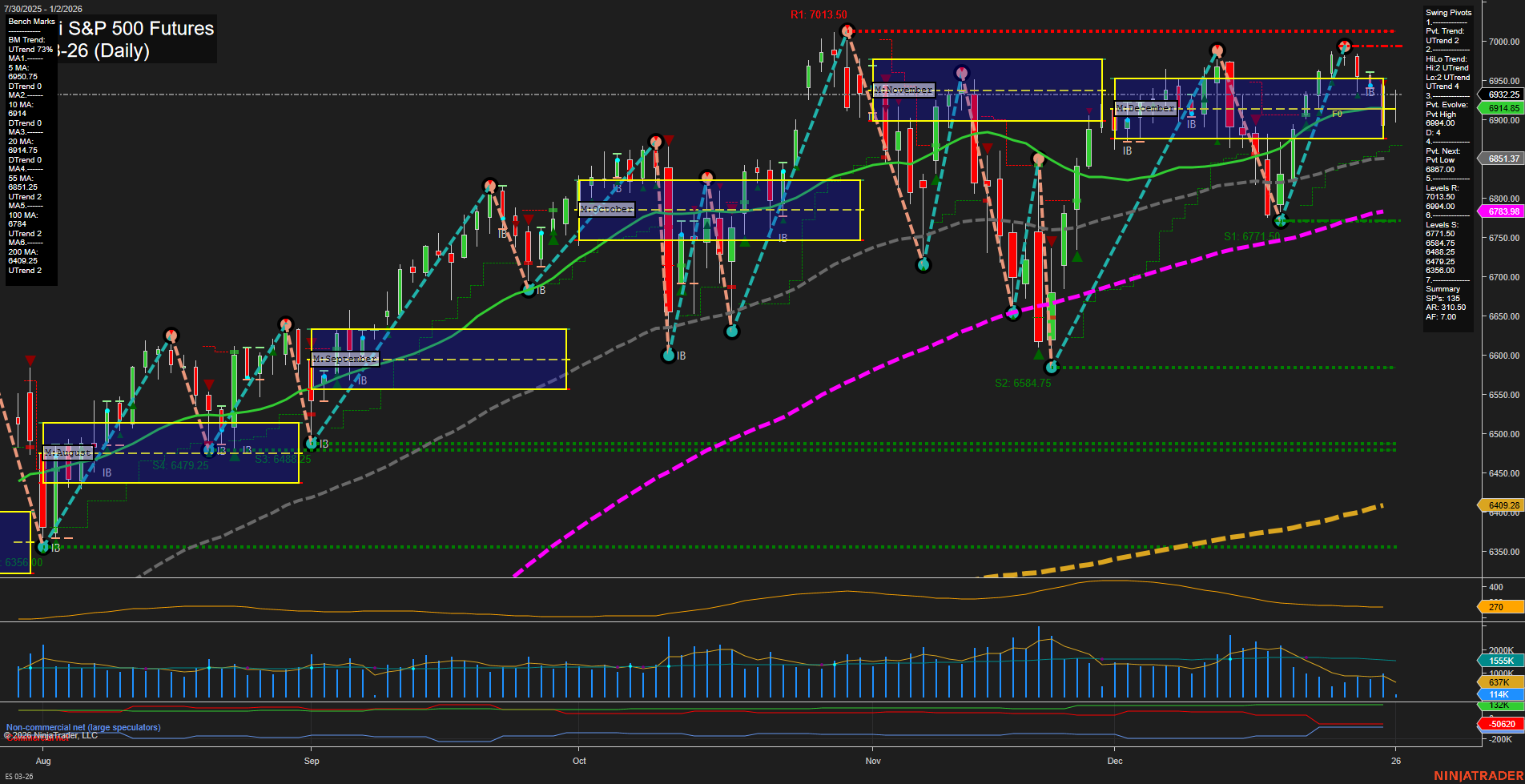

The ES E-mini S&P 500 Futures daily chart shows a market in transition. Price action is currently near recent highs, with medium-sized bars and average momentum, indicating a balanced but active environment. The short-term WSFG trend is down, with price below the weekly NTZ, suggesting some near-term resistance and possible consolidation or pullback. However, both the intermediate-term (MSFG) and long-term (YSFG) trends remain up, with price above their respective NTZs, reflecting underlying bullish structure. Swing pivots confirm this mixed picture: the short-term pivot trend is up, and the intermediate-term HiLo trend is also up, with the most recent evolution at a pivot high. Key resistance sits at 7013.50 and 6941.85, while support is layered below at 6771.25 and 6584.75. All benchmark moving averages from short to long-term are trending upward, reinforcing the broader bullish bias. ATR and volume metrics indicate moderate volatility and healthy participation. Recent trade signals show both long and short entries, highlighting the choppy, rotational nature of the current market as it tests upper resistance zones. Overall, the market is consolidating near highs, with short-term indecision but strong intermediate and long-term uptrends. This environment often precedes either a breakout continuation or a deeper retracement, depending on how price reacts to resistance and support in the coming sessions.