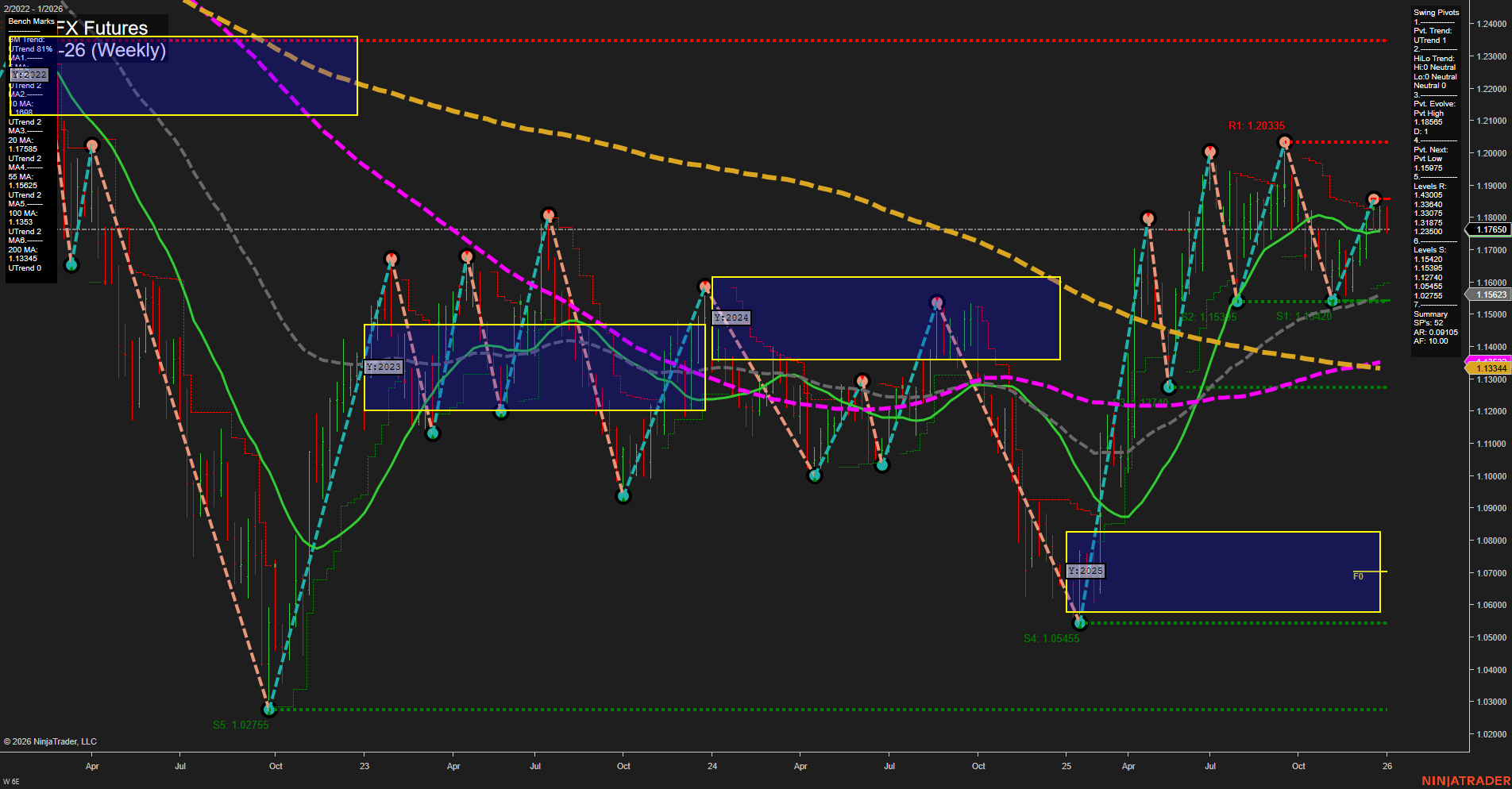

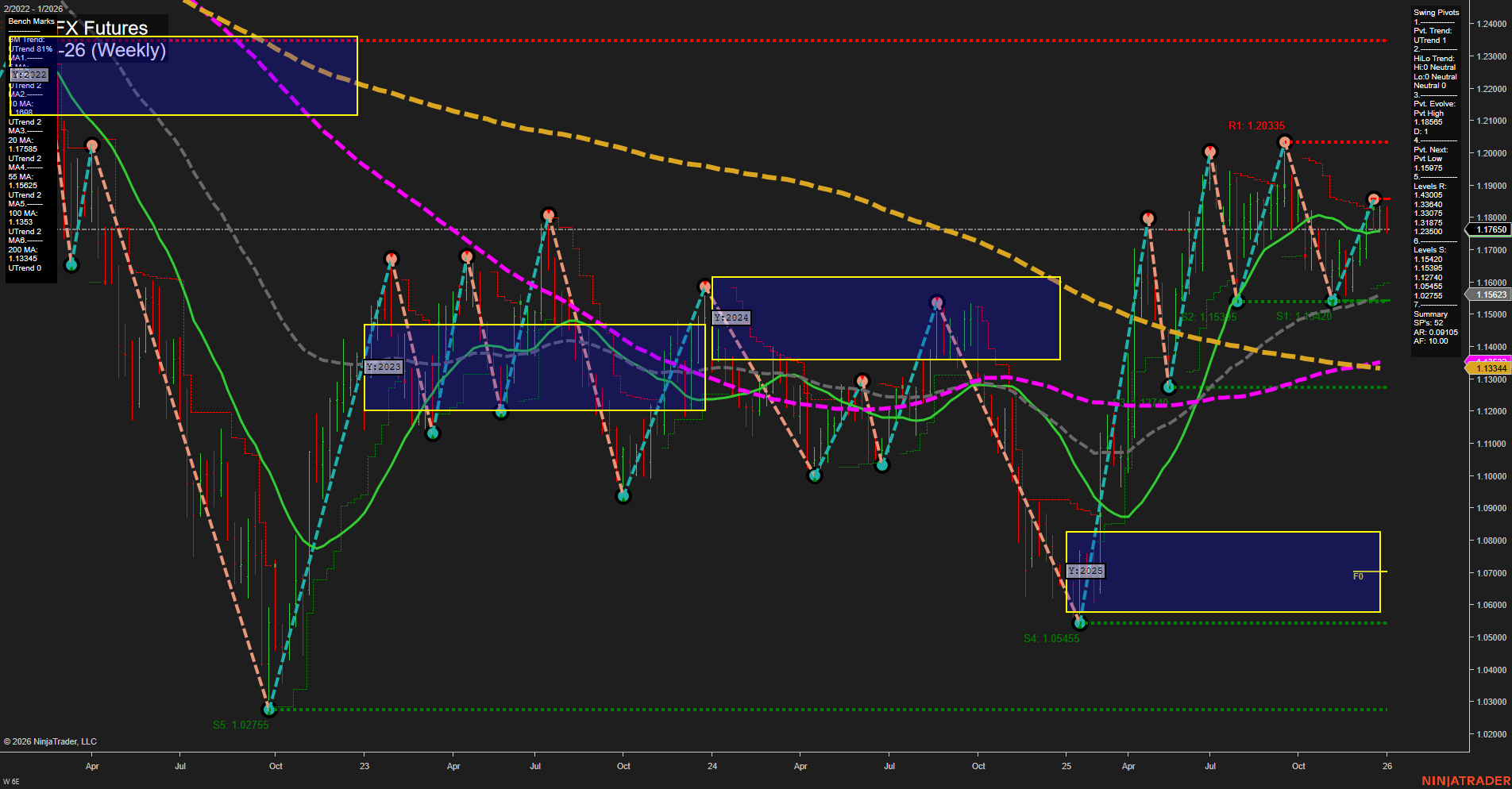

6E Euro FX Futures Weekly Chart Analysis: 2026-Jan-02 07:02 CT

Price Action

- Last: 1.13344,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -54%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: -8%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: 78%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 1.18705,

- 4. Pvt. Next: Pvt low 1.11535,

- 5. Levels R: 1.20335, 1.18705, 1.17585, 1.14705,

- 6. Levels S: 1.11535, 1.05455, 1.02755.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.17585 Down Trend,

- (Intermediate-Term) 10 Week: 1.16523 Down Trend,

- (Long-Term) 20 Week: 1.15333 Up Trend,

- (Long-Term) 55 Week: 1.14000 Down Trend,

- (Long-Term) 100 Week: 1.15334 Down Trend,

- (Long-Term) 200 Week: 1.13344 Down Trend.

Recent Trade Signals

- 30 Dec 2025: Short 6E 03-26 @ 1.17925 Signals.USAR-WSFG

- 29 Dec 2025: Short 6E 03-26 @ 1.1808 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

The 6E Euro FX Futures weekly chart shows a market in transition. Short- and intermediate-term trends are bearish, as confirmed by the WSFG and MSFG both trending down and price trading below their respective NTZ/F0% levels. Recent short trade signals reinforce this downside bias. However, the long-term YSFG trend remains up, with price still above the yearly NTZ/F0% and the 20-week moving average showing an uptrend, suggesting underlying support on a broader time frame. Swing pivots indicate the most recent move was up, but with resistance levels overhead and the next pivot low at 1.11535, the market could be vulnerable to further pullbacks. The moving averages are mixed, with most long-term benchmarks still in downtrends except for the 20-week. Overall, the market is experiencing a corrective phase within a larger uptrend, with short-term momentum favoring the bears and long-term structure still holding. This environment may lead to choppy price action, with potential for both retracements and sharp reversals as the market tests key support and resistance levels.

Chart Analysis ATS AI Generated: 2026-01-02 07:02 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.