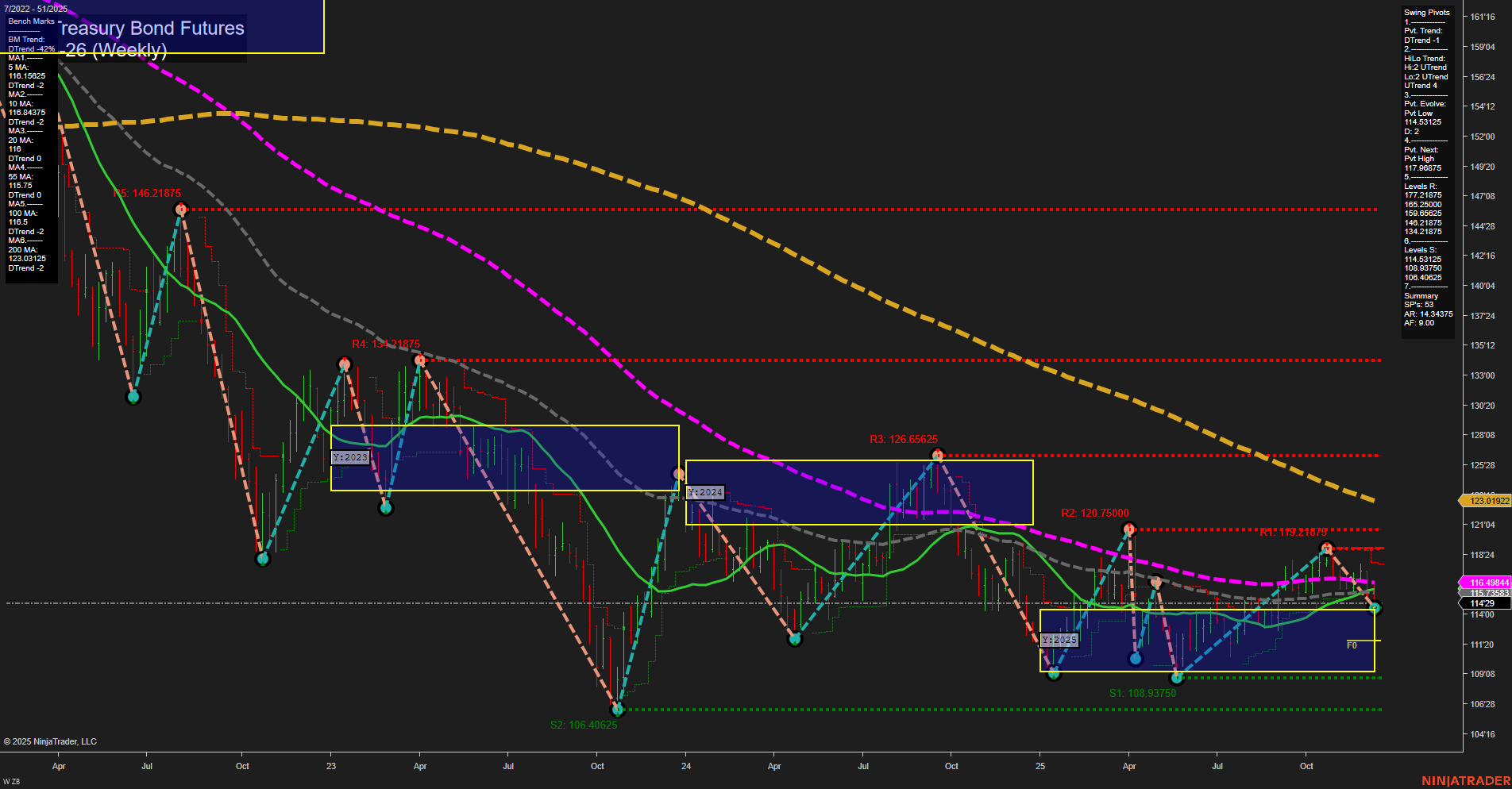

The ZB U.S. Treasury Bond Futures weekly chart reflects a market in a prolonged downtrend, with all major moving averages (from 5-week to 200-week) trending lower, confirming persistent bearish sentiment over the long term. The most recent price action shows medium-sized bars and average momentum, indicating neither a strong selloff nor a sharp rally, but rather a market in consolidation after previous declines. The short-term swing pivot trend is down, while the intermediate-term HiLo trend has shifted to up, suggesting some recovery attempts or countertrend rallies within the broader bearish structure. Price is currently near a recent swing low (114'03125), with the next significant resistance at 117'09875 and multiple overhead resistance levels from 120'75000 up to 147'08, highlighting the overhead supply. Support is clustered just below, with key levels at 114'03125 and 108'93750. The neutral bias across the session fib grids (weekly, monthly, yearly) and the lack of a clear directional impulse suggest the market is in a holding pattern, possibly awaiting new macroeconomic catalysts or policy signals. Overall, the chart structure points to a market that remains under long-term pressure, with short-term and intermediate-term swings providing tactical opportunities within a broader consolidation and downtrend environment.