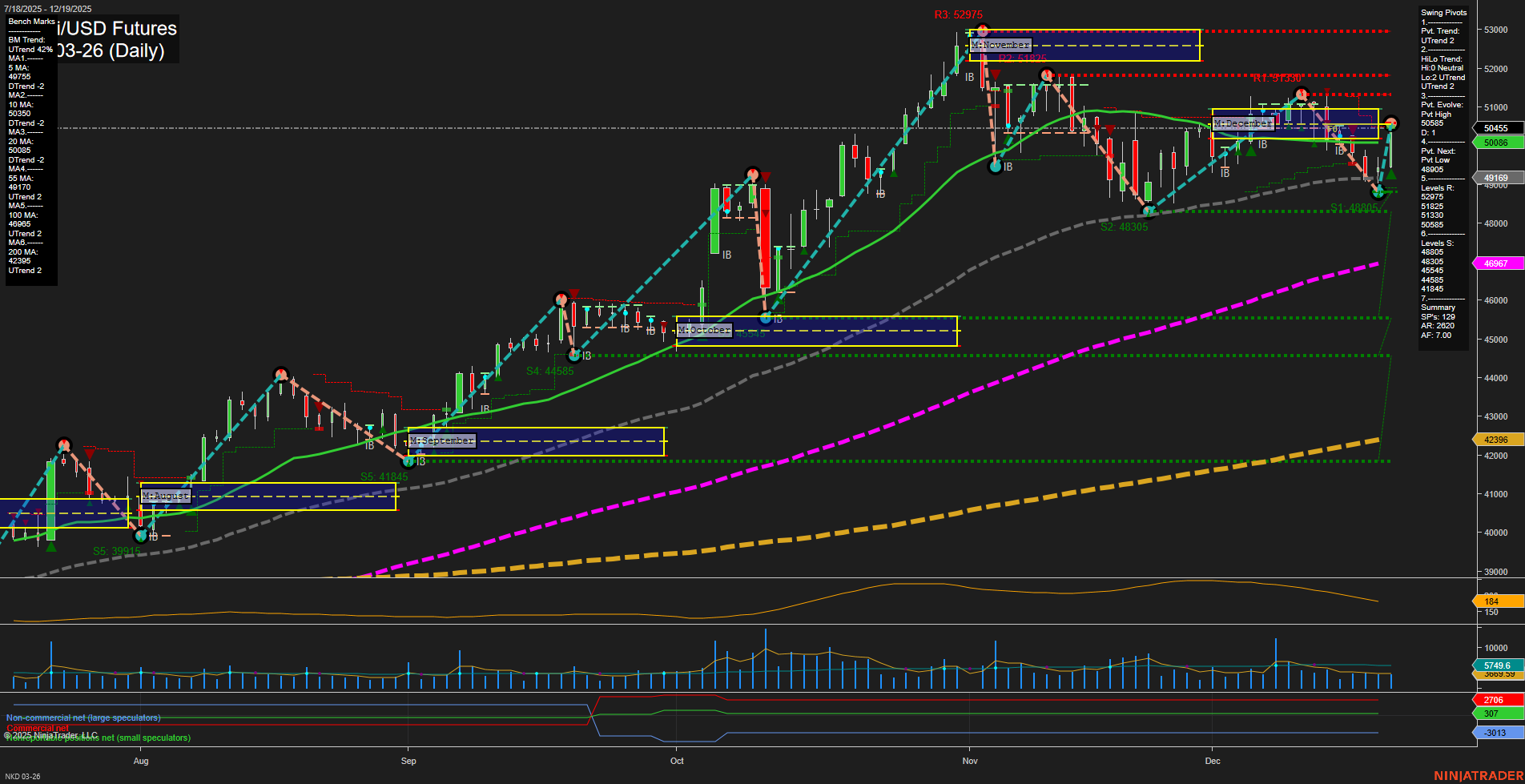

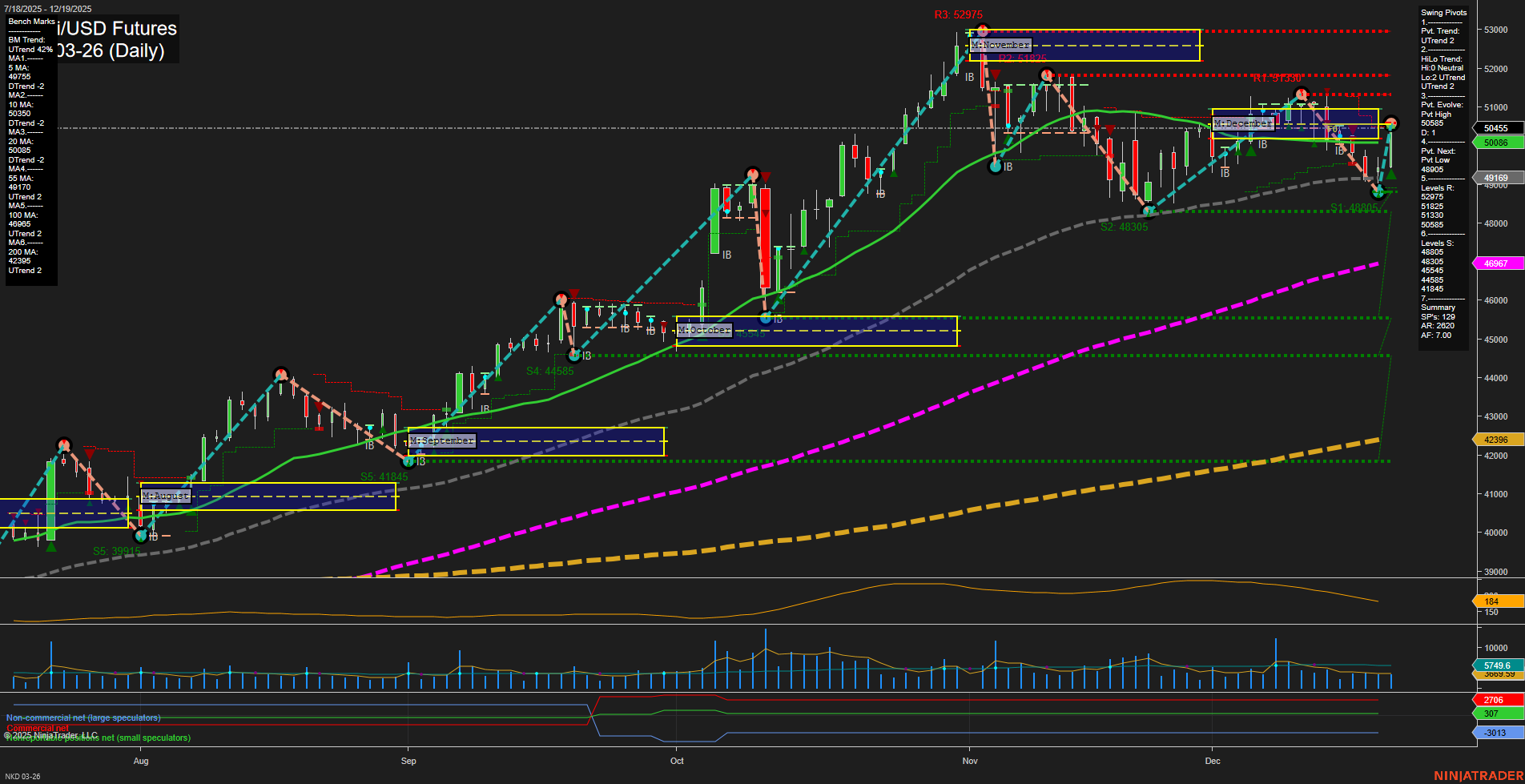

NKD Nikkei/USD Futures Daily Chart Analysis: 2025-Dec-21 18:07 CT

Price Action

- Last: 49160,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 7%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Dec

- Intermediate-Term

- MSFG Current: 23%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 147%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 50598,

- 4. Pvt. Next: Pvt low 48805,

- 5. Levels R: 52975, 51935, 51325, 51035, 50598,

- 6. Levels S: 48305, 44845, 41845, 39116.

Daily Benchmarks

- (Short-Term) 5 Day: 49175 Down Trend,

- (Short-Term) 10 Day: 49505 Down Trend,

- (Intermediate-Term) 20 Day: 50086 Down Trend,

- (Intermediate-Term) 55 Day: 49697 Down Trend,

- (Long-Term) 100 Day: 47409 Up Trend,

- (Long-Term) 200 Day: 42396 Up Trend.

Additional Metrics

Recent Trade Signals

- 19 Dec 2025: Long NKD 03-26 @ 50125 Signals.USAR-MSFG

- 19 Dec 2025: Long NKD 03-26 @ 50125 Signals.USAR.TR120

- 15 Dec 2025: Short NKD 03-26 @ 50210 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The NKD Nikkei/USD futures daily chart shows a market in transition. Price action has recently slowed, with medium-sized bars and a slight loss of momentum. The short-term trend has shifted to the downside, as indicated by the swing pivot DTrend and all short-term and intermediate-term moving averages turning down. However, the intermediate and long-term trends remain bullish, supported by the MSFG and YSFG trends, as well as the 100-day and 200-day moving averages, which are still in uptrends.

Recent trade signals reflect this mixed environment, with a short signal on December 15th followed by two long signals on December 19th, suggesting potential for a near-term reversal or bounce. Resistance is layered above at 50598 and higher, while support is found at 48305 and below. Volatility (ATR) is moderate, and volume remains steady. The market appears to be in a corrective phase within a larger uptrend, possibly consolidating after a strong rally earlier in the year. Swing traders should note the potential for further choppy or range-bound action in the short term, while the broader trend context remains constructive for bulls.

Chart Analysis ATS AI Generated: 2025-12-21 18:07 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.