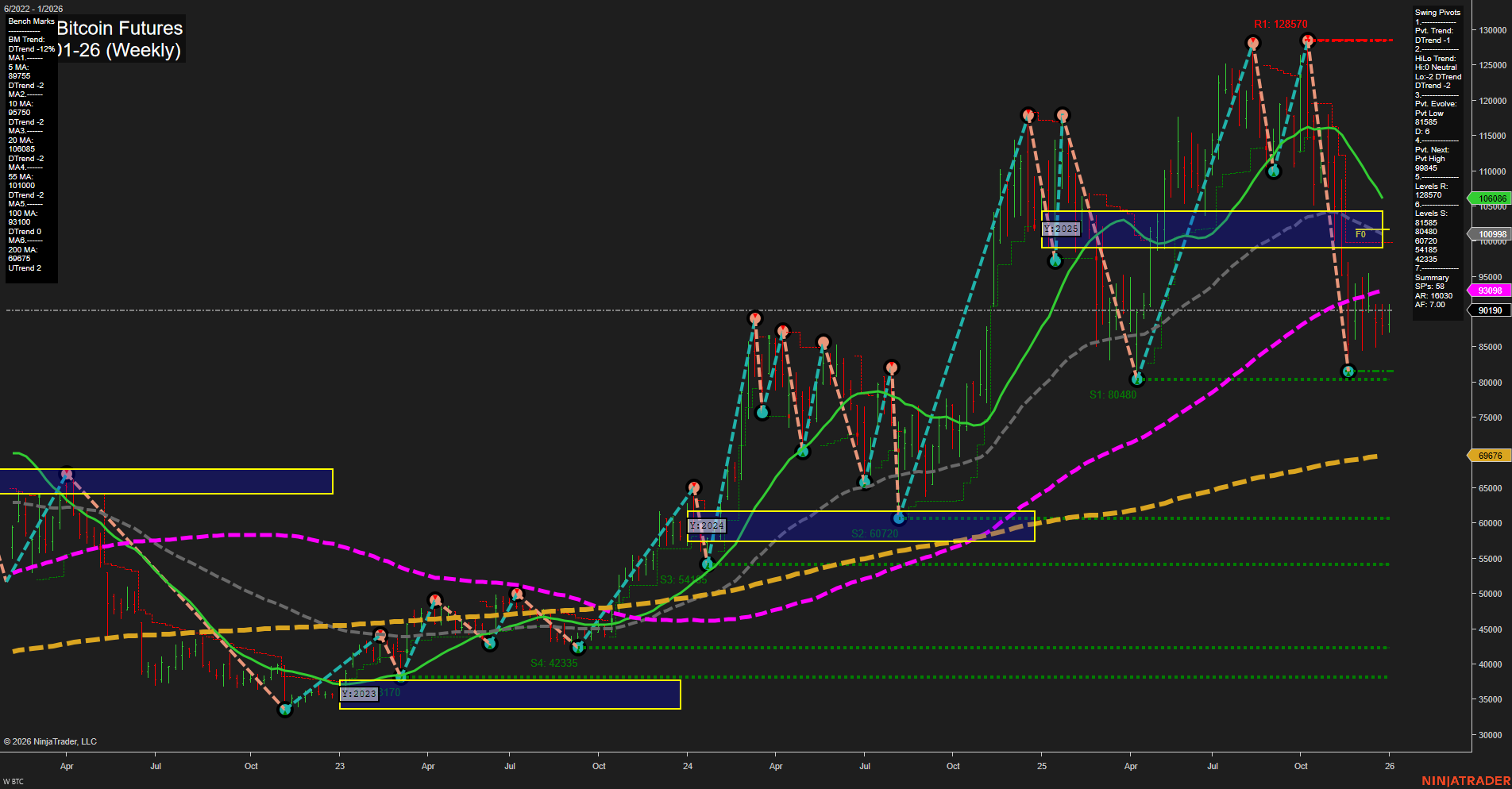

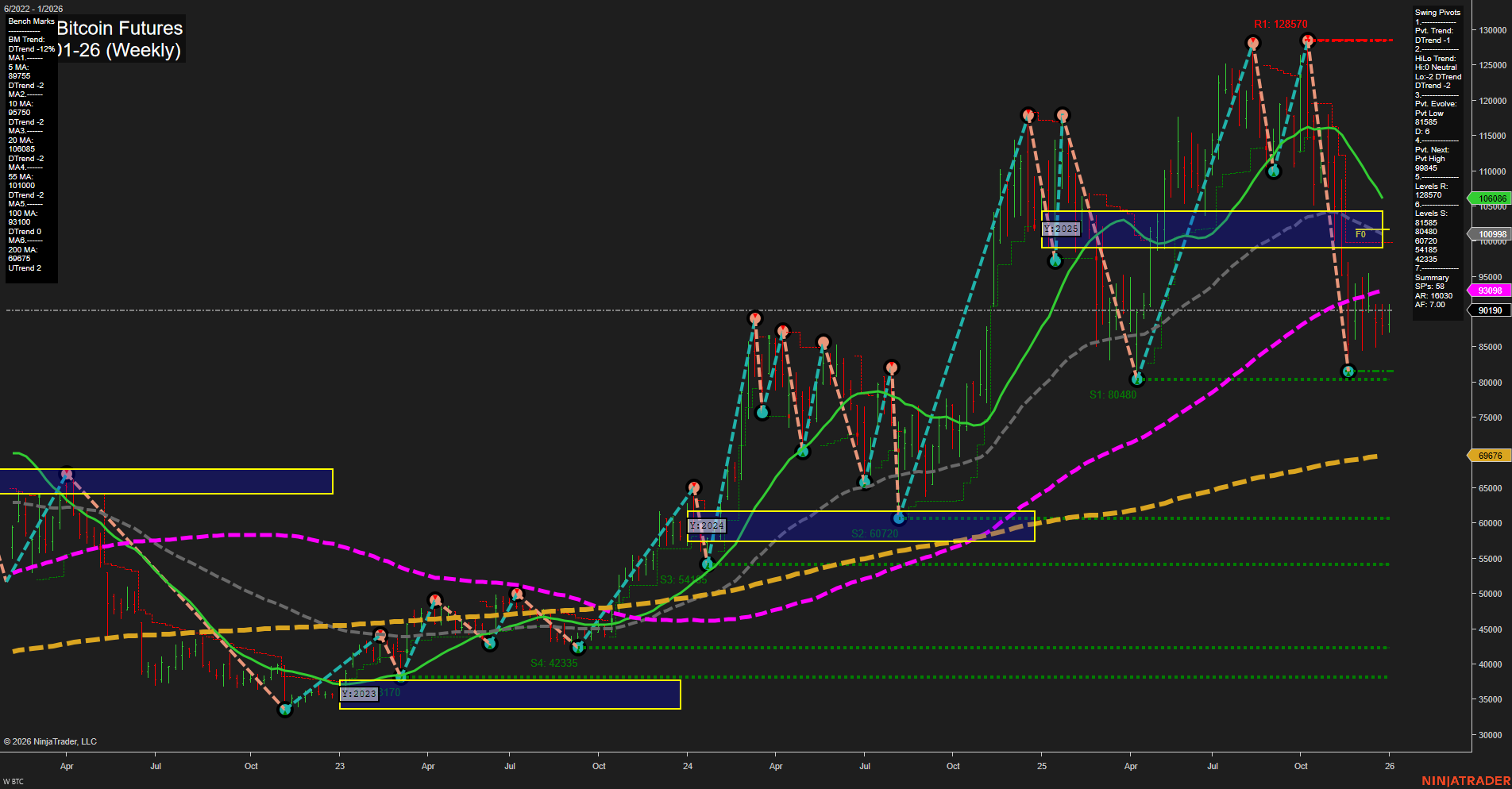

BTC CME Bitcoin Futures Weekly Chart Analysis: 2026-Jan-02 07:03 CT

Price Action

- Last: 100985,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 32%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: 5%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2026

- Long-Term

- YSFG Current: -45%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 80480,

- 4. Pvt. Next: Pvt high 128570,

- 5. Levels R: 128570, 120250, 109985,

- 6. Levels S: 80480, 60720, 54435, 42335.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 98750 Down Trend,

- (Intermediate-Term) 10 Week: 98790 Down Trend,

- (Long-Term) 20 Week: 100698 Down Trend,

- (Long-Term) 55 Week: 95000 Up Trend,

- (Long-Term) 100 Week: 93098 Up Trend,

- (Long-Term) 200 Week: 69676 Up Trend.

Recent Trade Signals

- 02 Jan 2026: Long BTC 01-26 @ 89720 Signals.USAR.TR120

- 02 Jan 2026: Long BTC 01-26 @ 89465 Signals.USAR-WSFG

- 29 Dec 2025: Long BTC 01-26 @ 90745 Signals.USAR-MSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The current weekly chart for BTC CME Bitcoin Futures shows a market in transition. Price action is volatile with large bars and fast momentum, indicating heightened activity and potential for sharp moves. Short-term and intermediate-term Fib grid trends are up, with price holding above their respective NTZ/F0% levels, but the yearly (long-term) grid trend remains down, with price below the annual NTZ/F0%. Swing pivots indicate a short-term and intermediate-term downtrend, with the most recent pivot low at 80,480 and resistance at 128,570, suggesting the market is correcting after a significant rally. Weekly benchmarks show short- and intermediate-term moving averages trending down, while longer-term averages (55, 100, 200 week) remain in uptrends, reflecting a longer-term bullish structure despite recent pullbacks. Recent trade signals are long, aligning with the short-term and intermediate-term grid trends, but the overall structure suggests a period of consolidation or correction within a broader bullish cycle. The market is currently testing support levels, and the interplay between short-term weakness and long-term strength may result in choppy or range-bound conditions before a decisive move emerges.

Chart Analysis ATS AI Generated: 2026-01-02 07:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.