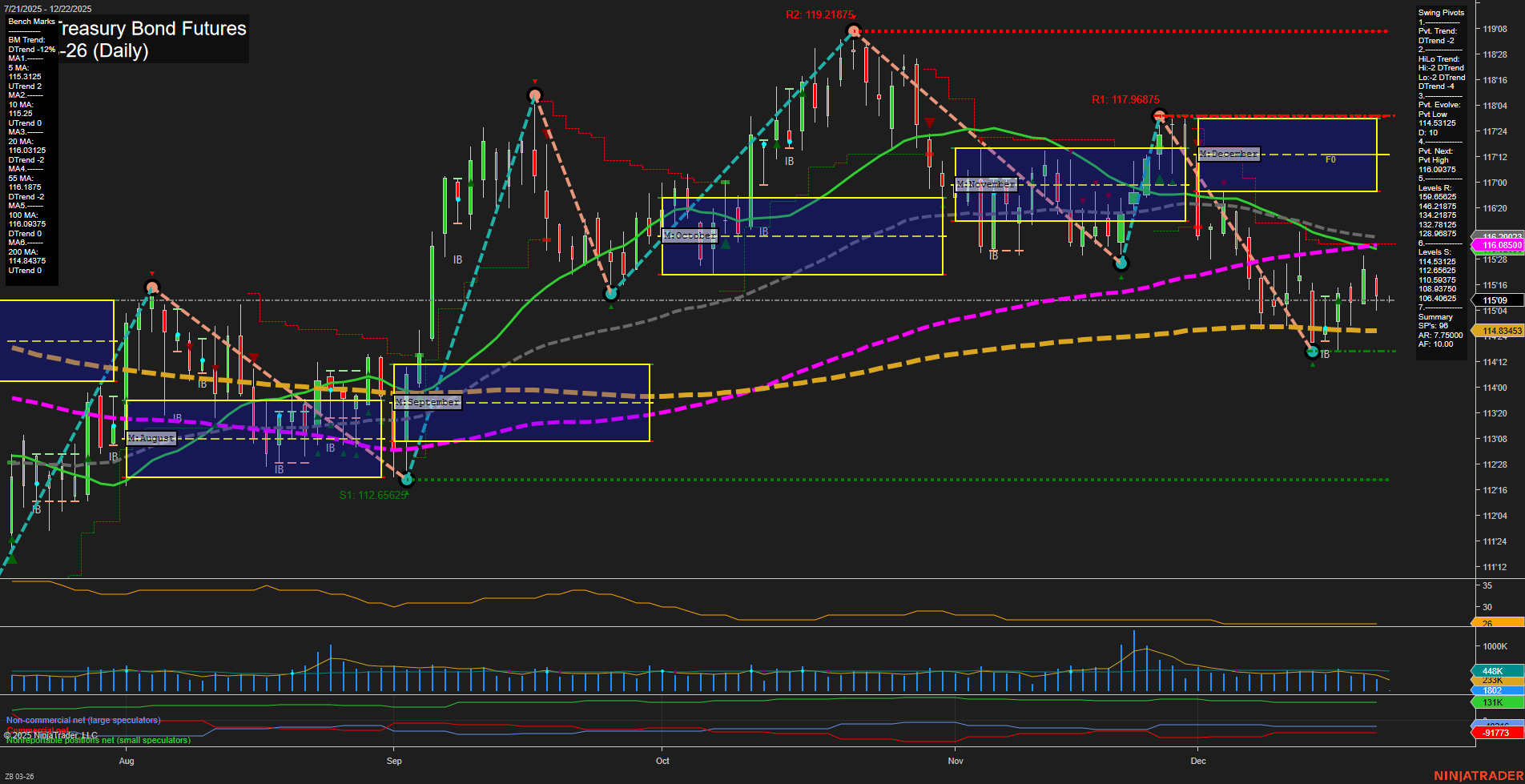

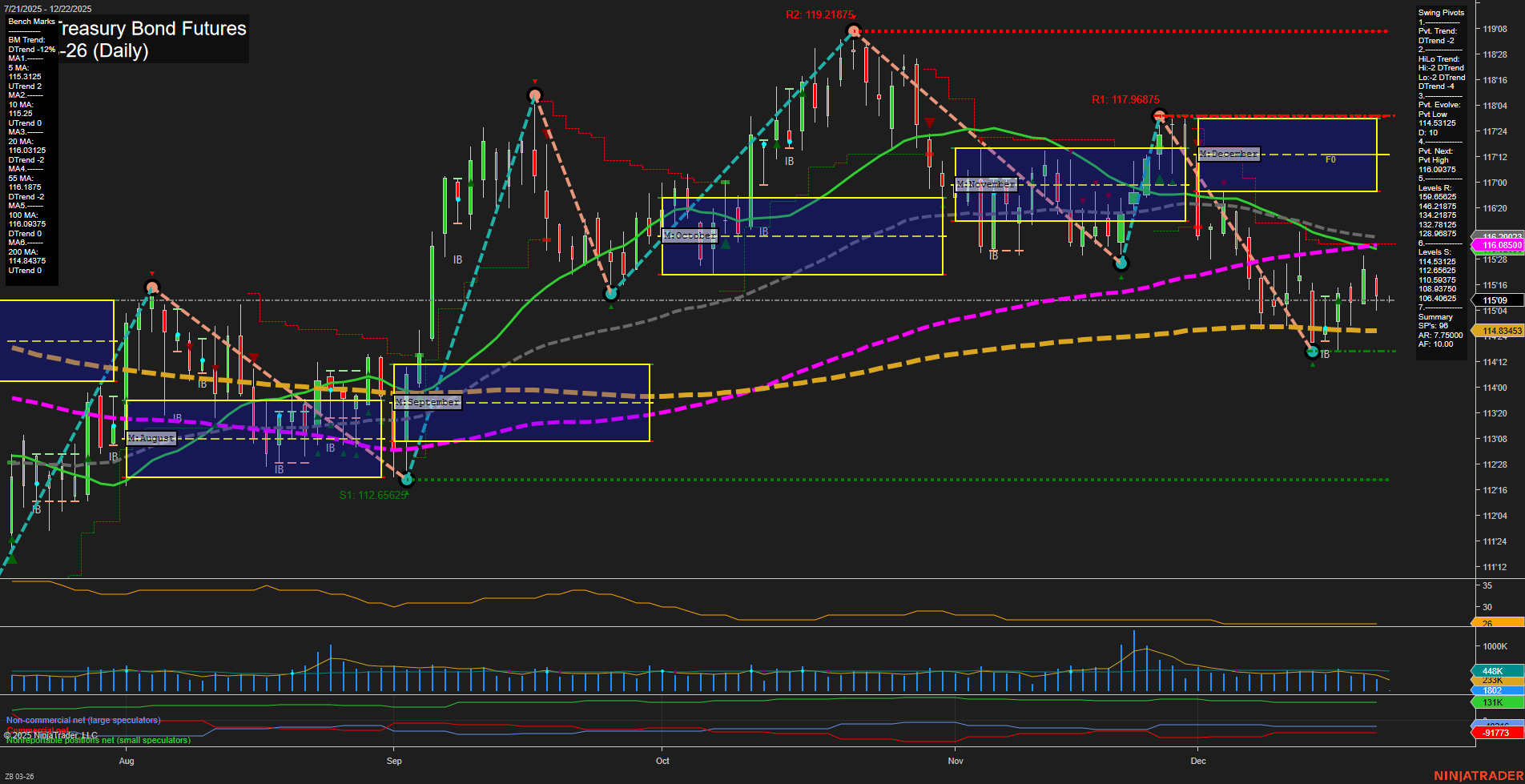

ZB U.S. Treasury Bond Futures Daily Chart Analysis: 2025-Dec-21 18:11 CT

Price Action

- Last: 115’09,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Dec

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 114.3025,

- 4. Pvt. Next: Pvt high 116.08375,

- 5. Levels R: 119.21875, 117.96875, 116.08375,

- 6. Levels S: 114.3025, 112.65625.

Daily Benchmarks

- (Short-Term) 5 Day: 115.3125 Down Trend,

- (Short-Term) 10 Day: 115.125 Down Trend,

- (Intermediate-Term) 20 Day: 116.1875 Down Trend,

- (Intermediate-Term) 55 Day: 116.8125 Down Trend,

- (Long-Term) 100 Day: 116.9375 Down Trend,

- (Long-Term) 200 Day: 114.84375 Up Trend.

Additional Metrics

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

The ZB U.S. Treasury Bond Futures daily chart reflects a market in a corrective phase, with both short-term and intermediate-term trends pointing downward. Price action is characterized by medium-sized bars and slow momentum, indicating a lack of strong directional conviction. The swing pivot structure confirms a dominant downtrend, with the most recent pivot low at 114.3025 and resistance levels overhead at 116.08375, 117.96875, and 119.21875. All key moving averages except the 200-day are trending down, reinforcing the bearish bias in the short and intermediate timeframes, while the 200-day MA remains in an uptrend, suggesting longer-term support is still intact. The ATR and volume metrics indicate moderate volatility and participation. Overall, the market is consolidating near recent lows, with no clear breakout or reversal signal present. The technical landscape suggests continued caution as the market digests recent declines, with traders watching for either a base formation or further downside extension.

Chart Analysis ATS AI Generated: 2025-12-21 18:11 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.