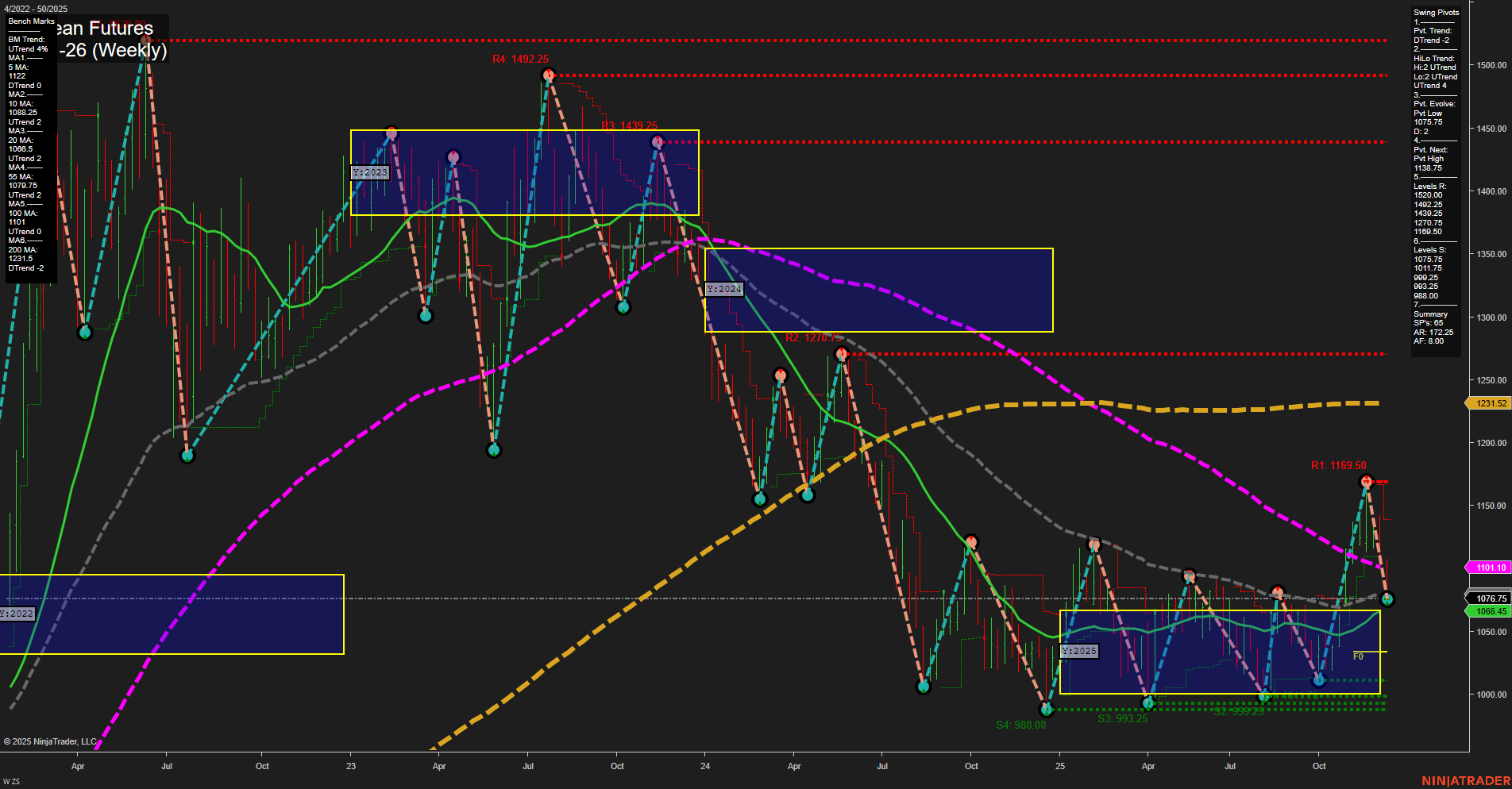

ZS Soybean Futures are currently trading at 1076.45, with medium-sized weekly bars and slow momentum, reflecting a market in consolidation after a recent decline. The short-term and intermediate-term Fib grid trends (WSFG and MSFG) are both down, with price below their respective NTZ/F0% levels, confirming a bearish bias in the near term. The long-term yearly grid (YSFG) shows a slight uptrend, but price action remains below most major moving averages, all of which are trending down, reinforcing a broader bearish structure. Swing pivot analysis highlights a short-term downtrend (DTrend) but an intermediate-term uptrend (UTrend), suggesting some underlying support and potential for countertrend rallies. The most recent pivot low at 1066.45 is being tested, with the next resistance at 1133.75. Key resistance levels remain well above current price, while support is clustered just below, indicating a market at risk of further downside if these supports break. Recent trade signals have triggered short entries, aligning with the prevailing short-term bearish momentum. The overall technical landscape points to continued pressure on the downside, with any rallies likely to encounter resistance at the moving averages and prior swing highs. The market is in a corrective phase within a larger downtrend, with volatility likely to persist as price tests key support and resistance zones.