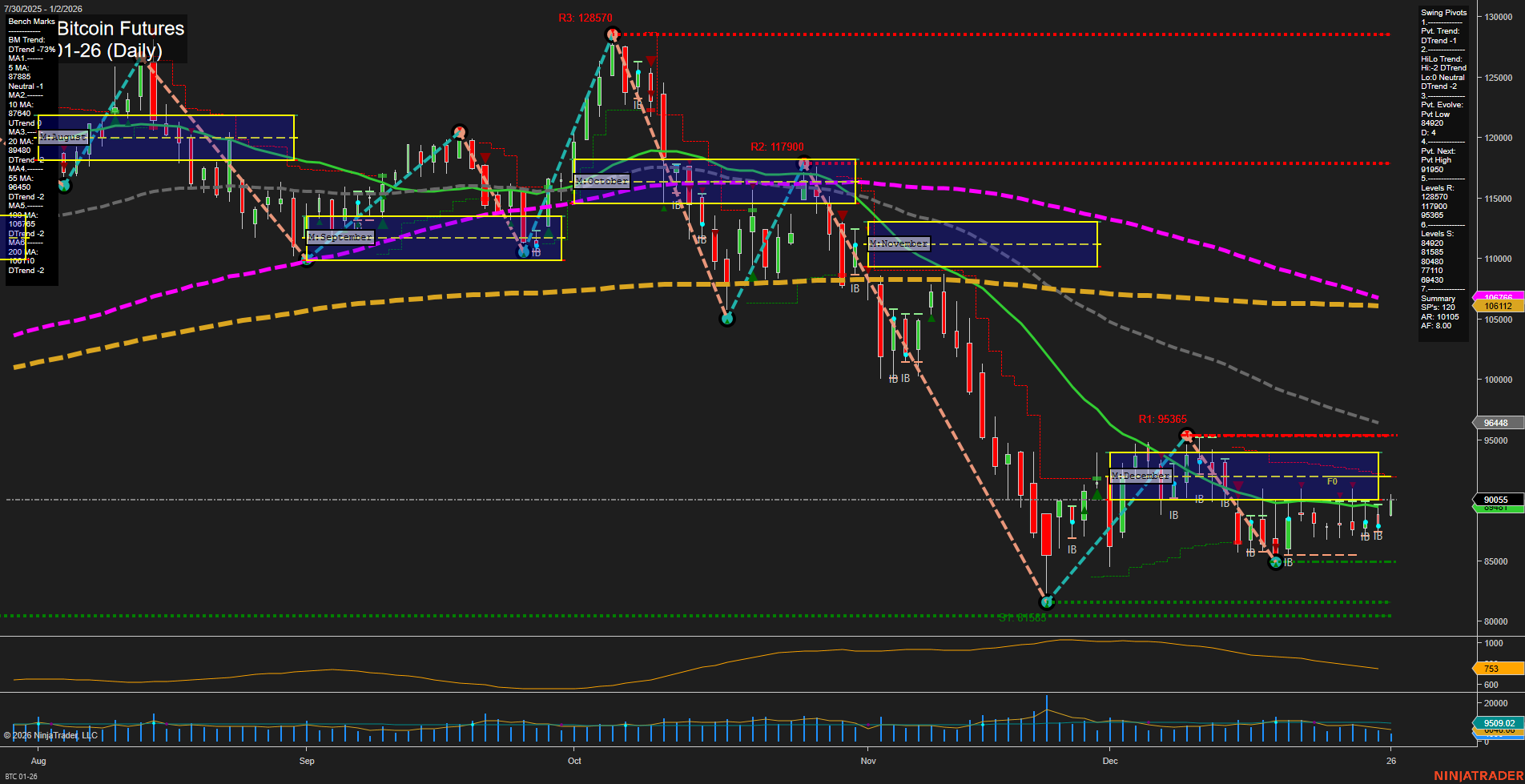

The current BTC futures daily chart reflects a market in transition. Price action is consolidating with small bars and slow momentum, indicating a lack of strong directional conviction. Short-term and intermediate-term fib grid trends (WSFG, MSFG) are both up, with price holding above their respective NTZ/F0% levels, suggesting a potential for upward bias in the near term. However, swing pivot structure remains in a downtrend for both short and intermediate timeframes, with the most recent pivot low at 84,020 and the next resistance at 91,650. Daily benchmarks show mixed signals: the 20-day MA is turning up, but all other key moving averages (5, 10, 55, 100, 200) are trending down, highlighting a broader bearish context. The long-term YSFG trend is down, with price well below the yearly F0%/NTZ, reinforcing a bearish macro backdrop. ATR and volume metrics are moderate, reflecting contained volatility and average participation. Recent trade signals have triggered new long entries, aligning with the short-term fib grid uptrend, but these are counter to the prevailing swing pivot and long-term trends. Overall, the market is in a consolidation phase, with short-term upward attempts facing significant overhead resistance and a dominant long-term downtrend. Swing traders may interpret this as a potential basing or pause before a larger move, with key levels to watch for breakout or rejection patterns.