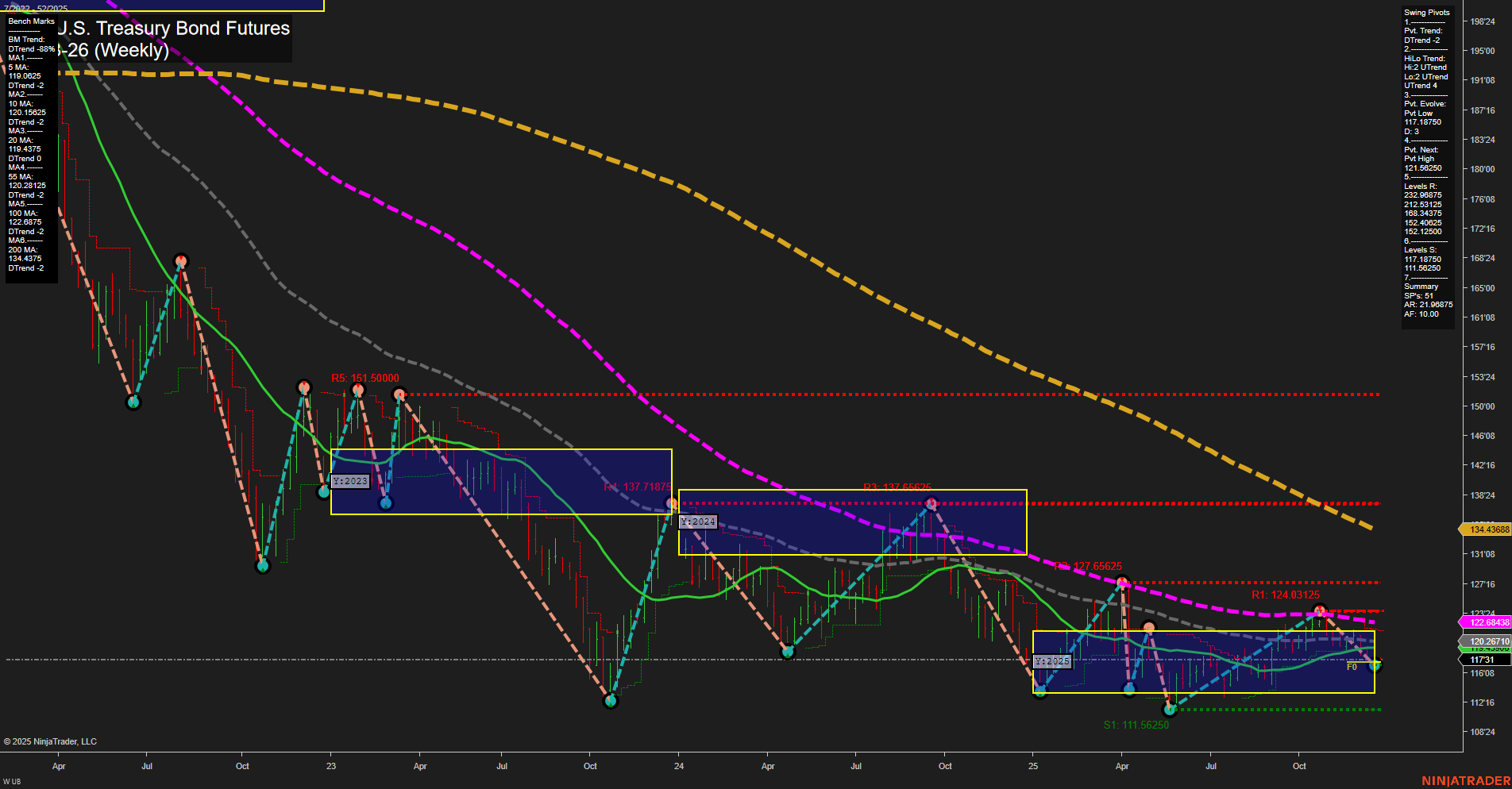

The UB Ultra U.S. Treasury Bond Futures weekly chart shows a market in transition. Price action is currently below key short- and intermediate-term Fibonacci grid levels, with momentum at an average pace and medium-sized bars, indicating neither extreme volatility nor tight consolidation. The short-term trend remains bearish, as confirmed by the WSFG and swing pivot direction, with price below the NTZ and recent pivots evolving at lower levels. Intermediate-term signals are mixed: while the HiLo trend is up, both the MSFG and moving averages point to a downtrend, suggesting a possible pause or consolidation phase after prior declines. Long-term structure remains bearish, with all major moving averages (except the 20-week) trending down and price well below the 100- and 200-week benchmarks, despite the YSFG showing a slight upward bias. Resistance is layered well above current price, while support is close by, highlighting a market that may be testing the lower end of its recent range. Recent trade signals have triggered long entries, hinting at a potential short-term bounce or retracement, but the overall technical backdrop still favors caution, with the dominant trend remaining down on higher timeframes. The market is currently in a corrective phase within a broader bearish context, with any rallies likely to encounter significant resistance overhead.