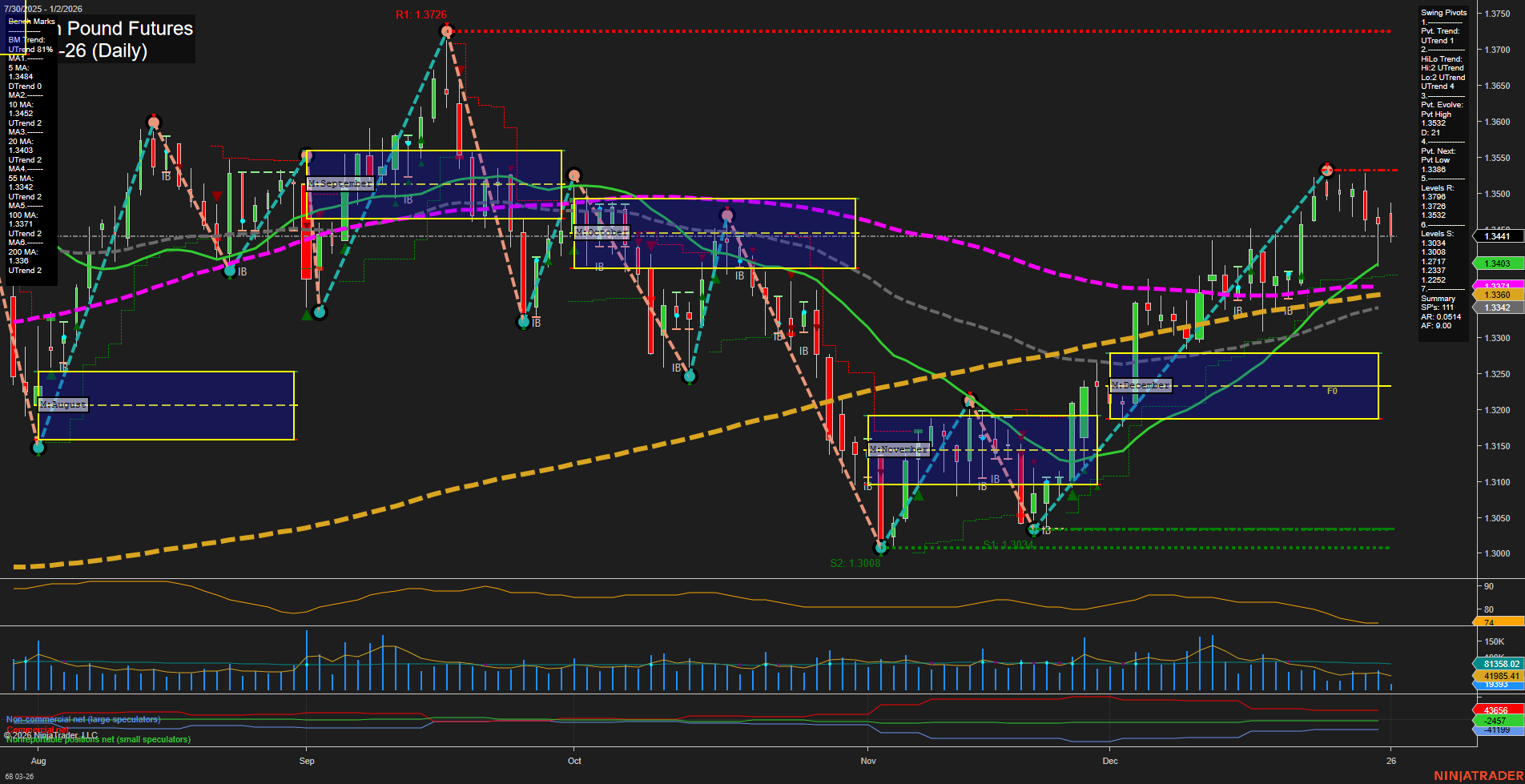

The 6B British Pound Futures daily chart shows a market in transition. Price action is currently consolidating after a strong rally from the November lows, with medium-sized bars and average momentum indicating a pause rather than a decisive move. Short-term and intermediate-term session fib grid trends (WSFG and MSFG) are both down, with price below their respective NTZ/F0% levels, suggesting some overhead resistance and a lack of immediate bullish momentum. However, both the short-term and intermediate-term swing pivot trends are up, with the most recent pivot high at 1.3532 and the next potential pivot low at 1.3388, indicating the market is still in an upswing phase unless 1.3388 is breached. Daily benchmarks show a cluster of short- and intermediate-term moving averages trending up, supporting the recent bullish move, but the longer-term 100 and 200 day MAs remain in a downtrend, highlighting a broader context of recovery within a larger bearish structure. The ATR and volume metrics suggest moderate volatility and participation. Recent trade signals have triggered short entries near current levels, reflecting the short-term fib grid's downward bias and possible resistance overhead. Overall, the market is at a technical crossroads: short-term signals are mixed to neutral, intermediate-term structure remains bullish, and the long-term trend is still neutral as price tests key moving averages and resistance levels. The market is likely to remain choppy as it digests recent gains, with traders watching for a break above 1.3532 for bullish continuation or a move below 1.3388 for a potential retracement.