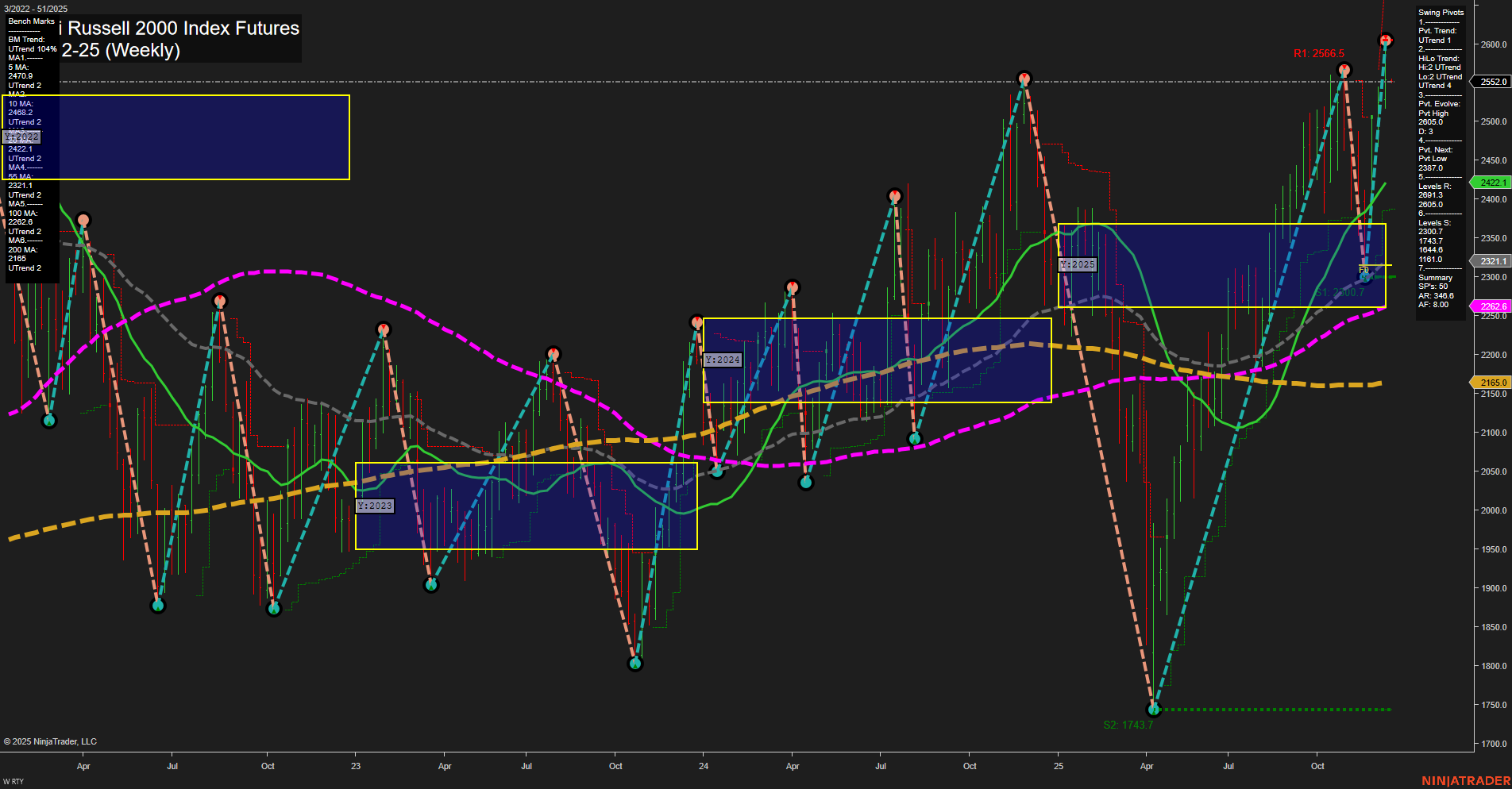

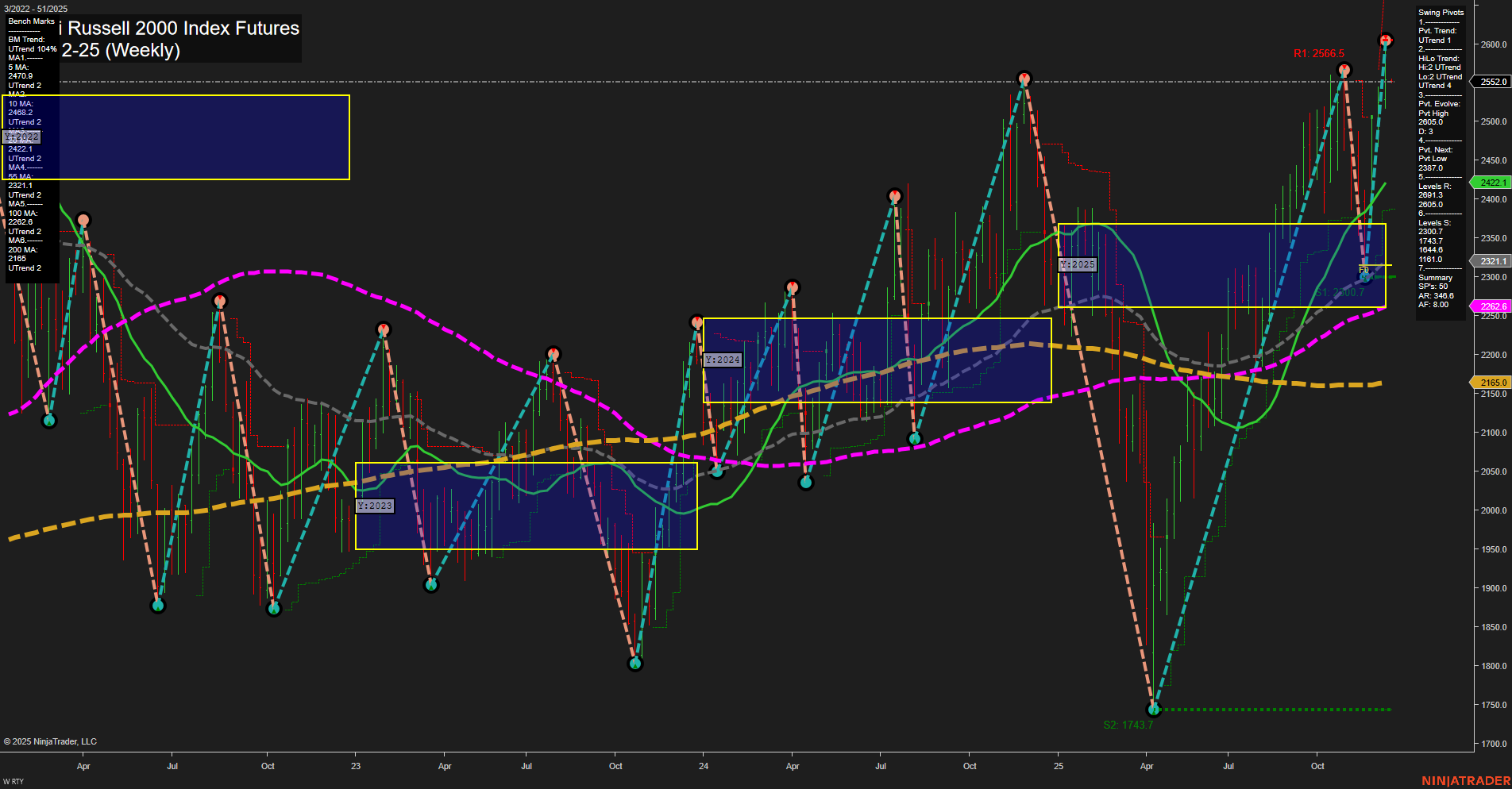

RTY E-mini Russell 2000 Index Futures Weekly Chart Analysis: 2025-Dec-14 18:13 CT

Price Action

- Last: 2552.0,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 26%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Dec

- Intermediate-Term

- MSFG Current: 38%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 44%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 2566.5,

- 4. Pvt. Next: Pvt low 2003.9,

- 5. Levels R: 2566.5, 2387.0,

- 6. Levels S: 1743.7.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 2470.0 Up Trend,

- (Intermediate-Term) 10 Week: 2421.2 Up Trend,

- (Long-Term) 20 Week: 2321.1 Up Trend,

- (Long-Term) 55 Week: 2226.9 Up Trend,

- (Long-Term) 100 Week: 2268.2 Up Trend,

- (Long-Term) 200 Week: 2165.0 Up Trend.

Recent Trade Signals

- 12 Dec 2025: Short RTY 12-25 @ 2566.6 Signals.USAR.TR120

- 11 Dec 2025: Long RTY 12-25 @ 2552.8 Signals.USAR-WSFG

- 10 Dec 2025: Long RTY 12-25 @ 2524.2 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The RTY E-mini Russell 2000 Index Futures weekly chart shows a strong bullish structure across all timeframes. Price action is characterized by large bars and fast momentum, indicating robust buying interest and volatility. The market is trading above all key Fibonacci grid levels (WSFG, MSFG, YSFG), with each grid showing an upward trend and price holding above the NTZ (neutral zone) center lines, reinforcing the bullish bias.

Swing pivot analysis confirms an uptrend in both short- and intermediate-term metrics, with the most recent pivot high at 2566.5 acting as immediate resistance and a significant support level at 1743.7. All benchmark moving averages from 5-week to 200-week are trending upward, further supporting the prevailing bullish sentiment.

Recent trade signals reflect active participation on both sides, but the overall trend remains upward, with the most recent signals favoring long positions. The market has experienced a strong rally from the yearly lows, forming higher lows and higher highs, and is currently testing resistance near the recent swing high. This environment suggests a continuation of the bullish cycle, with potential for further upside if resistance is cleared, while volatility and sharp pullbacks remain possible given the size of recent bars and momentum.

Chart Analysis ATS AI Generated: 2025-12-14 18:13 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.