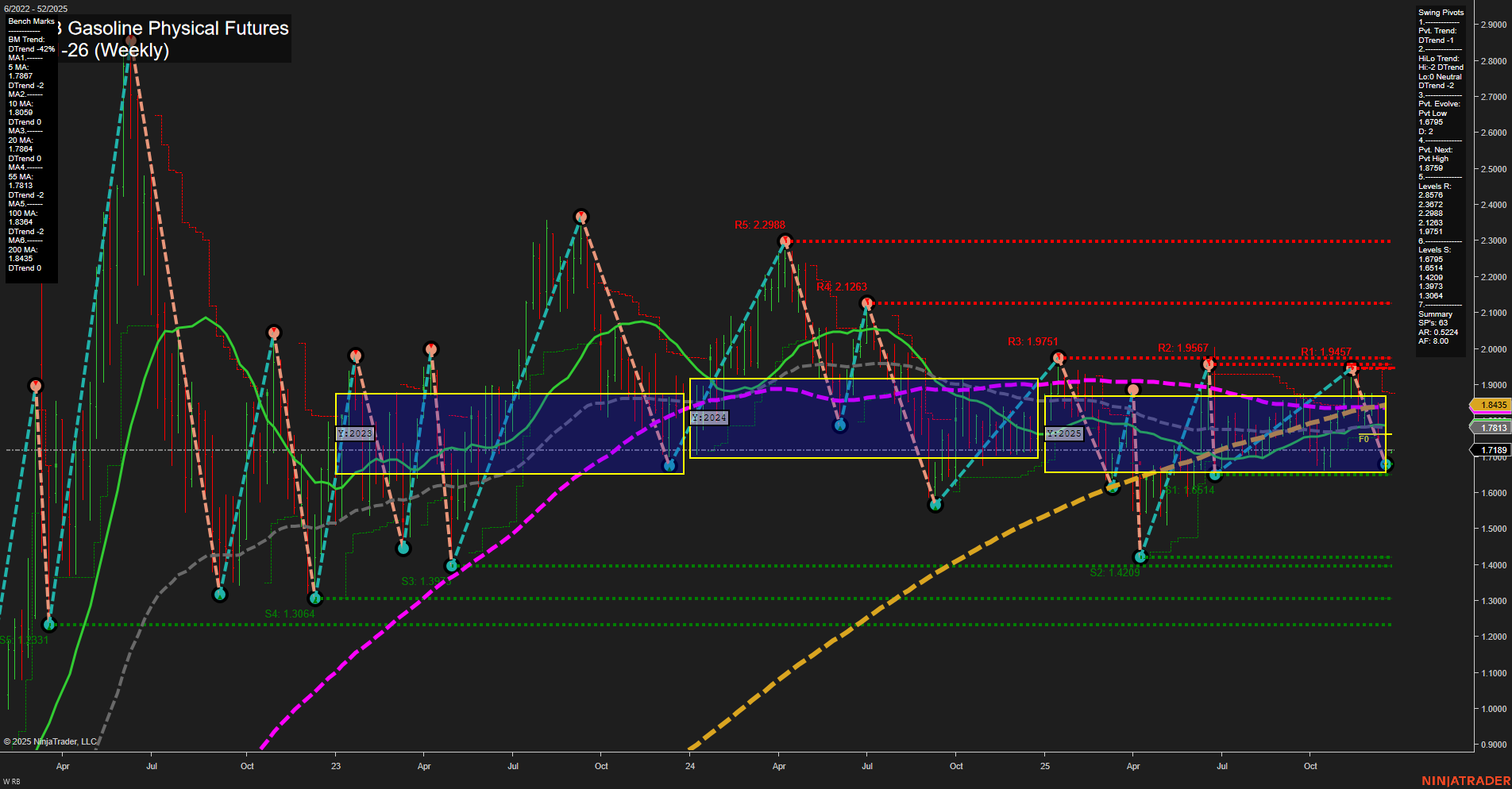

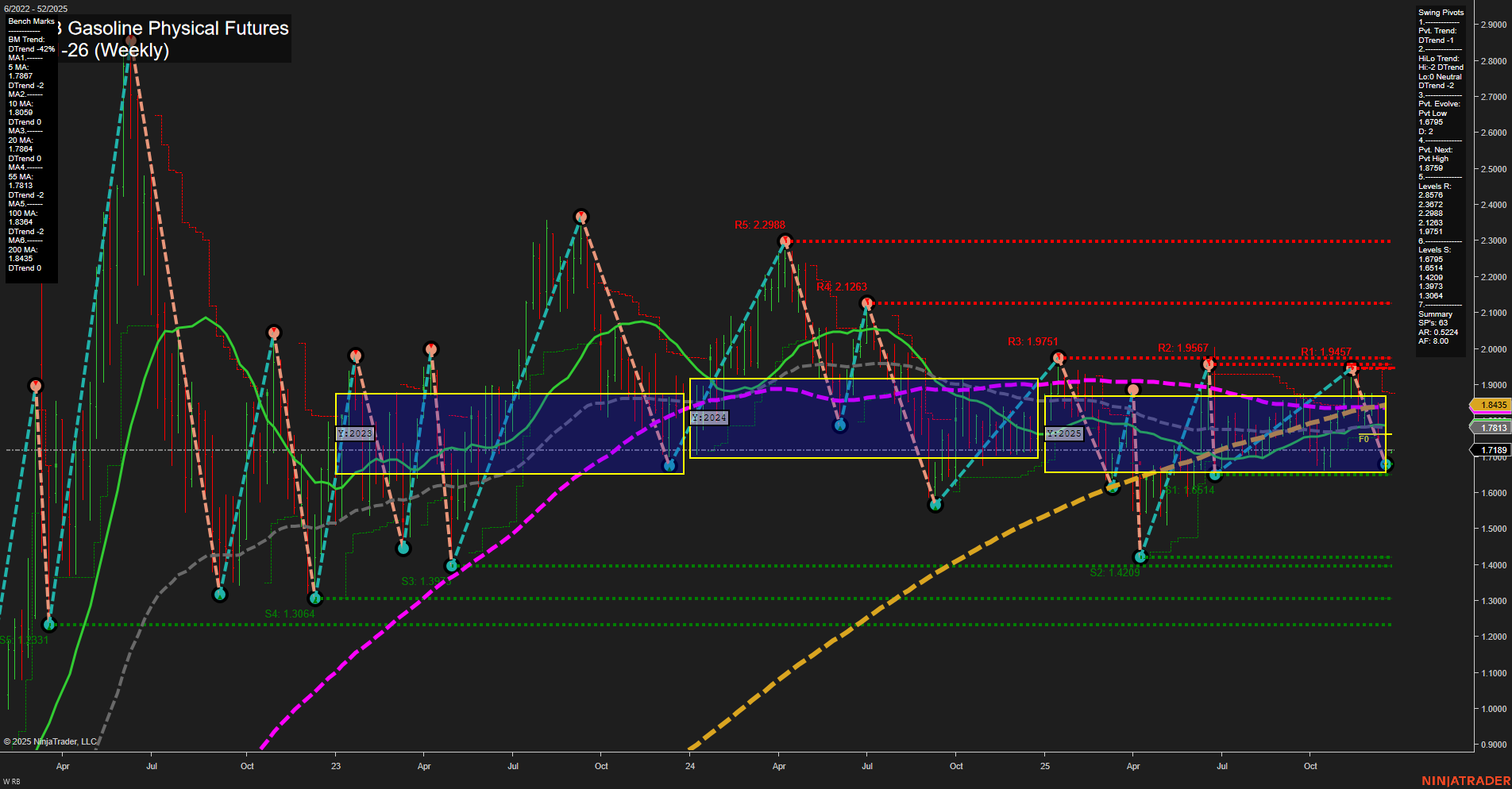

RB RBOB Gasoline Physical Futures Weekly Chart Analysis: 2025-Dec-21 18:08 CT

Price Action

- Last: 1.7189,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 10%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Dec

- Intermediate-Term

- MSFG Current: -85%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: -4%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 1.675,

- 4. Pvt. Next: Pvt high 1.8785,

- 5. Levels R: 2.2988, 2.1263, 1.9751, 1.9567, 1.9457,

- 6. Levels S: 1.6751, 1.6514, 1.4209, 1.3071, 1.3064, 1.2034.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.7867 Down Trend,

- (Intermediate-Term) 10 Week: 1.8089 Down Trend,

- (Long-Term) 20 Week: 1.7844 Down Trend,

- (Long-Term) 55 Week: 1.8843 Down Trend,

- (Long-Term) 100 Week: 1.8864 Down Trend,

- (Long-Term) 200 Week: 1.8435 Down Trend.

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The chart reflects a market in a broad consolidation phase, with price action contained within the yearly NTZ (neutral trading zone) and showing slow momentum. Short-term, there is a slight upward bias as price sits just above the weekly session fib grid center, but the prevailing swing pivot trend remains down. Intermediate and long-term trends are clearly bearish, with all major moving averages trending lower and price below key benchmarks. Resistance levels are stacked above, while support is clustered near recent lows, suggesting the market is testing the lower end of its multi-month range. The overall structure points to a market lacking strong directional conviction, with rallies being sold and support levels repeatedly tested. This environment is typical of a choppy, range-bound market, where swing traders may see mean reversion opportunities but should be mindful of the dominant downward pressure on higher timeframes.

Chart Analysis ATS AI Generated: 2025-12-21 18:08 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.