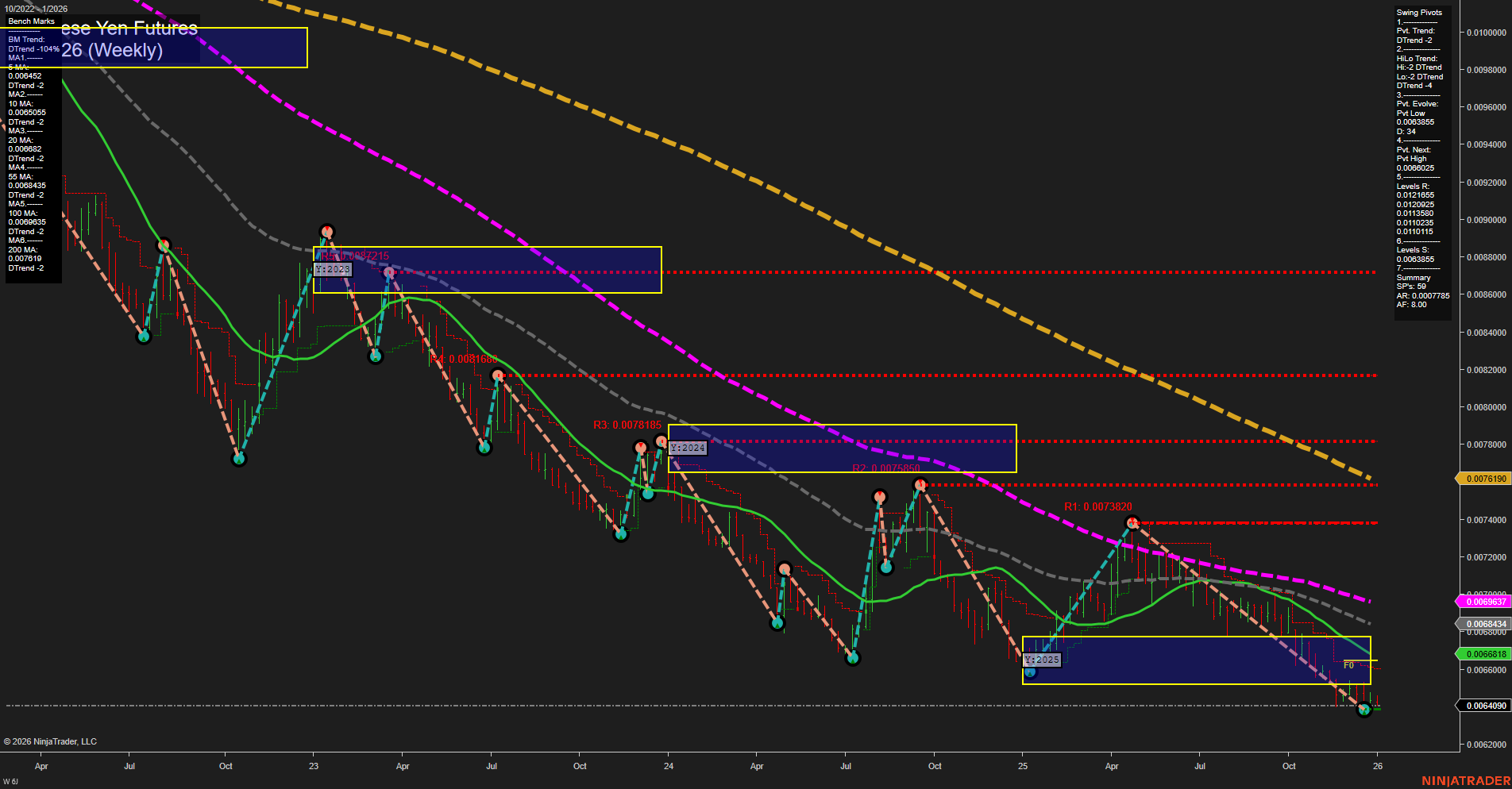

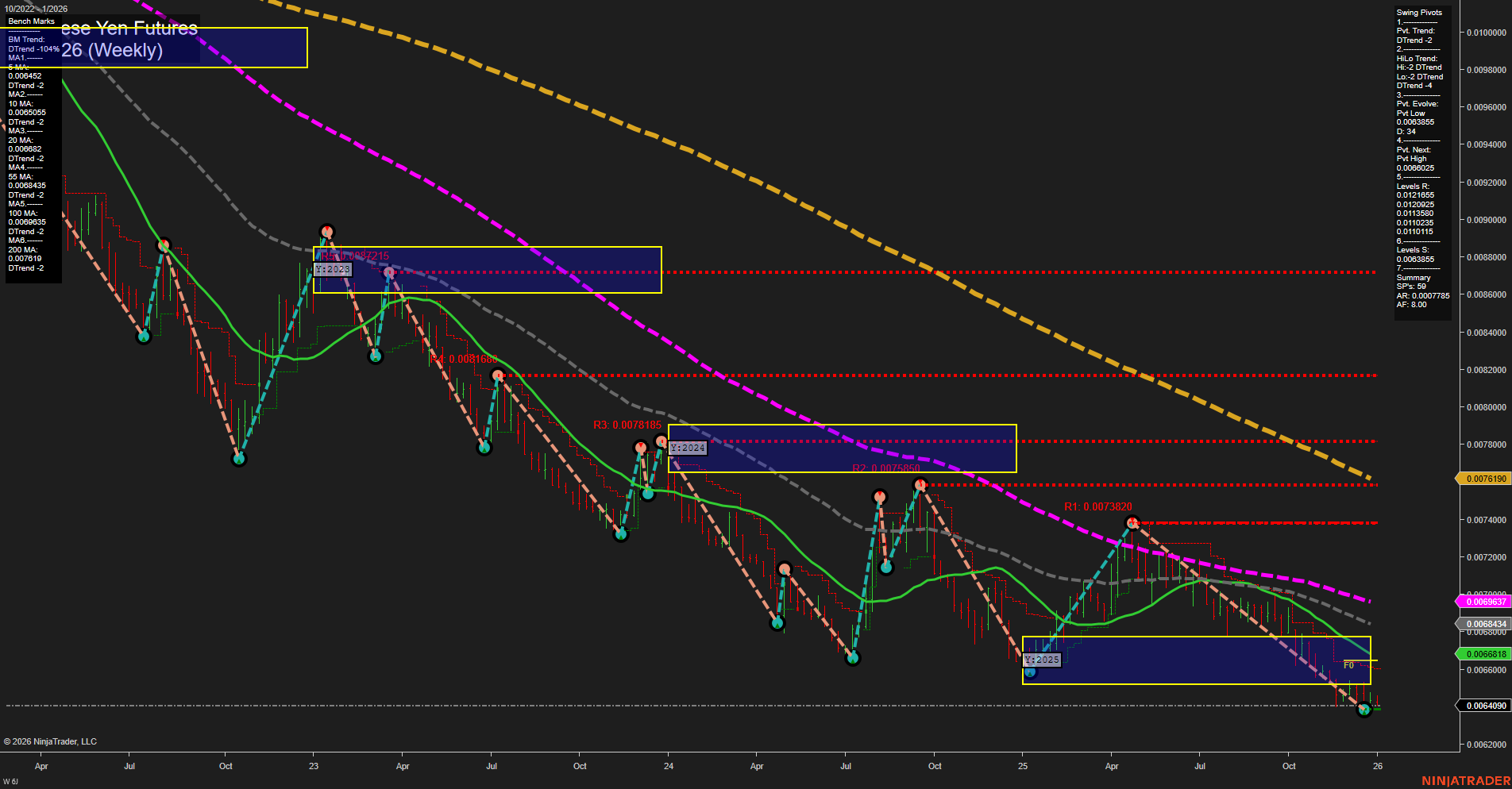

6J Japanese Yen Futures Weekly Chart Analysis: 2026-Jan-02 07:02 CT

Price Action

- Last: 0.0064090,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -16%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: -4%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: -19%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt Low 0.0063985,

- 4. Pvt. Next: Pvt High 0.0068025,

- 5. Levels R: 0.0078185, 0.0078650, 0.0073820, 0.0071315, 0.0068025,

- 6. Levels S: 0.0063985.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.0065432 Down Trend,

- (Intermediate-Term) 10 Week: 0.0066843 Down Trend,

- (Long-Term) 20 Week: 0.0068518 Down Trend,

- (Long-Term) 55 Week: 0.0069637 Down Trend,

- (Long-Term) 100 Week: 0.0073785 Down Trend,

- (Long-Term) 200 Week: 0.0076190 Down Trend.

Recent Trade Signals

- 02 Jan 2026: Short 6J 03-26 @ 0.0064155 Signals.USAR-WSFG

- 31 Dec 2025: Short 6J 03-26 @ 0.0064225 Signals.USAR-MSFG

- 26 Dec 2025: Short 6J 03-26 @ 0.006436 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The 6J Japanese Yen Futures weekly chart continues to exhibit a persistent downtrend across all timeframes. Price action remains below all major moving averages, with each benchmark MA (from 5-week to 200-week) trending lower, confirming sustained bearish momentum. The most recent swing pivot has established a new low at 0.0063985, with the next resistance levels significantly higher, indicating little immediate overhead pressure but also a lack of bullish reversal signals. The price is trading below the NTZ center and F0% lines on all session fib grids (weekly, monthly, yearly), reinforcing the dominant downward bias. Recent trade signals have all triggered short entries, aligning with the prevailing trend. The market structure shows a series of lower highs and lower lows, with no evidence of a reversal or significant retracement. Volatility appears moderate, and the slow momentum suggests a controlled, grinding decline rather than a sharp selloff. Overall, the technical landscape remains decisively bearish, with no clear signs of a bottom or counter-trend rally at this stage.

Chart Analysis ATS AI Generated: 2026-01-02 07:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.