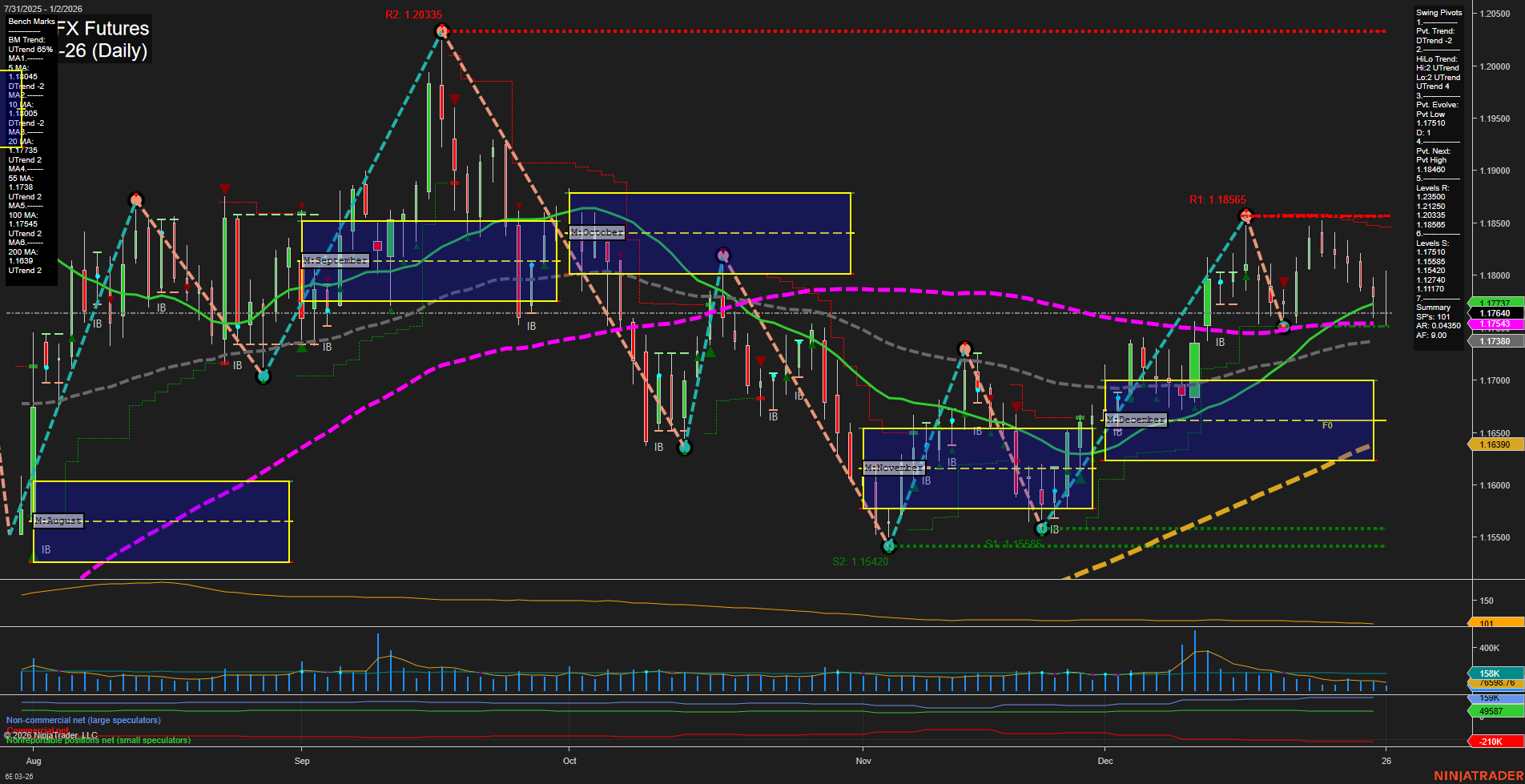

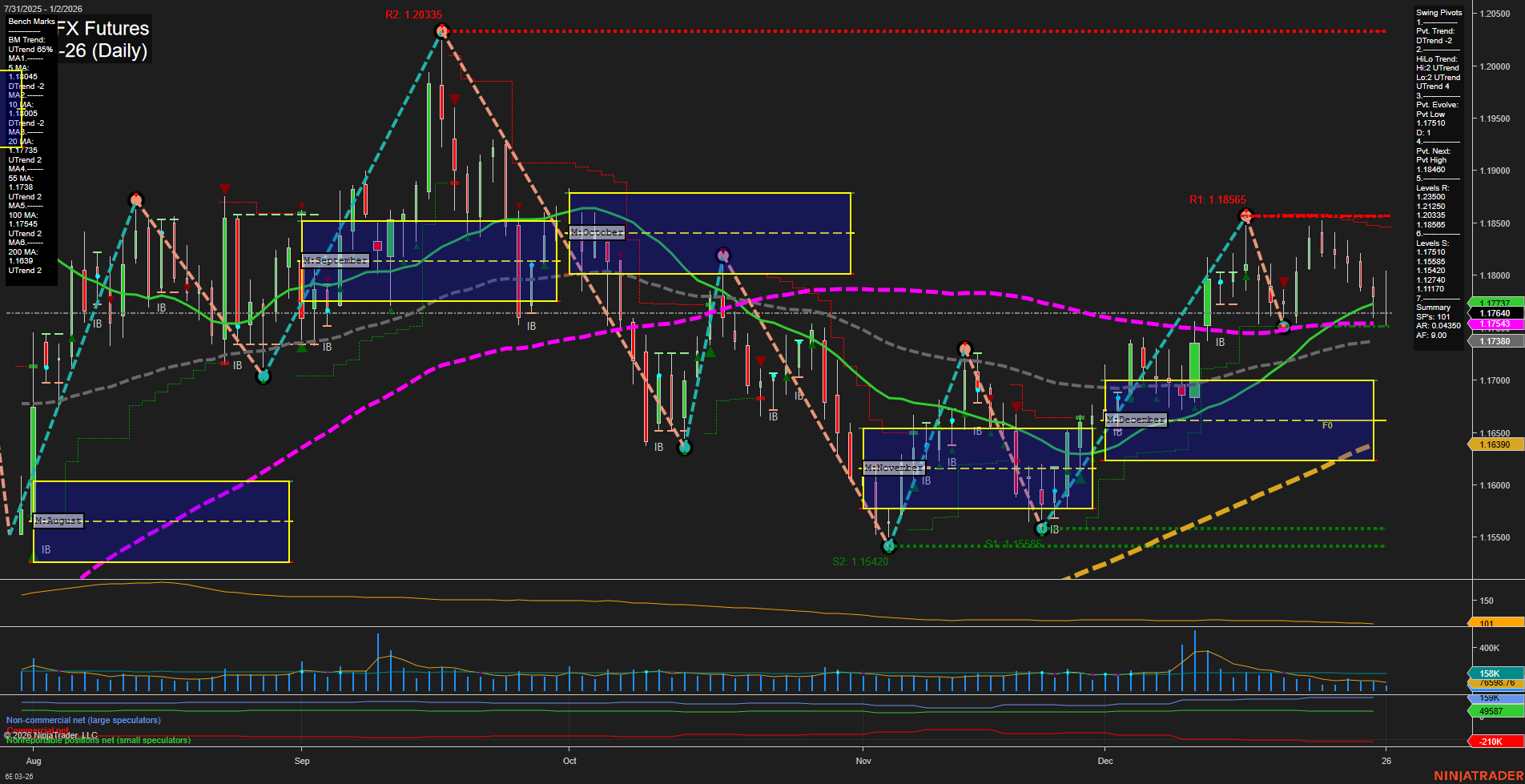

6E Euro FX Futures Daily Chart Analysis: 2026-Jan-02 07:01 CT

Price Action

- Last: 1.17747,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -54%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Jan

- Intermediate-Term

- MSFG Current: -8%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2026

- Long-Term

- YSFG Current: 78%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 1.18565,

- 4. Pvt. Next: Pvt low 1.1710,

- 5. Levels R: 1.18565, 1.18480, 1.18355, 1.20335,

- 6. Levels S: 1.17170, 1.16590, 1.16390, 1.15420.

Daily Benchmarks

- (Short-Term) 5 Day: 1.17764 Down Trend,

- (Short-Term) 10 Day: 1.17543 Down Trend,

- (Intermediate-Term) 20 Day: 1.17640 Down Trend,

- (Intermediate-Term) 55 Day: 1.17380 Up Trend,

- (Long-Term) 100 Day: 1.16390 Up Trend,

- (Long-Term) 200 Day: 1.16390 Up Trend.

Additional Metrics

Recent Trade Signals

- 30 Dec 2025: Short 6E 03-26 @ 1.17925 Signals.USAR-WSFG

- 29 Dec 2025: Short 6E 03-26 @ 1.1808 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The 6E Euro FX Futures daily chart shows a market in transition. Short-term momentum is slow and the price is trading below both the weekly and monthly session fib grid centers, with the WSFG and MSFG both trending down. The most recent swing pivot is a high at 1.18565, with the next key level to watch being a potential swing low at 1.1710. Resistance is layered above at 1.18565 and 1.18480, while support is found at 1.17170 and 1.16590. Short-term and intermediate-term moving averages are in a downtrend, but the longer-term 100 and 200 day MAs remain in an uptrend, reflecting underlying bullishness on the yearly timeframe. Recent trade signals have triggered short entries, aligning with the current short-term bearish bias. Volatility (ATR) and volume (VOLMA) are moderate, suggesting a market that could be consolidating after a recent move. Overall, the short-term outlook is bearish, the intermediate-term is neutral as the market tests support, and the long-term remains bullish, indicating a possible larger trend continuation if support holds and momentum returns.

Chart Analysis ATS AI Generated: 2026-01-02 07:02 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2026. Algo Trading Systems LLC.