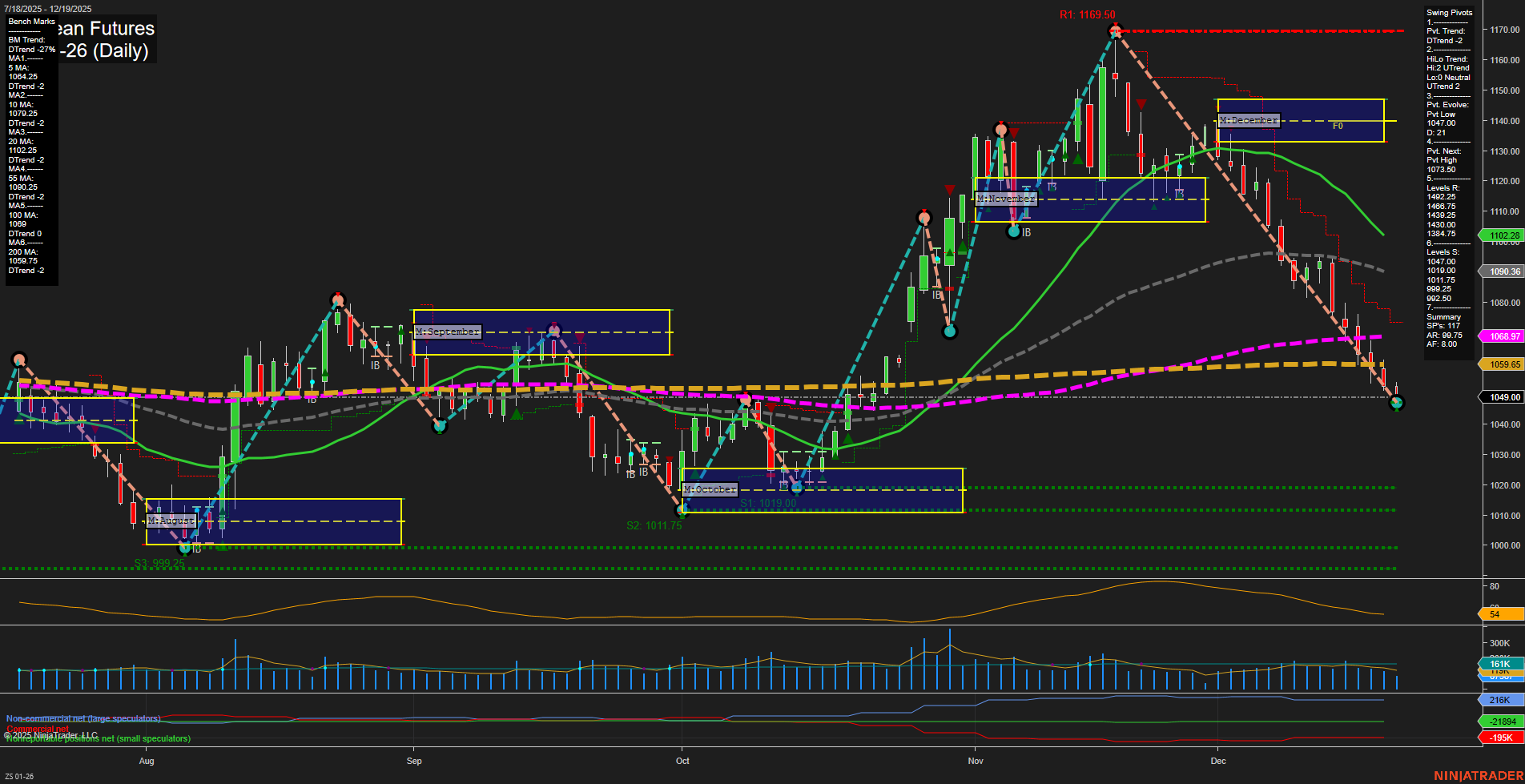

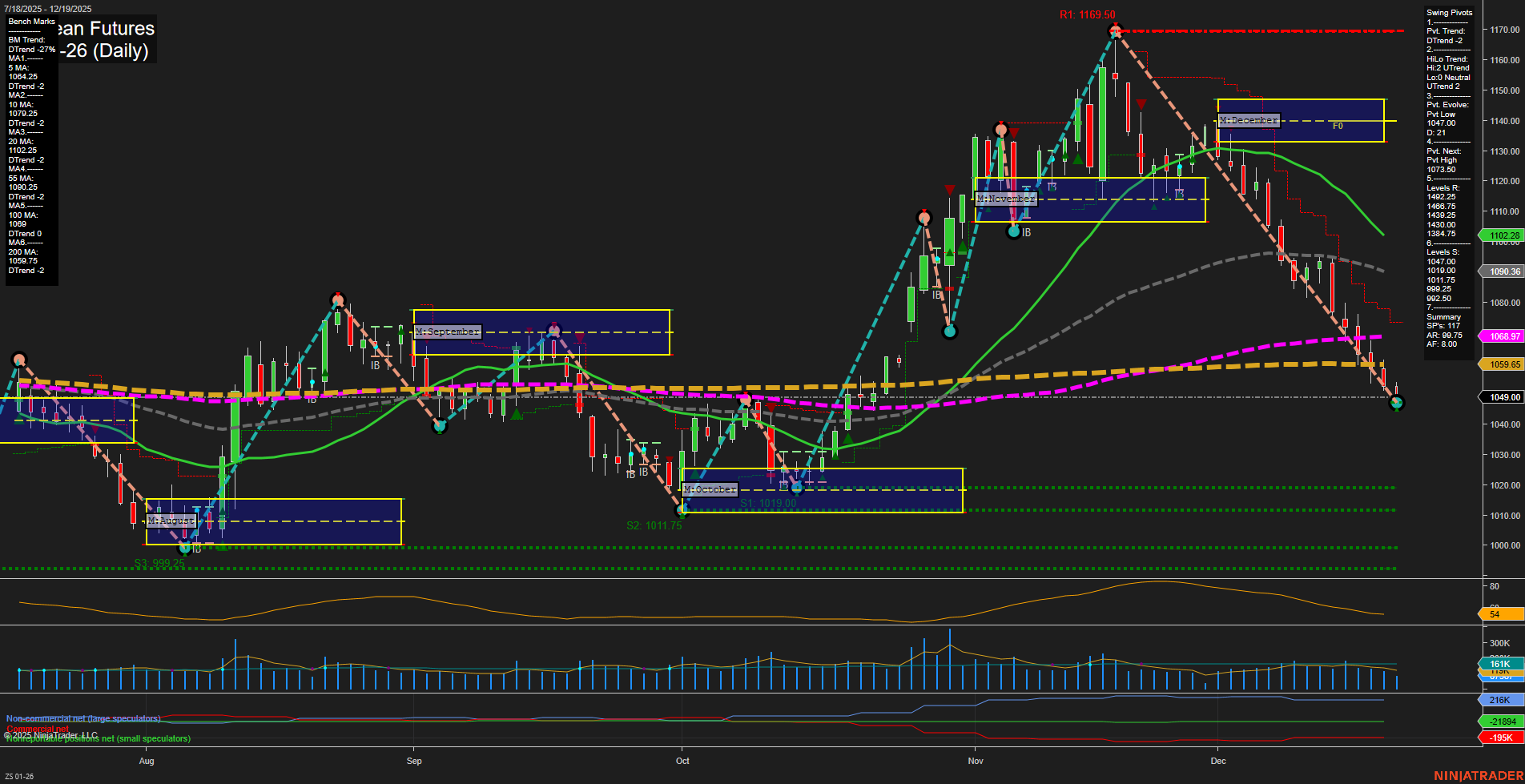

ZS Soybean Futures Daily Chart Analysis: 2025-Dec-21 18:12 CT

Price Action

- Last: 1049.00,

- Bars: Medium,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -79%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Dec

- Intermediate-Term

- MSFG Current: -101%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 4%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 1049.00,

- 4. Pvt. Next: Pvt high 1073.50,

- 5. Levels R: 1169.50, 1146.75, 1138.75, 1109.00, 1073.50,

- 6. Levels S: 1049.00, 1011.75, 999.25.

Daily Benchmarks

- (Short-Term) 5 Day: 1064.25 Down Trend,

- (Short-Term) 10 Day: 1082.25 Down Trend,

- (Intermediate-Term) 20 Day: 1102.25 Down Trend,

- (Intermediate-Term) 55 Day: 1109.25 Down Trend,

- (Long-Term) 100 Day: 1068.97 Down Trend,

- (Long-Term) 200 Day: 1095.65 Down Trend.

Additional Metrics

Recent Trade Signals

- 16 Dec 2025: Short ZS 01-26 @ 1067.25 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

Soybean futures have experienced a sharp and persistent selloff, with price action breaking decisively below both the weekly and monthly session fib grids (WSFG, MSFG), confirming strong downside momentum. The most recent swing pivot has established a new low at 1049.00, with all short- and intermediate-term moving averages trending down and price trading below every key benchmark. Resistance levels are stacked well above current price, while support is thin and spaced out, suggesting the market is in a clear downtrend phase with little immediate technical support until the 1011.75 and 999.25 levels. The fast momentum and elevated ATR reflect heightened volatility, likely driven by a combination of technical breakdowns and possible fundamental pressures such as harvest cycle, export data, or macro news. Despite the long-term YSFG trend remaining up, the current structure is dominated by bearish sentiment and trend continuation patterns, with no clear reversal signals present. Volume remains robust, supporting the conviction behind the move. Swing traders will note the dominance of lower highs and lower lows, with the market in a trend extension phase rather than a consolidation or reversal environment.

Chart Analysis ATS AI Generated: 2025-12-21 18:12 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.