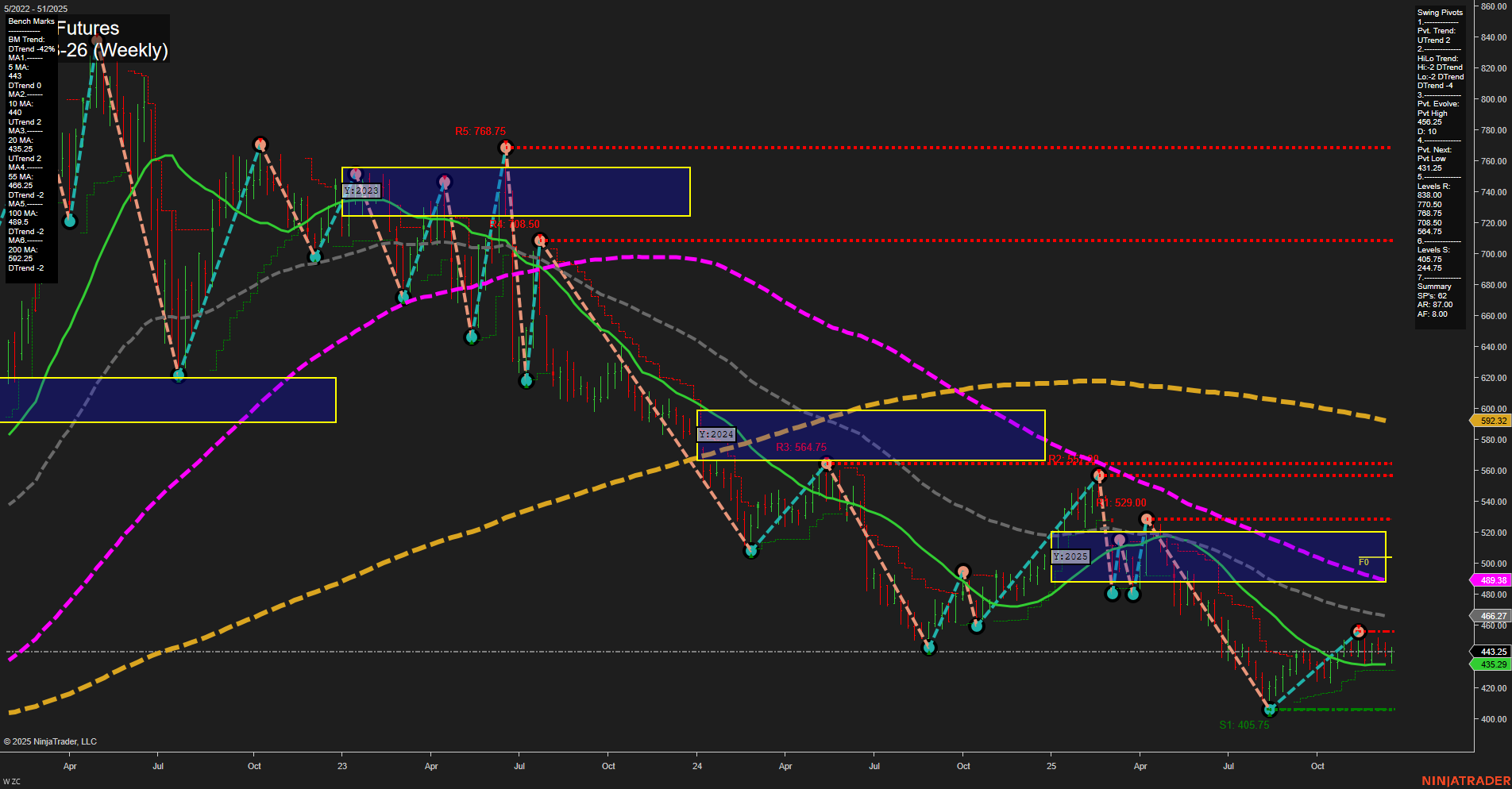

Corn futures are currently showing a mixed technical landscape. Short-term momentum has shifted to the upside, as indicated by the uptrend in the weekly session fib grid (WSFG) and the most recent swing pivot trend, supported by small bars and slow momentum—suggesting a cautious but constructive move higher. The price is trading above the short-term fib grid center (F0%), and both the 5- and 10-week moving averages are trending up, reinforcing the short-term bullish bias. However, the intermediate- and long-term outlooks remain bearish. The monthly and yearly session fib grids (MSFG and YSFG) both show price below their respective F0% levels, with downtrends in place. The intermediate-term swing pivot HiLo trend is also down, and the longer-term moving averages (55, 100, and 200 week) are all trending lower, indicating persistent overhead resistance and a lack of sustained buying pressure at higher timeframes. Key resistance levels are clustered above at 529.00 and 564.75, while support is established at 405.75. The recent trade signals reflect this tug-of-war, with both long and short entries triggered in close succession, highlighting a choppy, range-bound environment. Overall, the market is attempting a short-term bounce within a broader downtrend, with any rallies likely to encounter significant resistance unless there is a decisive shift in intermediate or long-term momentum.